Question: Question 11 (12 marks) Items 1 through 6 present various internal control in place 1. Credit is granted by a credit department. 2. Once shipment

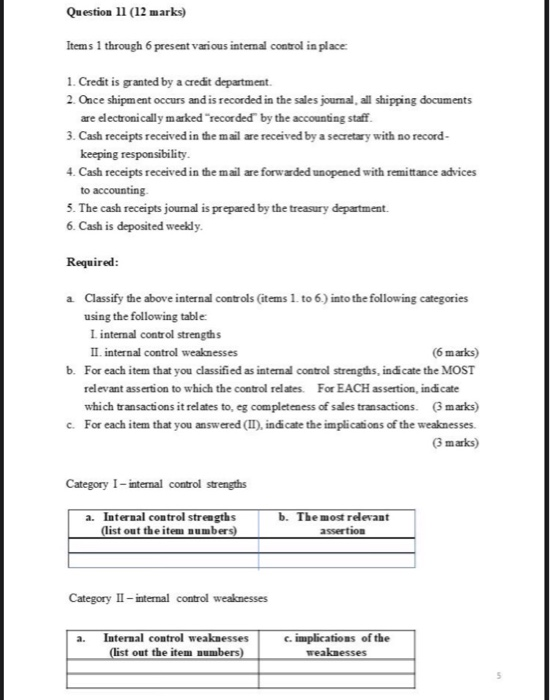

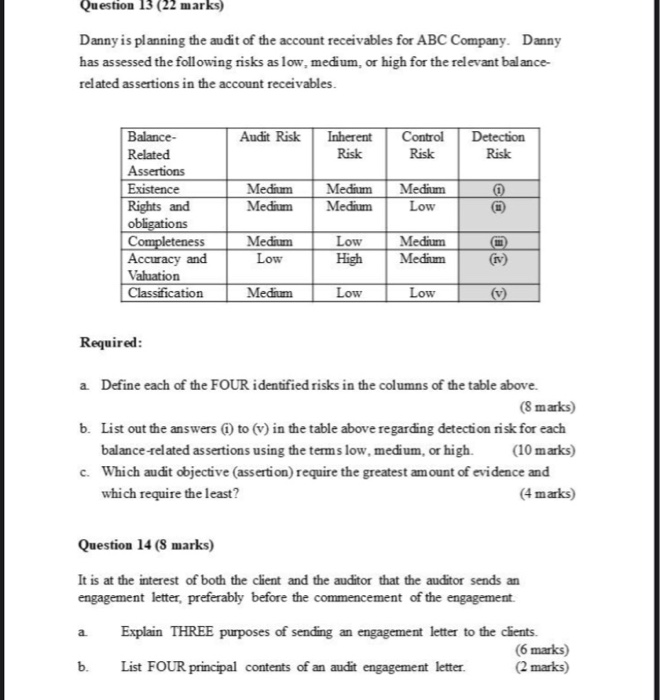

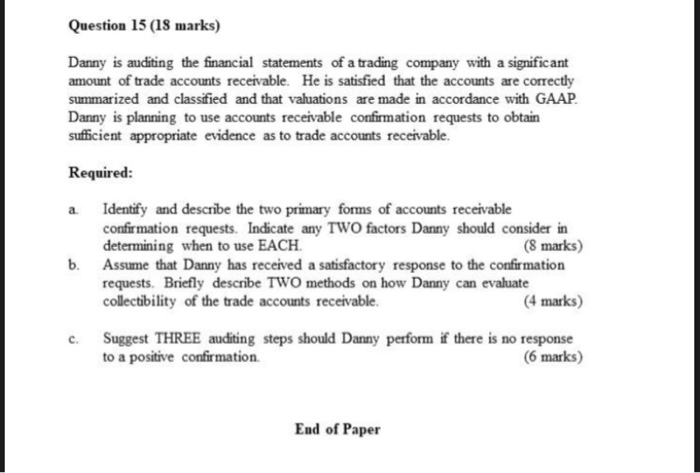

Question 11 (12 marks) Items 1 through 6 present various internal control in place 1. Credit is granted by a credit department. 2. Once shipment occurs and is recorded in the sales joumal, all shipping documents are electronically marked "recorded by the accounting staff. 3. Cash receipts received in the mail are received by a secretary with no record keeping responsibility 4. Cash receipts received in the mail are forwarded unopened with remittance advices to accounting 5. The cash receipts journal is prepared by the treasury department. 6. Cash is deposited weekly Required: a Classify the above internal controls (items 1. to 6.) into the following categories using the following table I internal control strengths II. internal control weaknesses (6 marks) b. For each item that you classified as internal control strengths indicate the MOST relevant assertion to which the control relates For EACH assertion, indicate which transactions it relates to es completeness of sales transactions marks) c. For each item that you answered (II), indicate the implications of the weaknesses. (3 marks) Category I - internal control strengths a. Internal control strengths (list out the item numbers) b. The most relevant assertion Category II - internal control weaknesses a. Internal control weaknesses (list out the item numbers) c.implications of the weaknesses Question 12 (10 marks) The following are 10 audit procedures taken from an audit program: 1. Select items from inventory records and examine those items in the warehouse. 2. Perform test of reasonableness on depreciation expense of equipment items, taking into account their remaining useful lives, additions, and disposals during the year and compare the expenses against the amount calculated by client 3. Contact the banks with which the client does business to confirm the cash balances, loan balances, and the outstanding banking facility. 4. Use audit software to foot and cross-foot the cash disbursement journal and trace totals to the general ledger. 5. Examine evidence to check whether customer orders have been approved for credit by the credit manager 6. Discuss the probability of losing an ongoing court case and the likely compensation amount with the client's legal counsel. 7. Select samples of payroll records and compute the overtime payment. 8. Observe the endorsement of incoming checks by the accountant. 9. Interview the sales manager and the credit manager to understand if there is a segregation of duties between the credit-granting function and the sales function. 10. Divide individual manufacturing expenses by total manufacturing expenses and compare the results with those in previous years to check for unusual fluctuations. Required: Identify the type of evidence for each procedure using the following table inspection of asset, confirmation, inspection of documents, analytical procedures, inquiries, recalculation, reperformance, and observation (10 marks) Audit Procedures (list out the item numbers) Answer 2 Question 13 (22 marks) Danny is planning the audit of the account receivables for ABC Company. Danny has assessed the following risks as low, medium, or high for the relevant balance related assertions in the account receivables. Audit Risk Inherent Risk Control Risk Detection Risk Medium Medium Medium Medium Medium Low C G Balance- Related Assertions Existence Rights and obligations Completeness Accuracy and Valuation Classification Medium Low Low High Medium Medium Sl 90 Medium Low Low Required: a Define each of the FOUR identified risks in the columns of the table above. (8 marks) b. List out the answers () to (v) in the table above regarding detection risk for each balance-related assertions using the terms low, medium, or high. (10 marks) c. Which audit objective assertion) require the greatest amount of evidence and which require the least? (4 marks) Question 14 (8 marks) It is at the interest of both the client and the auditor that the auditor sends an engagement letter, preferably before the commencement of the engagement. Explain THREE purposes of sending an engagement letter to the chents. 6 marks) b. List FOUR principal contents of an audit engagement letter (2 marks) a Question 15 (18 marks) Danny is auditing the financial statements of a trading company with a significant amount of trade accounts receivable. He is satisfied that the accounts are correctly summarized and classified and that valuations are made in accordance with GAAP. Danny is planning to use accounts receivable confirmation requests to obtain sufficient appropriate evidence as to trade accounts receivable. Required: a. Identify and describe the two primary forms of accounts receivable confirmation requests. Indicate any TWO factors Danny should consider in determining when to use EACH. (8 marks) b. Assume that Danny has received a satisfactory response to the confirmation requests. Briefly describe TWO methods on how Danny can evaluate collectibility of the trade accounts receivable. (4 marks) c. Suggest THREE auditing steps should Danny perform if there is no response to a positive confirmation (6 marks) End of Paper Question 11 (12 marks) Items 1 through 6 present various internal control in place 1. Credit is granted by a credit department. 2. Once shipment occurs and is recorded in the sales joumal, all shipping documents are electronically marked "recorded by the accounting staff. 3. Cash receipts received in the mail are received by a secretary with no record keeping responsibility 4. Cash receipts received in the mail are forwarded unopened with remittance advices to accounting 5. The cash receipts journal is prepared by the treasury department. 6. Cash is deposited weekly Required: a Classify the above internal controls (items 1. to 6.) into the following categories using the following table I internal control strengths II. internal control weaknesses (6 marks) b. For each item that you classified as internal control strengths indicate the MOST relevant assertion to which the control relates For EACH assertion, indicate which transactions it relates to es completeness of sales transactions marks) c. For each item that you answered (II), indicate the implications of the weaknesses. (3 marks) Category I - internal control strengths a. Internal control strengths (list out the item numbers) b. The most relevant assertion Category II - internal control weaknesses a. Internal control weaknesses (list out the item numbers) c.implications of the weaknesses Question 12 (10 marks) The following are 10 audit procedures taken from an audit program: 1. Select items from inventory records and examine those items in the warehouse. 2. Perform test of reasonableness on depreciation expense of equipment items, taking into account their remaining useful lives, additions, and disposals during the year and compare the expenses against the amount calculated by client 3. Contact the banks with which the client does business to confirm the cash balances, loan balances, and the outstanding banking facility. 4. Use audit software to foot and cross-foot the cash disbursement journal and trace totals to the general ledger. 5. Examine evidence to check whether customer orders have been approved for credit by the credit manager 6. Discuss the probability of losing an ongoing court case and the likely compensation amount with the client's legal counsel. 7. Select samples of payroll records and compute the overtime payment. 8. Observe the endorsement of incoming checks by the accountant. 9. Interview the sales manager and the credit manager to understand if there is a segregation of duties between the credit-granting function and the sales function. 10. Divide individual manufacturing expenses by total manufacturing expenses and compare the results with those in previous years to check for unusual fluctuations. Required: Identify the type of evidence for each procedure using the following table inspection of asset, confirmation, inspection of documents, analytical procedures, inquiries, recalculation, reperformance, and observation (10 marks) Audit Procedures (list out the item numbers) Answer 2 Question 13 (22 marks) Danny is planning the audit of the account receivables for ABC Company. Danny has assessed the following risks as low, medium, or high for the relevant balance related assertions in the account receivables. Audit Risk Inherent Risk Control Risk Detection Risk Medium Medium Medium Medium Medium Low C G Balance- Related Assertions Existence Rights and obligations Completeness Accuracy and Valuation Classification Medium Low Low High Medium Medium Sl 90 Medium Low Low Required: a Define each of the FOUR identified risks in the columns of the table above. (8 marks) b. List out the answers () to (v) in the table above regarding detection risk for each balance-related assertions using the terms low, medium, or high. (10 marks) c. Which audit objective assertion) require the greatest amount of evidence and which require the least? (4 marks) Question 14 (8 marks) It is at the interest of both the client and the auditor that the auditor sends an engagement letter, preferably before the commencement of the engagement. Explain THREE purposes of sending an engagement letter to the chents. 6 marks) b. List FOUR principal contents of an audit engagement letter (2 marks) a Question 15 (18 marks) Danny is auditing the financial statements of a trading company with a significant amount of trade accounts receivable. He is satisfied that the accounts are correctly summarized and classified and that valuations are made in accordance with GAAP. Danny is planning to use accounts receivable confirmation requests to obtain sufficient appropriate evidence as to trade accounts receivable. Required: a. Identify and describe the two primary forms of accounts receivable confirmation requests. Indicate any TWO factors Danny should consider in determining when to use EACH. (8 marks) b. Assume that Danny has received a satisfactory response to the confirmation requests. Briefly describe TWO methods on how Danny can evaluate collectibility of the trade accounts receivable. (4 marks) c. Suggest THREE auditing steps should Danny perform if there is no response to a positive confirmation (6 marks) End of Paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts