Answered step by step

Verified Expert Solution

Question

1 Approved Answer

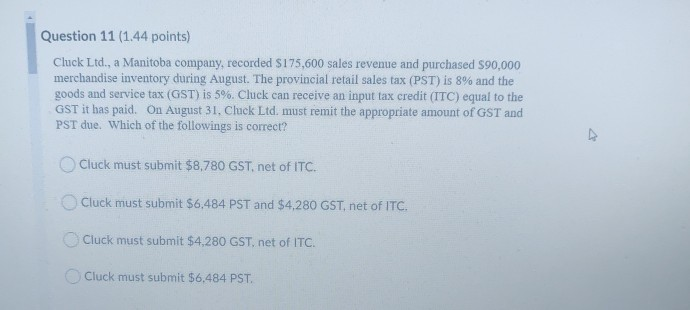

Question 11 (1.44 points) Cluck Ltd., a Manitoba company, recorded $175,600 sales revenue and purchased S90,000 merchandise inventory during August. The provincial retail sales tax

Question 11 (1.44 points) Cluck Ltd., a Manitoba company, recorded $175,600 sales revenue and purchased S90,000 merchandise inventory during August. The provincial retail sales tax (PST) is 8% and the goods and service tax (GST) is 5%. Cluck can receive an input tax credit (ITC) equal to the GST it has paid. On August 31, Cluck Ltd. must remit the appropriate amount of GST and PST due. Which of the followings is correct? A Cluck must submit $8,780 GST, net of ITC. Cluck must submit $6,484 PST and $4,280 GST, net of ITC. Cluck must submit $4,280 GST.net of ITC. Cluck must submit $6.484 PST

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started