Answered step by step

Verified Expert Solution

Question

1 Approved Answer

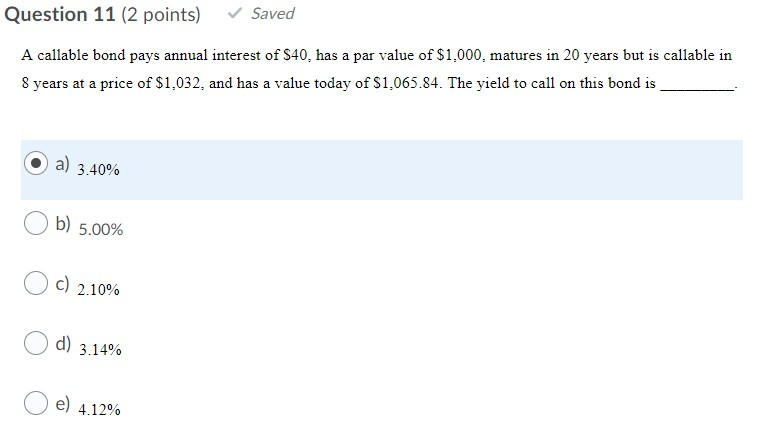

Question 11 (2 points) Saved A callable bond pays annual interest of $40, has a par value of $1,000, matures in 20 years but is

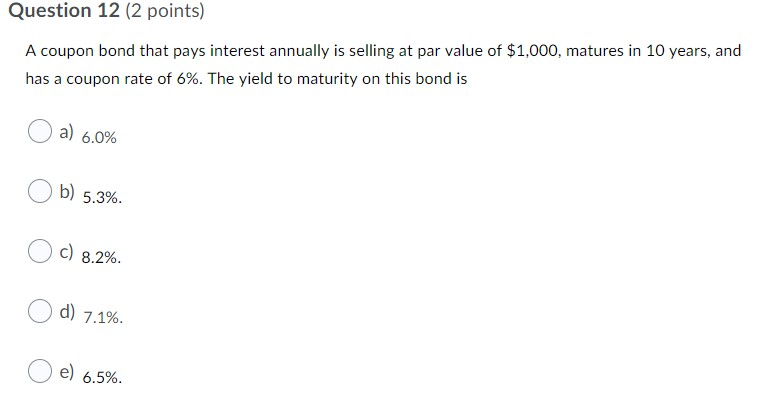

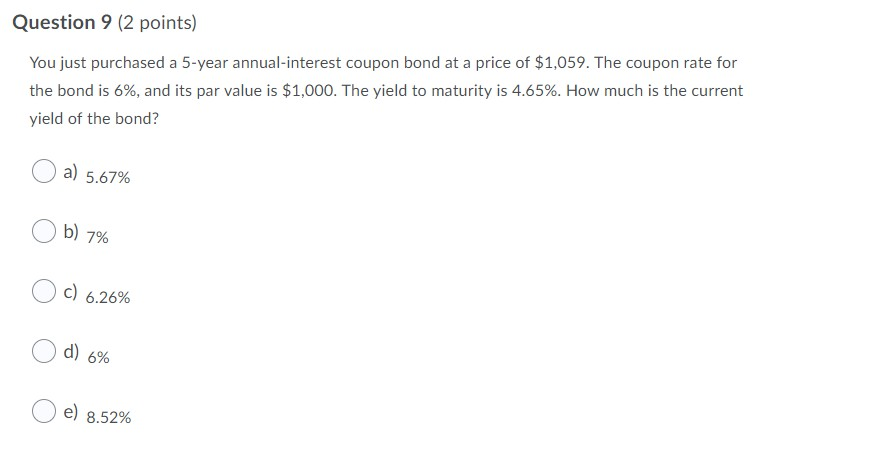

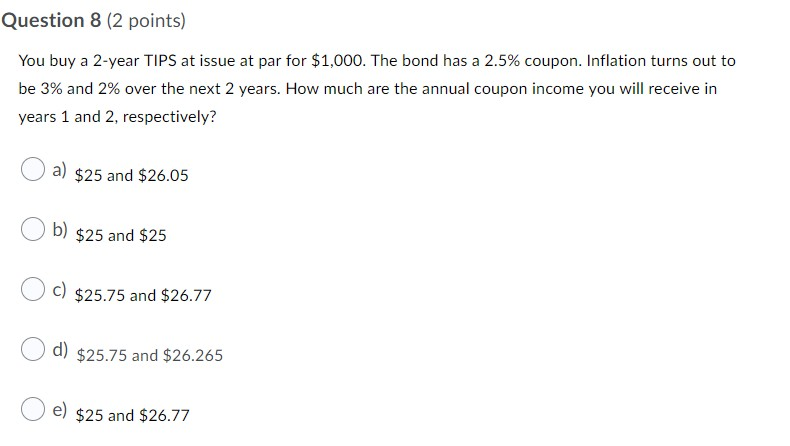

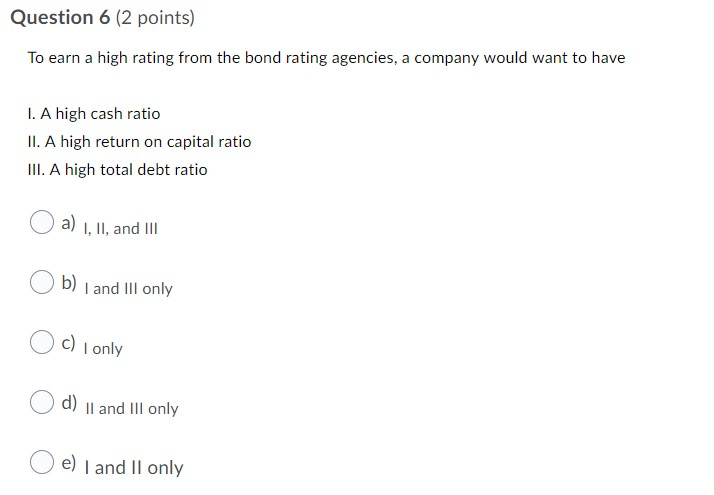

Question 11 (2 points) Saved A callable bond pays annual interest of $40, has a par value of $1,000, matures in 20 years but is callable in 8 years at a price of $1.032, and has a value today of $1,065.84. The yield to call on this bond is _ a) 3.40% Ob) 5.00% Oc) 2.10% d) 3.14% e) 4.12% Question 12 (2 points) A coupon bond that pays interest annually is selling at par value of $1,000, matures in 10 years, and has a coupon rate of 6%. The yield to maturity on this bond is a) 6.0% b) 5.3%. O 8.2%. O O 7.1%. O e) 6.5%. Question 9 (2 points) You just purchased a 5-year annual-interest coupon bond at a price of $1,059. The coupon rate for the bond is 6%, and its par value is $1,000. The yield to maturity is 4.65%. How much is the current yield of the bond? a) 5.67% Ob) 7% O OC) 6.26% O Od) 6% O O e) 8.52% Question 8 (2 points) You buy a 2-year TIPS at issue at par for $1,000. The bond has a 2.5% coupon. Inflation turns out to be 3% and 2% over the next 2 years. How much are the annual coupon income you will receive in years 1 and 2, respectively? O a) $25 and $26.05 Ob) $25 and $25 O c) $25.75 and $26.77 d) $25.75 and $26.265 Oe) $25 and $26.77 Question 6 (2 points) To earn a high rating from the bond rating agencies, a company would want to have 1. A high cash ratio II. A high return on capital ratio III. A high total debt ratio a) I, II, and III O b) and Ill only O c) I only d) II and III only e) I and II only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started