Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 11 (30 marks) a) Suppose you bought one call option contract for $200 (a standard option contract size is 100 shares). The strike

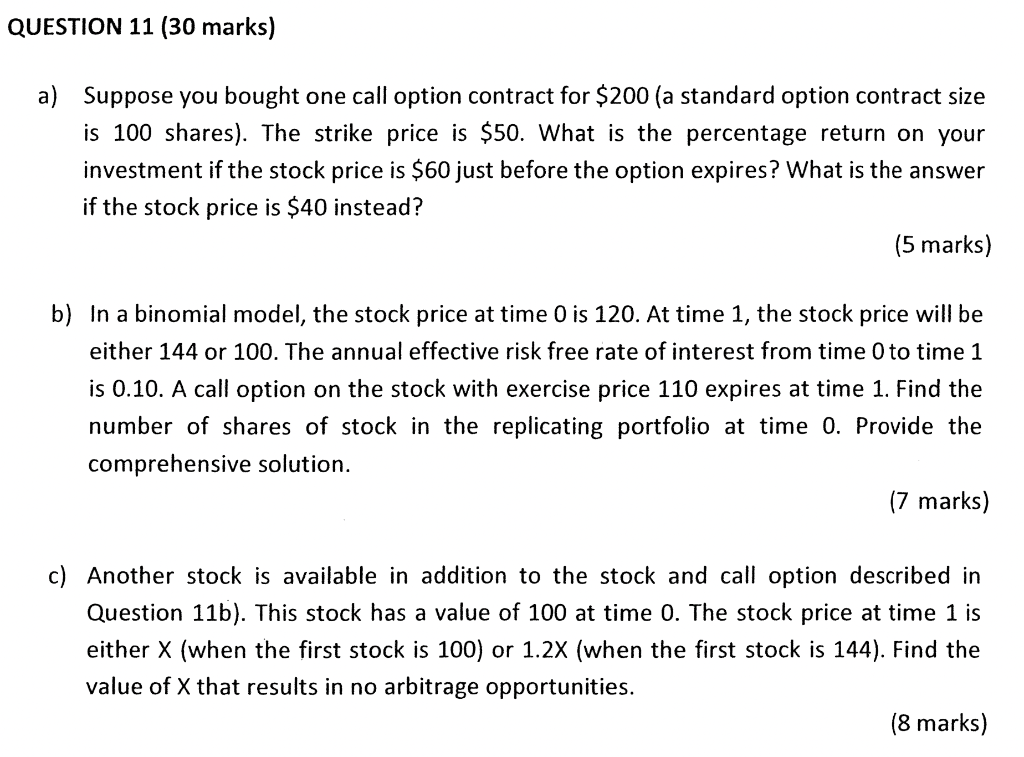

QUESTION 11 (30 marks) a) Suppose you bought one call option contract for $200 (a standard option contract size is 100 shares). The strike price is $50. What is the percentage return on your investment if the stock price is $60 just before the option expires? What is the answer if the stock price is $40 instead? (5 marks) b) In a binomial model, the stock price at time 0 is 120. At time 1, the stock price will be either 144 or 100. The annual effective risk free rate of interest from time 0 to time 1 is 0.10. A call option on the stock with exercise price 110 expires at time 1. Find the number of shares of stock in the replicating portfolio at time 0. Provide the comprehensive solution. (7 marks) c) Another stock is available in addition to the stock and call option described in Question 11b). This stock has a value of 100 at time 0. The stock price at time 1 is either X (when the first stock is 100) or 1.2X (when the first stock is 144). Find the value of X that results in no arbitrage opportunities. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started