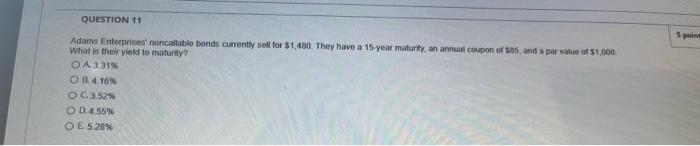

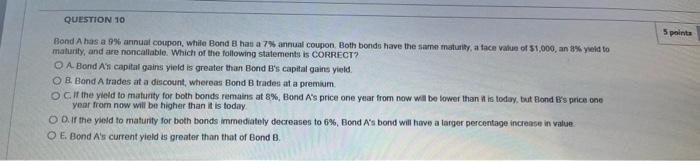

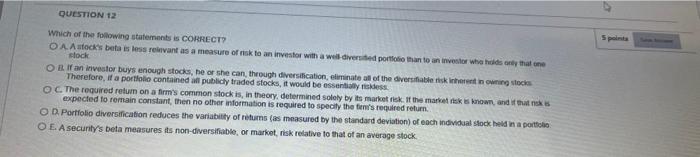

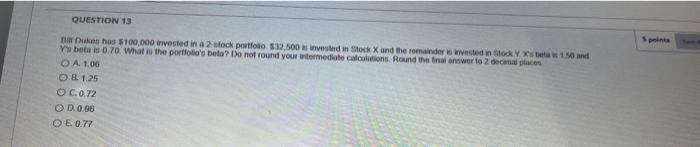

QUESTION 11 5 point Adams Enterprices' noncallable bonds currently sell for $1.480. They have a 15-year maturity, an annual coupon of 585, anda per value of $1.000 What is their yield to maturity? O A3319 O E 4.16% O 3.52 O D.4.55% O E.5.28% QUESTION 10 5 points Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. Which of the following statements is CORRECT? O A Bond A's capital gains yield is greater than Bond B's capital gains yield OB Bond A trades at a discount, whereas Bond Btrades at a premium Cif the yield to maturity for both bonds remains at 8%, Bond A's price one year from now will be lower than it is today, but Rond B's price one year from now will be higher than it is today ODIr the yield to maturity for both bonds immediately decreases to 6%, Bond A's bond will have a larger percentage increase in value O E Bond A's current yield is greater than that of Bond B. QUESTION 12 Spa Which of the following statement is CORRECT? O A Asock's but is less relevant as a measure of risk to an investor with a well-diversited portion than one who is the slock O I If an investor buys enough stocks, he or she can through diversiication, eliminate all of the diversifatinskih in wong to Therefore, if a portfolio contained all publicly traded stocks, it would be essentially des OC. The required return on a firm's common stock is, in theory, determined solely by its maritisk if the market is known, and it that is expected to remain constant, then no other information is required to specily the time's required return O Portfolio diversification reduces the variability of returns (as measured by the standard deviation of each individual stock held in a portfolio O E. A security's beta measures its non-diversifiable, or market, risk relative to that of an average stock QUESTION 13 Du has $100,000 invested in a 2 stock portfolio 532.500 din Stock X and the remainder is invested in stand Y's botais 0.70. What is the portfolio's beta? Do not round your intermediate calculations. Round the final answer is 2 decimal place O A 1.06 DE 1.25 OC0.72 OD.0.98 OE 0.77