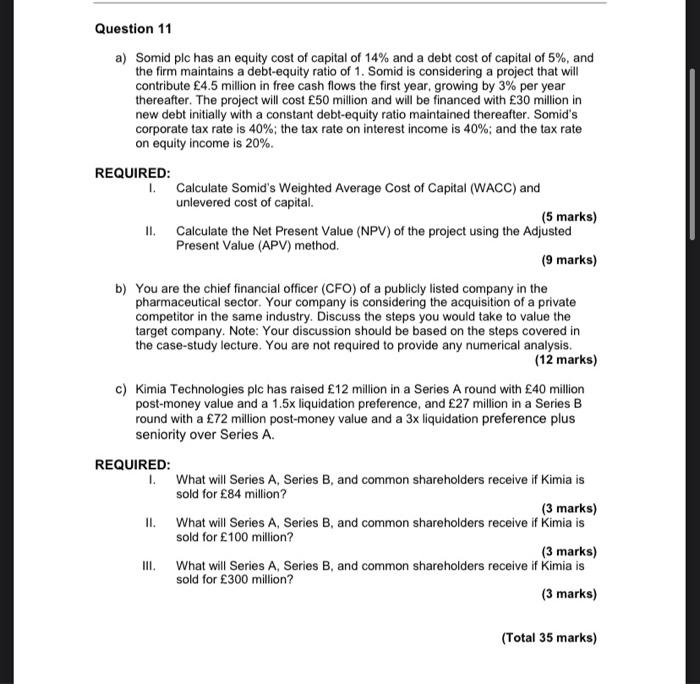

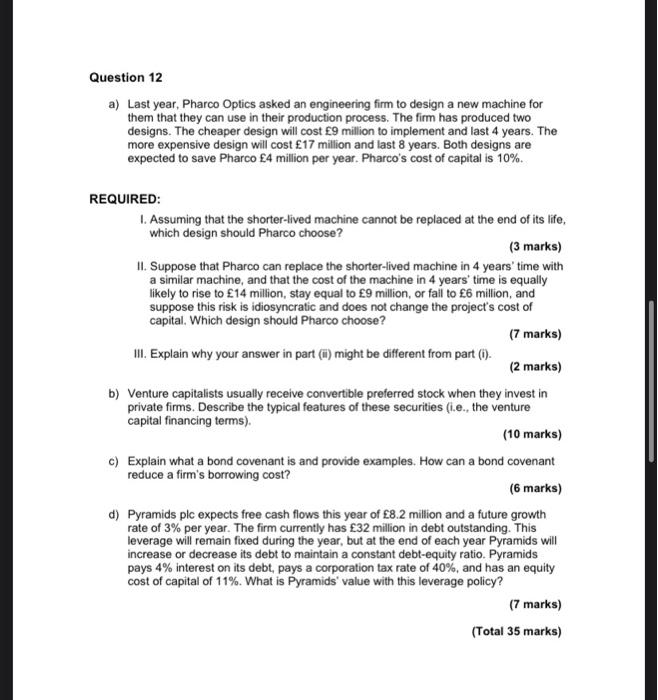

Question 11 a) Somid plc has an equity cost of capital of 14% and a debt cost of capital of 5%, and the firm maintains a debt-equity ratio of 1. Somid is considering a project that will contribute 4.5 million in free cash flows the first year, growing by 3% per year thereafter. The project will cost 50 million and will be financed with 30 million in new debt initially with a constant debt-equity ratio maintained thereafter. Somid's corporate tax rate is 40%; the tax rate on interest income is 40%; and the tax rate on equity income is 20%. REQUIRED: 1. Calculate Somid's Weighted Average Cost of Capital (WACC) and unlevered cost of capital. (5 marks) II. Calculate the Net Present Value (NPV) of the project using the Adjusted Present Value (APV) method. (9 marks) b) You are the chief financial officer (CFO) of a publicly listed company in the pharmaceutical sector. Your company is considering the acquisition of a private competitor in the same industry. Discuss the steps you would take to value the target company. Note: Your discussion should be based on the steps covered in the case-study lecture. You are not required to provide any numerical analysis. (12 marks) c) Kimia Technologies plc has raised 12 million in a Series Around with 40 million post-money value and a 1.5x liquidation preference, and 27 million in a Series B round with a 72 million post-money value and a 3x liquidation preference plus seniority over Series A. REQUIRED: 1. What will Series A, Series B, and common shareholders receive if Kimia is sold for 84 million? (3 marks) II. What will Series A, Series B, and common shareholders receive if Kimia is sold for 100 million? (3 marks) III. What will Series A Series B, and common shareholders receive if Kimia is sold for 300 million? (3 marks) (Total 35 marks) Question 12 a) Last year, Pharco Optics asked an engineering firm to design a new machine for them that they can use in their production process. The firm has produced two designs. The cheaper design will cost 9 million to implement and last 4 years. The more expensive design will cost 17 million and last 8 years. Both designs are expected to save Pharco 4 million per year. Pharco's cost of capital is 10%. REQUIRED: 1. Assuming that the shorter-lived machine cannot be replaced at the end of its life, which design should Pharco choose ? (3 marks) II. Suppose that Pharco can replace the shorter-lived machine in 4 years' time with a similar machine, and that the cost of the machine in 4 years' time is equally likely to rise to 14 million, stay equal to 9 million, or fail to 6 million, and suppose this risk is idiosyncratic and does not change the project's cost of capital. Which design should Pharco choose? (7 marks) III. Explain why your answer in part) might be different from part (0) (2 marks) b) Venture capitalists usually receive convertible preferred stock when they invest in private firms. Describe the typical features of these securities (i.e., the venture capital financing terms). (10 marks) c) Explain what a bond covenant is and provide examples. How can a bond covenant reduce a firm's borrowing cost? (6 marks) d) Pyramids plc expects free cash flows this year of 8.2 million and a future growth rate of 3% per year. The firm currently has 32 million in debt outstanding. This leverage will remain fixed during the year, but at the end of each year Pyramids will increase or decrease its debt to maintain a constant debt-equity ratio. Pyramids pays 4% interest on its debt, pays a corporation tax rate of 40%, and has an equity cost of capital of 11%. What is Pyramids' value with this leverage policy? (7 marks) (Total 35 marks) Question 11 a) Somid plc has an equity cost of capital of 14% and a debt cost of capital of 5%, and the firm maintains a debt-equity ratio of 1. Somid is considering a project that will contribute 4.5 million in free cash flows the first year, growing by 3% per year thereafter. The project will cost 50 million and will be financed with 30 million in new debt initially with a constant debt-equity ratio maintained thereafter. Somid's corporate tax rate is 40%; the tax rate on interest income is 40%; and the tax rate on equity income is 20%. REQUIRED: 1. Calculate Somid's Weighted Average Cost of Capital (WACC) and unlevered cost of capital. (5 marks) II. Calculate the Net Present Value (NPV) of the project using the Adjusted Present Value (APV) method. (9 marks) b) You are the chief financial officer (CFO) of a publicly listed company in the pharmaceutical sector. Your company is considering the acquisition of a private competitor in the same industry. Discuss the steps you would take to value the target company. Note: Your discussion should be based on the steps covered in the case-study lecture. You are not required to provide any numerical analysis. (12 marks) c) Kimia Technologies plc has raised 12 million in a Series Around with 40 million post-money value and a 1.5x liquidation preference, and 27 million in a Series B round with a 72 million post-money value and a 3x liquidation preference plus seniority over Series A. REQUIRED: 1. What will Series A, Series B, and common shareholders receive if Kimia is sold for 84 million? (3 marks) II. What will Series A, Series B, and common shareholders receive if Kimia is sold for 100 million? (3 marks) III. What will Series A Series B, and common shareholders receive if Kimia is sold for 300 million? (3 marks) (Total 35 marks) Question 12 a) Last year, Pharco Optics asked an engineering firm to design a new machine for them that they can use in their production process. The firm has produced two designs. The cheaper design will cost 9 million to implement and last 4 years. The more expensive design will cost 17 million and last 8 years. Both designs are expected to save Pharco 4 million per year. Pharco's cost of capital is 10%. REQUIRED: 1. Assuming that the shorter-lived machine cannot be replaced at the end of its life, which design should Pharco choose ? (3 marks) II. Suppose that Pharco can replace the shorter-lived machine in 4 years' time with a similar machine, and that the cost of the machine in 4 years' time is equally likely to rise to 14 million, stay equal to 9 million, or fail to 6 million, and suppose this risk is idiosyncratic and does not change the project's cost of capital. Which design should Pharco choose? (7 marks) III. Explain why your answer in part) might be different from part (0) (2 marks) b) Venture capitalists usually receive convertible preferred stock when they invest in private firms. Describe the typical features of these securities (i.e., the venture capital financing terms). (10 marks) c) Explain what a bond covenant is and provide examples. How can a bond covenant reduce a firm's borrowing cost? (6 marks) d) Pyramids plc expects free cash flows this year of 8.2 million and a future growth rate of 3% per year. The firm currently has 32 million in debt outstanding. This leverage will remain fixed during the year, but at the end of each year Pyramids will increase or decrease its debt to maintain a constant debt-equity ratio. Pyramids pays 4% interest on its debt, pays a corporation tax rate of 40%, and has an equity cost of capital of 11%. What is Pyramids' value with this leverage policy? (7 marks) (Total 35 marks)