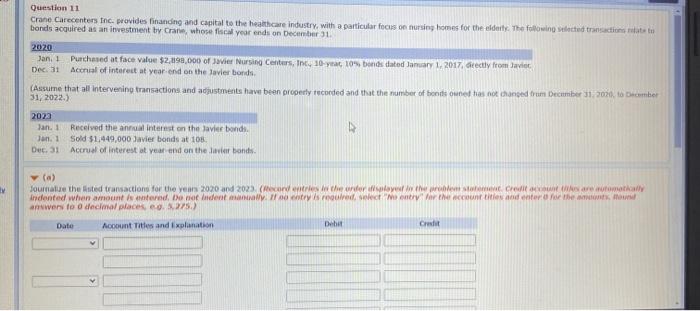

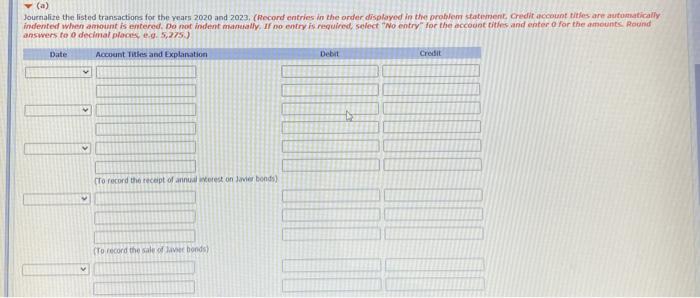

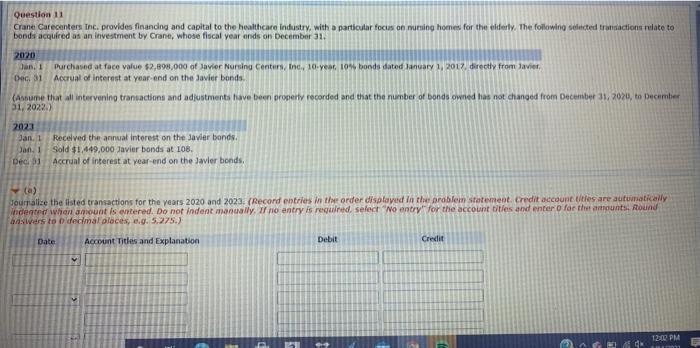

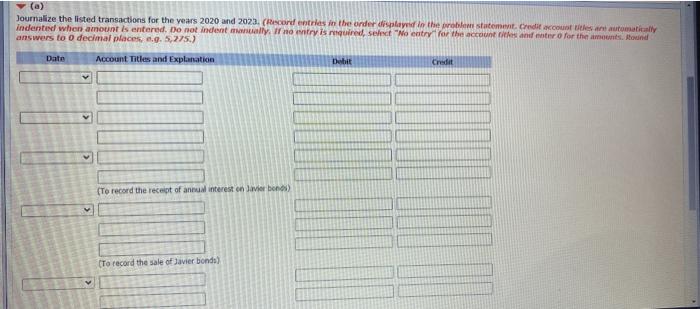

Question 11 Crane Carecenters inc. provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions to bonds acquired as an investment by Crane, whose fiscal year ends on December 31 2020 Jan I purchased at face value $2,198,000 of Her Nursing Centers, Ines 10-year los bonds dated January 1, 2017 Grectly from Javier Dec. 31 Aceral of interest at year end on the Javier bonds (Assume that all intervening transactions and adjustments have been property recorded and that the number of bonito oured has not changed from December 31, 2020, to bomber 31, 2022.) 2022 Jan. 1 Received the annual interest on the Javier bond Jan. Sold $1,449,000 Javier bonds at 10. Dec. 31 Accrual of interest a year and on the Javier bonds () Journalue the listed transactions for the years 2020 and 2023 (Record entries in the ordered the woblem credit care automatically Indented when amount is entered to be indenti. Il trys roguire selecte entry for the countities and enter for the found answers to decimal places, ed. 275.) Date Account Titles and Explanation Debat C (a) Journalize the listed transactions for the years 2020 and 2023, (Record entries in the order displayed in the problem statement Credit account titles ant automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to decimal places, eg. 5,275) Date Account Titles and Explanation Debit Credit (To record the receipt of annual rest on lae bonds) (To record the sale of bonds) Question 11 Crane Carecenters. The provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds acquired as an investment by Crane, whose fiscal year ands on December 31. 2020 Can I Purchased at face value $2,898,000 of Javier Nursing Centers, Inc., 10-year 10% bonds dated January 1, 2017, directly from Javier Dec 31 Accrual of interest at year and on the Javier bonds (Anume that all intervening transactions and adjustments have been property recorded and that the number of bonds owned has not changed from December 31, 2000, to December 31, 2022 2023 Jan. 1 Received the annual interest on the Javier bonds. n. 1 Sold $1,449,000 Javier bonds at 108. Del Accrual of interest at year-end on the Javier bonds a) Journalize the listed transactions for the years 2020 and 2023. (Record entries in the order displayed in the problem statement. Credit account Utles are automatically indegte whan amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts. Round Baswers to decimal places, e.g. 5.275.) Date Account Titles and Explanation Debit Credit 12:00 PM du (a) Journalize the listed transactions for the years 2020 and 2023. (Record entries in the order displayed in the ble statement Credit account des ant automatically indented when amount is entered. Do not indentally, I try is required, select "No entry for the accounts and enter for the amounts found answers to o decimal places,.. 5,275.) Date Account Titles and Explanation Debit Crit {To record the receipt of annual interest on Javier bonos) (To record the sale of Javier bonds)