Answered step by step

Verified Expert Solution

Question

1 Approved Answer

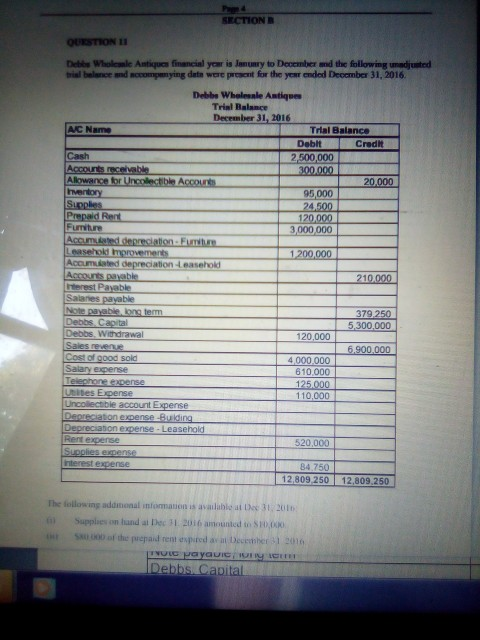

QUESTION 11 Debe Wholesale Antiques financial your is January to December and the following unadjusted trial balance and companying data were present for the year

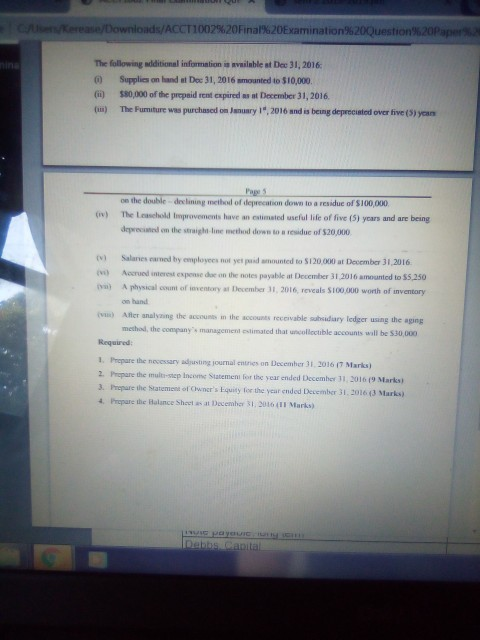

QUESTION 11 Debe Wholesale Antiques financial your is January to December and the following unadjusted trial balance and companying data were present for the year ended December 31, 2016 Debbe Wholesale Antiques Trial Balance December 31, 2016 AC Name Trial Balance Debit Credit Cash 2,500,000 Accounts receivable 300.000 Allowance for Uncollectible Accounts 20.000 thventory 95,000 Supplies 24,500 Prepaid Rent 120.000 Furniture 3,000 000 Accurated depreciation. Furniture Leasehold Improvements 1 200.000 Accumulated depreciation Leasehold Accounts payable 210.000 Interest Payable Saanes payable Notepayable long term 379 250 Debbs Capital 5,300,000 Debbs Withdrawal 120,000 Sales revenue 6.900.000 Cost of good sold 4.000.000 Salary expense 610,000 Telephone expense 125.000 luises Expense 110.000 Uncollectible account Expense Depreciation expense Building Depreciabon expense - Leasehold Rent expense 520,000 Supplies expense interest expense 84.750 12,809 250 12.809 250 The following admonal information is available at 31 20 Supplies in land al Dec 2016 amounted 10.000 S of the prepaid rent expired aras December 2016 TULO payaui Oy Debbs Capital A e reas/Downloads/ACCT1002%20Final%20Examination%20Question%20Papers The following additional information is silable at Dec 31, 2016: 0 Supplies on hand at Dec 31, 2016 mounted to $10,000 (ii) $80,000 of the prepaid rent expired at December 31, 2016. c) The Fumiture was purchased on Juary 1, 2016 and is being deprecated over five (5) you (v) Page 5 on the double declining method of deprecation down to a residue of $100.000 The Laschold provements have an estimated useful life of five (5) years and are being deprecated on the straight line method down to residue of $20,000 v Salones earned by employees not yet paid mounted to $120.000 at December 31,2016 Accrued interest expense or on the notes payable at December 31, 2016 amounted to $5,250 A physical count of inventory December 11, 2016, reveals $100,000 worth of inventory on hand Aller analyzing the account in the counts receivable subsidiary ledger using the aging method, the company's management estimated that collectible accounts will be 530 000 Required: 1. Prepare the necessary dusting journal entries on December 31, 2016 17 Marks) 2. Prepare the multi-step Income Statement for the year ended December 11, 2016 19 Marks 3. Prepare the Statement of Owner's quity for the year ended December 31, 2016 Marks) 4. Prepare the Balance Sheets at December 31, 2016 Marks) Das Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started