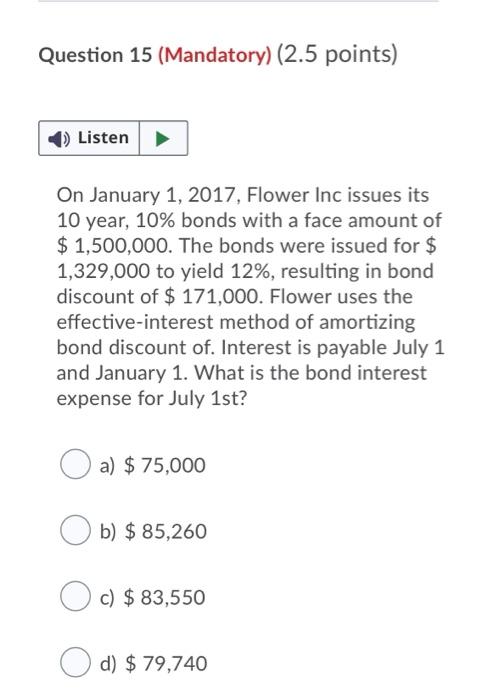

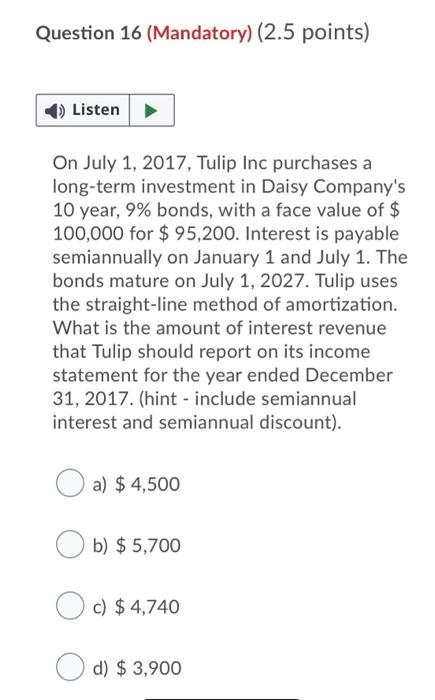

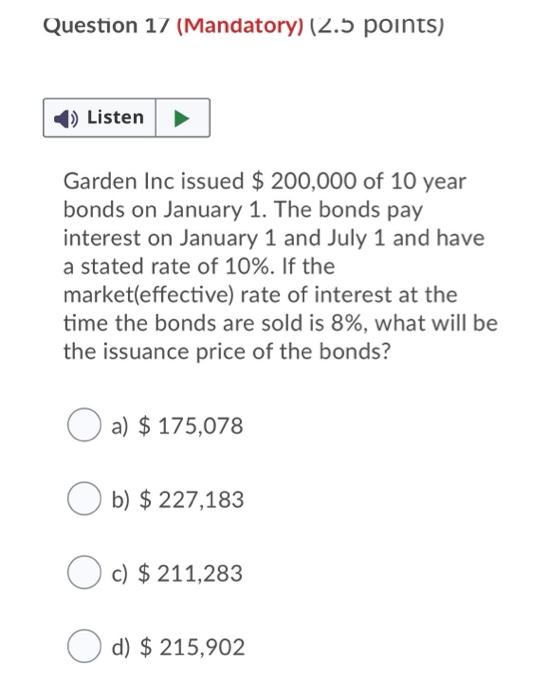

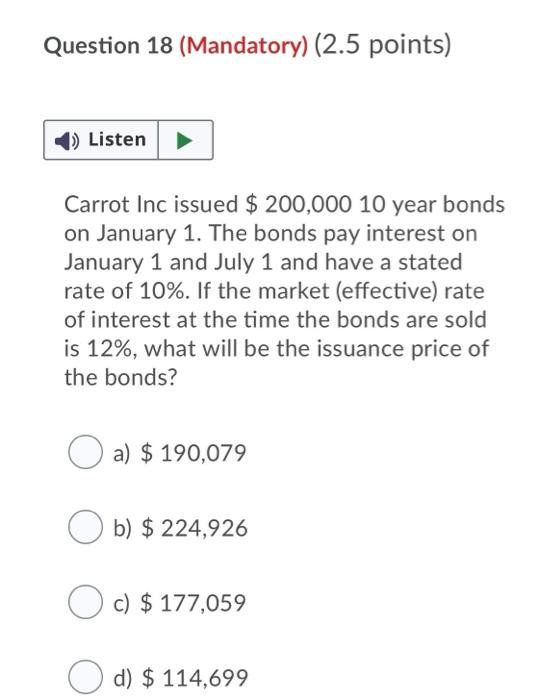

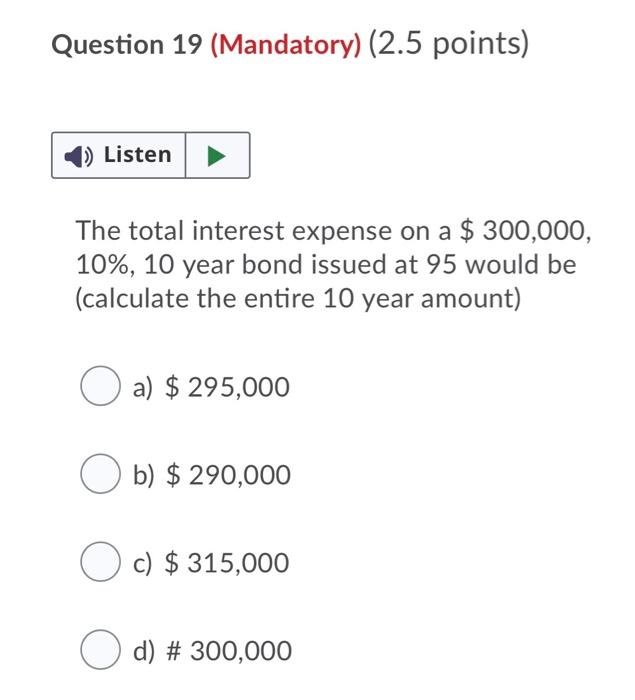

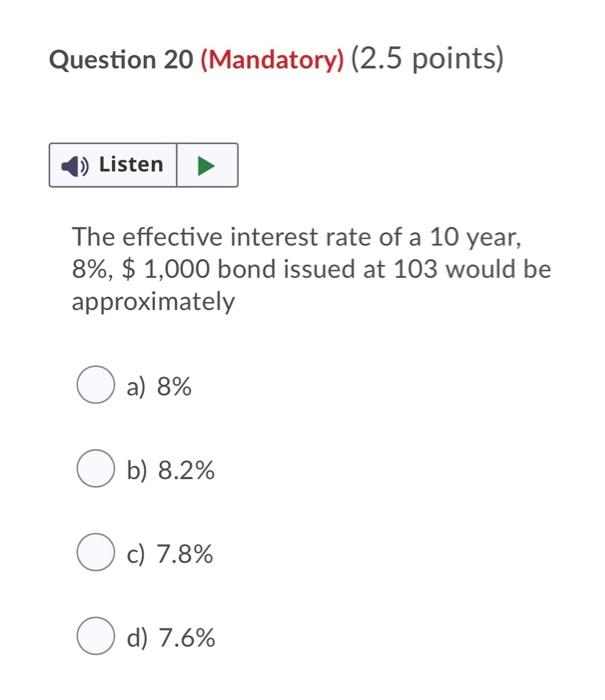

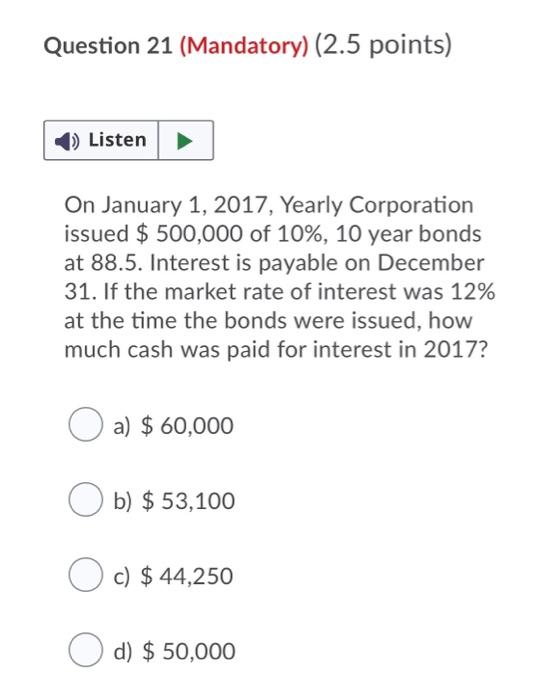

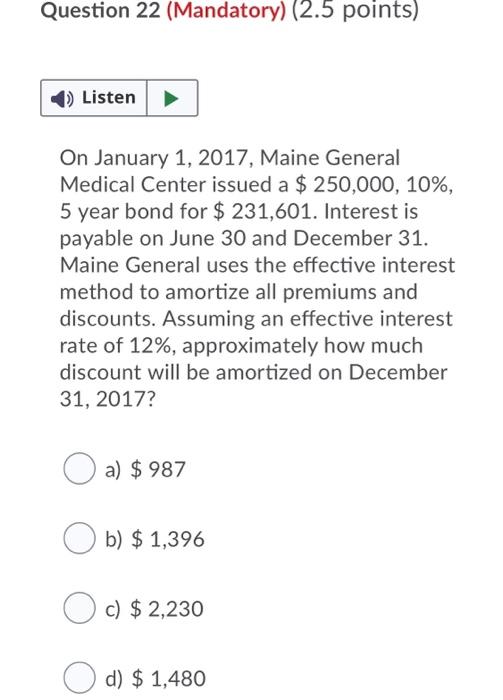

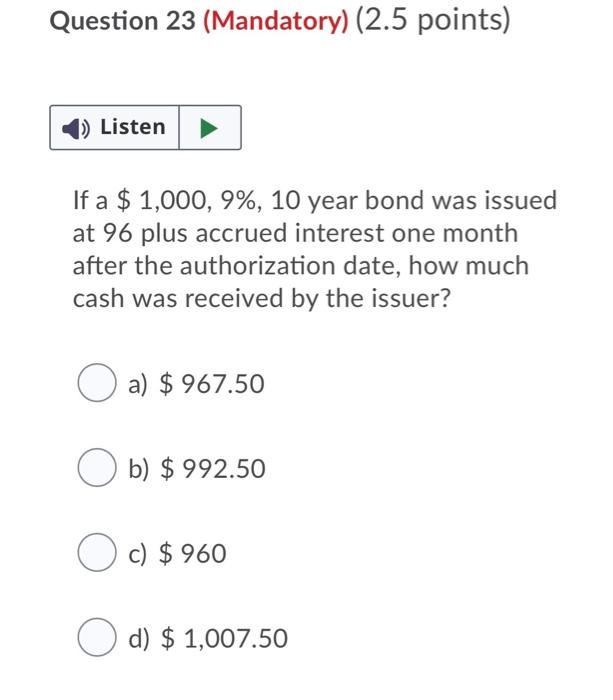

Question 11 (Mandatory) (2.5 points) 1) Listen Callable bonds a) can be converted to stock Ob) None of these is correct c) can be redeemed by the issuer at some time at a pre-specified price. d) mature in a series of payments Question 12 (Mandatory) (2.5 points) Listen When a company issues bonds, how are unamortized bond discounts and premiums classified on the balance sheet? a) Bond discounts are classified as assets, and bond premiums are classified as contra-asset accounts. b) Bond premiums are classified as additions to, and bond discounts are classified as deductions from, the face value of bonds. c) Bond discounts are classified as expenses, and bond premiums are classified as revenues. d) None of these are correct. Question 13 (Mandatory) (2.5 points) Listen Spring Inc, a claendar-year firm, is authorized to issue $ 200,000 of 10%, 20 year bonds dated January 1, 2017, with interest payable on January 1 and July 1 of each year. If the bonds were issued to yield 12%, the entry to account for the discount amortization and accrual of interest on December 31, 2017, would include a a) debit to Discount on Bonds Payable b) credit to Interest Payable c) debit to Bonds Payable ) d) Credit to Cash Question 14 (Mandatory) (2.5 points) ) Listen On January 1, Summer Inc issued a ten year bonds with a face amount of $ 1,000,000 and a state interest rate of 8% payable annually each January 1. The bonds were priced to yield at 10%. The total issue price (rounded) of the bonds should be what amount? a) $ 980,000 b) $ 920,000 c) $ 880,000 d) $ 1,000,000 Question 15 (Mandatory) (2.5 points) Listen On January 1, 2017, Flower Inc issues its 10 year, 10% bonds with a face amount of $ 1,500,000. The bonds were issued for $ 1,329,000 to yield 12%, resulting in bond discount of $ 171,000. Flower uses the effective-interest method of amortizing bond discount of. Interest is payable July 1 and January 1. What is the bond interest expense for July 1st? a) $ 75,000 b) $ 85,260 c) $ 83,550 Od) $ 79,740 Question 16 (Mandatory) (2.5 points) Listen On July 1, 2017, Tulip Inc purchases a long-term investment in Daisy Company's 10 year, 9% bonds, with a face value of $ 100,000 for $ 95,200. Interest is payable semiannually on January 1 and July 1. The bonds mature on July 1, 2027. Tulip uses the straight-line method of amortization. What is the amount of interest revenue that Tulip should report on its income statement for the year ended December 31, 2017. (hint - include semiannual interest and semiannual discount). a) $ 4,500 b) $ 5,700 $ c) $ 4,740 d) $ 3,900 Question 17 (Mandatory) (2.5 points) () Listen Garden Inc issued $ 200,000 of 10 year bonds on January 1. The bonds pay interest on January 1 and July 1 and have a stated rate of 10%. If the market(effective) rate of interest at the time the bonds are sold is 8%, what will be the issuance price of the bonds? O a) a) $ 175,078 b) $ 227,183 c) $ 211,283 d) $ 215,902 Question 18 (Mandatory) (2.5 points) Listen Carrot Inc issued $ 200,000 10 year bonds on January 1. The bonds pay interest on January 1 and July 1 and have a stated rate of 10%. If the market (effective) rate of interest at the time the bonds are sold is 12%, what will be the issuance price of the bonds? a) $ 190,079 b) $ 224,926 O c) $ 177,059 d) $ 114,699 Question 19 (Mandatory) (2.5 points) Listen The total interest expense on a $ 300,000, 10%, 10 year bond issued at 95 would be (calculate the entire 10 year amount) O a) $ 295,000 Ob) $ 290,000 Oc) $ 315,000 O d) # 300,000 Question 20 (Mandatory) (2.5 points) 1) Listen The effective interest rate of a 10 year, 8%, $ 1,000 bond issued at 103 would be approximately O a) 8% b) 8.2% O c) 7.8% O d) 7.6% Question 21 (Mandatory) (2.5 points) Listen On January 1, 2017, Yearly Corporation issued $ 500,000 of 10%, 10 year bonds at 88.5. Interest is payable on December 31. If the market rate of interest was 12% at the time the bonds were issued, how much cash was paid for interest in 2017? O a) $ 60,000 b) $ 53,100 O c) $ 44,250 d) $ 50,000 Question 22 (Mandatory) (2.5 points) Listen On January 1, 2017, Maine General Medical Center issued a $ 250,000, 10%, 5 year bond for $ 231,601. Interest is payable on June 30 and December 31. Maine General uses the effective interest method to amortize all premiums and discounts. Assuming an effective interest rate of 12%, approximately how much discount will be amortized on December 31, 2017? a) $ 987 b) $ 1,396 c) $ 2,230 d) $ 1,480 Question 23 (Mandatory) (2.5 points) 1) Listen If a $ 1,000, 9%, 10 year bond was issued at 96 plus accrued interest one month after the authorization date, how much cash was received by the issuer? a) $ 967.50 Ob) $ 992.50 O c) $ 960 d) $ 1,007.50