Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 11 of 2 Question 11 If the probability is 60% that you will receive a 12% return and there is s 40% probability that

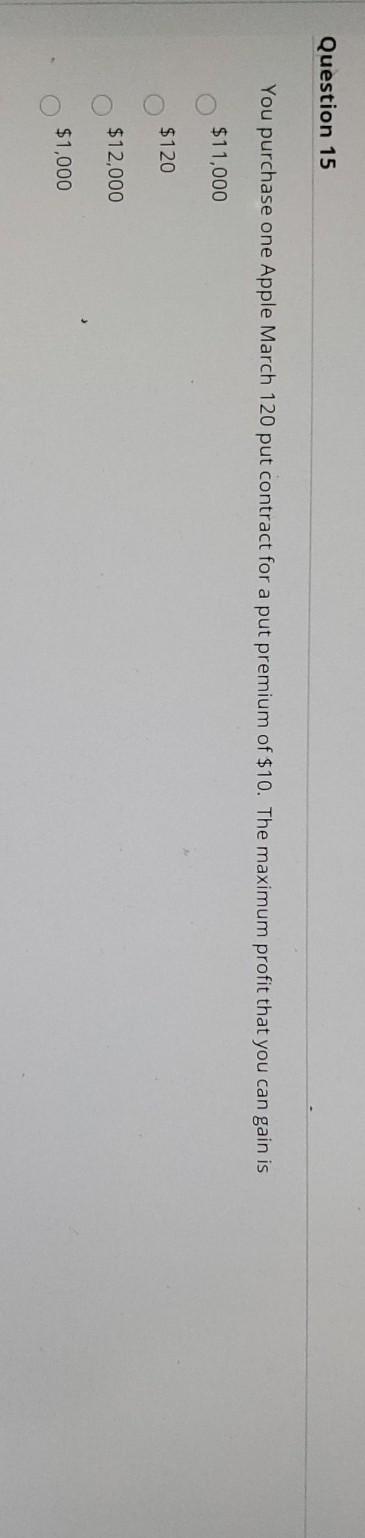

Question 11 of 2 Question 11 If the probability is 60% that you will receive a 12% return and there is s 40% probability that you will receive a 1% return, then the expected return from this investment is 75%. 10 points True False Question 12 of 36 Question 12 10 points Save Answer A callable bond pays annual interest of $60, has a par value of $1000, matures in 20 years but is callable in 10 years at a price of $1,100, and has a value (market price) of 5 966.39. The yield to call is 8.44% 7.2% 6.2796 696 Question 13 According to the capital asset pricing model (CAPM), fairly priced securities have positive alphas negative betas negative alphas Zero alphas Question 14 A Sharpe ratio of 0.25 is better, more efficient than a Sharpe ratio of 0.36. True False Question 15 You purchase one Apple March 120 put contract for a put premium of $10. The maximum profit that you can gain is $11,000 $120 $12,000 $1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started