Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 11 Paradise, a manufacturer located in rural New Brunswick, purchased a widget-making machine in 2017 and depreciated it using the double-declining-balance method. As at

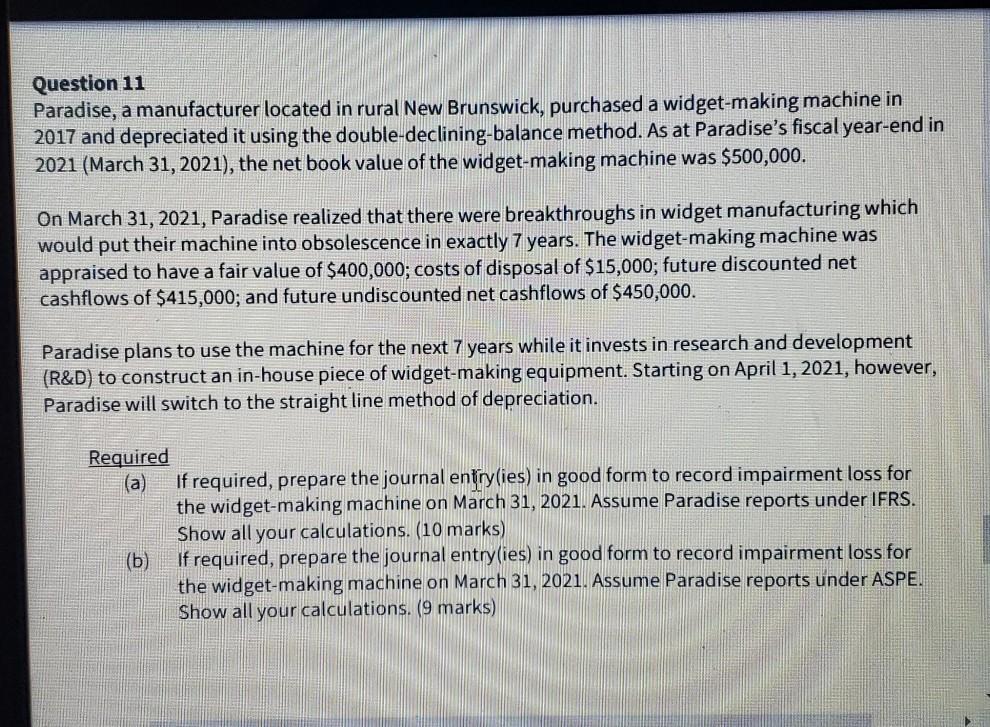

Question 11 Paradise, a manufacturer located in rural New Brunswick, purchased a widget-making machine in 2017 and depreciated it using the double-declining-balance method. As at Paradise's fiscal year-end in 2021 (March 31, 2021), the net book value of the widget-making machine was $500,000. On March 31, 2021, Paradise realized that there were breakthroughs in widget manufacturing which would put their machine into obsolescence in exactly 7 years. The widget-making machine was appraised to have a fair value of $400,000; costs of disposal of $15,000; future discounted net cashflows of $415,000; and future undiscounted net cashflows of $450,000. Paradise plans to use the machine for the next 7 years while it invests in research and development (R&D) to construct an in-house piece of widget-making equipment. Starting on April 1, 2021, however, Paradise will switch to the straight line method of depreciation. Required (a) If required, prepare the journal entry (ies) in good form to record impairment loss for the widget-making machine on March 31, 2021. Assume Paradise reports under IFRS. Show all your calculations. (10 marks) (b) If required, prepare the journal entry (ies) in good form to record impairment loss for the widget-making machine on March 31, 2021. Assume Paradise reports under ASPE. Show all your calculations. (9 marks) Question 11 Paradise, a manufacturer located in rural New Brunswick, purchased a widget-making machine in 2017 and depreciated it using the double-declining-balance method. As at Paradise's fiscal year-end in 2021 (March 31, 2021), the net book value of the widget-making machine was $500,000. On March 31, 2021, Paradise realized that there were breakthroughs in widget manufacturing which would put their machine into obsolescence in exactly 7 years. The widget-making machine was appraised to have a fair value of $400,000; costs of disposal of $15,000; future discounted net cashflows of $415,000; and future undiscounted net cashflows of $450,000. Paradise plans to use the machine for the next 7 years while it invests in research and development (R&D) to construct an in-house piece of widget-making equipment. Starting on April 1, 2021, however, Paradise will switch to the straight line method of depreciation. Required (a) If required, prepare the journal entry (ies) in good form to record impairment loss for the widget-making machine on March 31, 2021. Assume Paradise reports under IFRS. Show all your calculations. (10 marks) (b) If required, prepare the journal entry (ies) in good form to record impairment loss for the widget-making machine on March 31, 2021. Assume Paradise reports under ASPE. Show all your calculations. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started