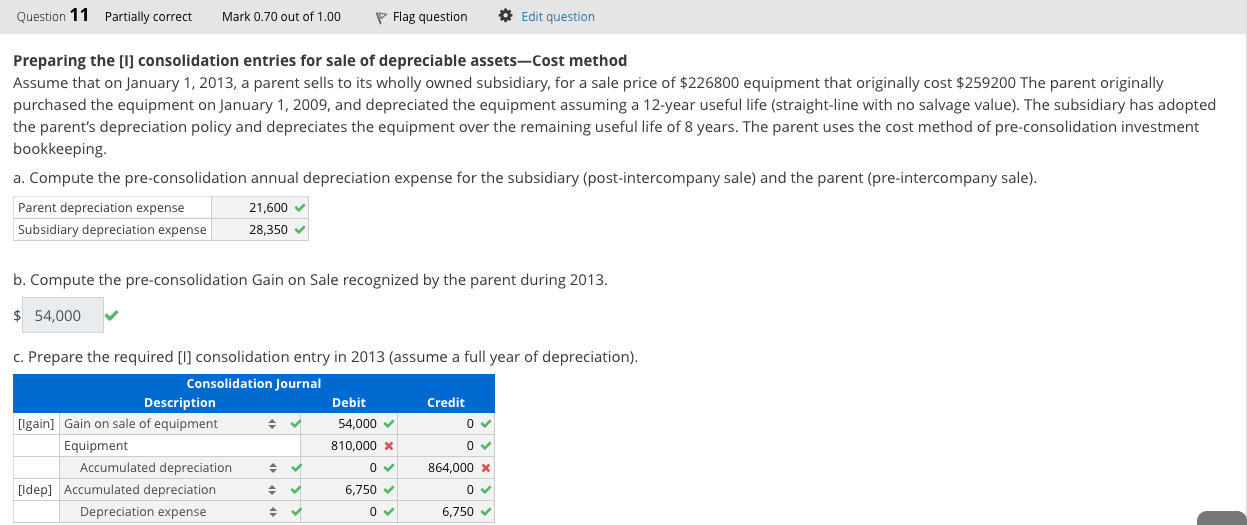

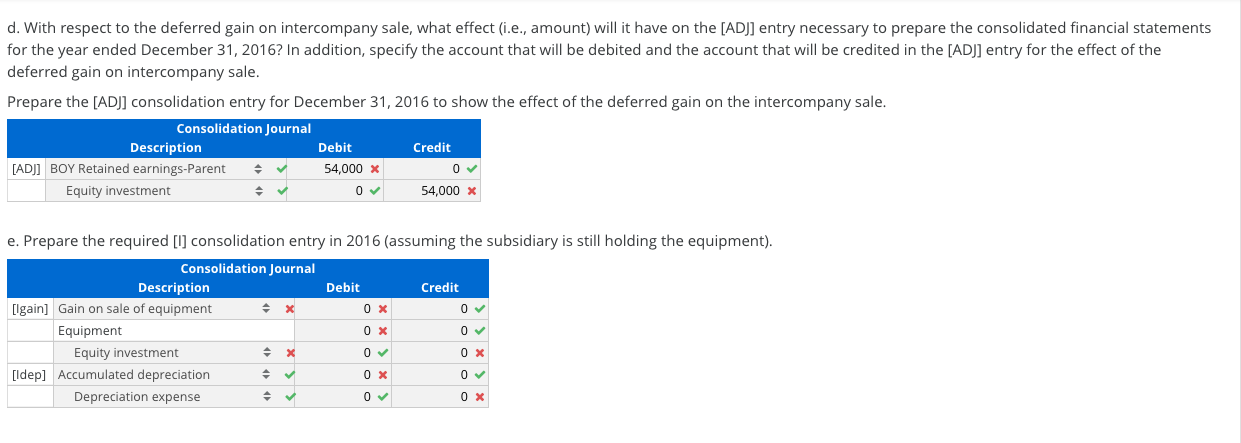

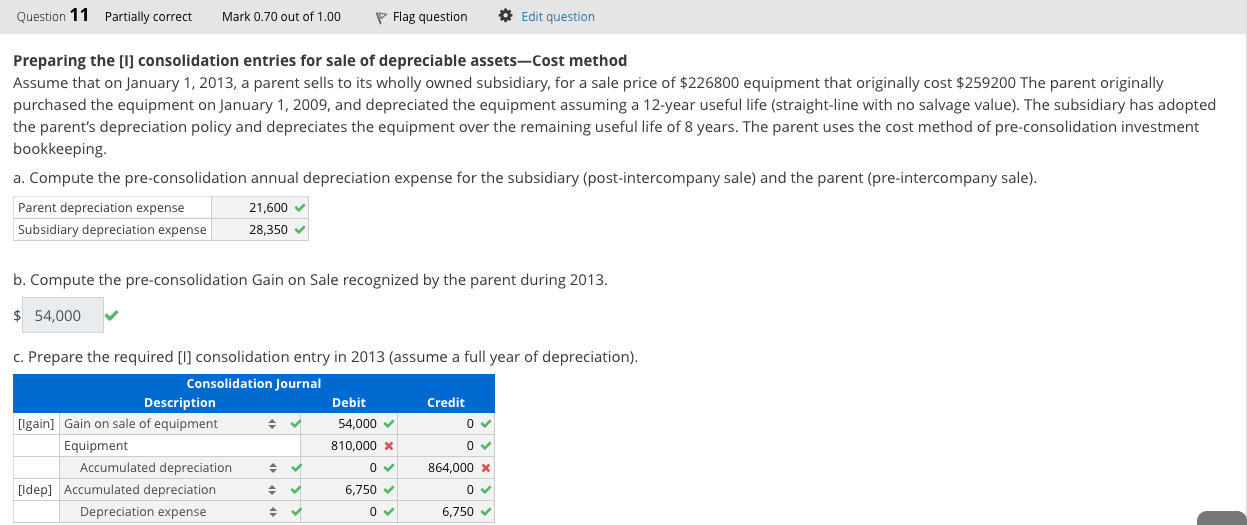

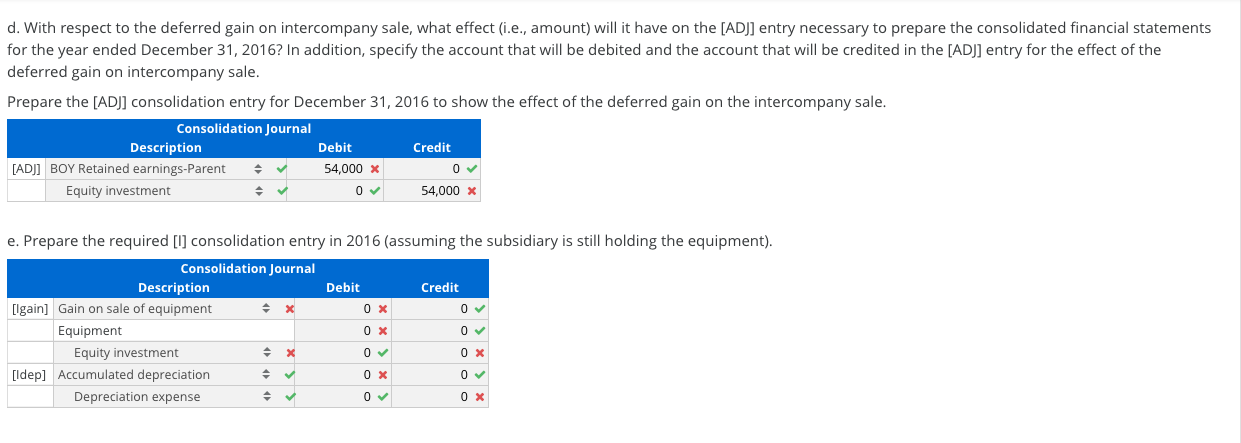

Question 11 Partially correct Mark 0.70 out of 1.00 Flag question Edit question Preparing the [i] consolidation entries for sale of depreciable assets-Cost method Assume that on January 1, 2013, a parent sells to its wholly owned subsidiary, for a sale price of $226800 equipment that originally cost $259200 The parent originally purchased the equipment on January 1, 2009, and depreciated the equipment assuming a 12-year useful life (straight-line with no salvage value). The subsidiary has adopted the parent's depreciation policy and depreciates the equipment over the remaining useful life of 8 years. The parent uses the cost method of pre-consolidation investment bookkeeping a. Compute the pre-consolidation annual depreciation expense for the subsidiary (post-intercompany sale) and the parent (pre-intercompany sale). Parent depreciation expense 21,600 Subsidiary depreciation expense 28,350 b. Compute the pre-consolidation Gain on Sale recognized by the parent during 2013. $ 54,000 C. Prepare the required [l] consolidation entry in 2013 (assume a full year of depreciation). Consolidation Journal Description Debit Credit [lgain] Gain on sale of equipment 54,000 0 Equipment 810,000 X 0 Accumulated depreciation 0 864,000 x [ldep] Accumulated depreciation 6,750 0 Depreciation expense 0 6,750 d. With respect to the deferred gain on intercompany sale, what effect (i.e., amount) will it have on the [AD]] entry necessary to prepare the consolidated financial statements for the year ended December 31, 2016? In addition, specify the account that will be debited and the account that will be credited in the [AD]] entry for the effect of the deferred gain on intercompany sale. Prepare the [AD]] consolidation entry for December 31, 2016 to show the effect of the deferred gain on the intercompany sale. Consolidation Journal Description Debit Credit [AD]] BOY Retained earnings-Parent 54,000 x 0 Equity investment 54,000 X 0 e. Prepare the required [l] consolidation entry in 2016 (assuming the subsidiary is still holding the equipment). Consolidation Journal Description Debit Credit [lgain] Gain on sale of equipment OX 0 Equipment OX 0 Equity investment X 0 OX [ldep] Accumulated depreciation OX 0 Depreciation expense 0 0 X