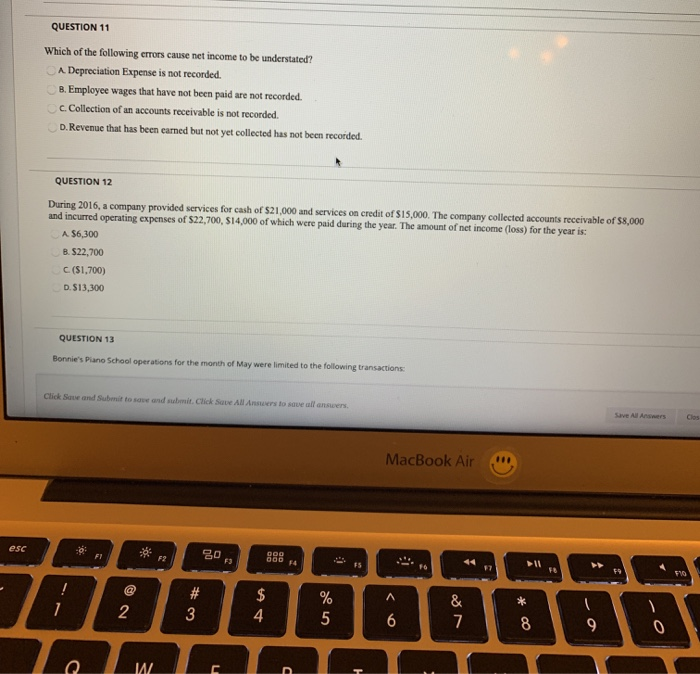

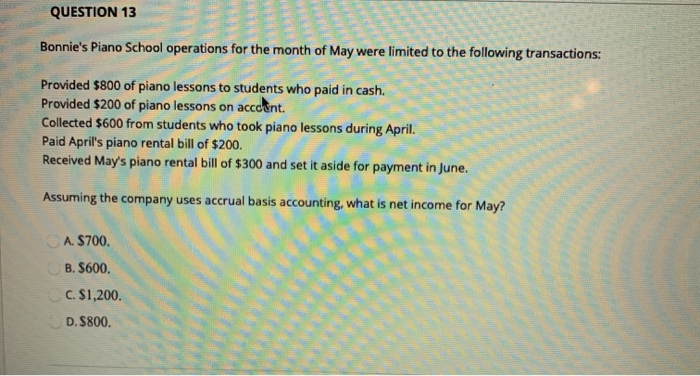

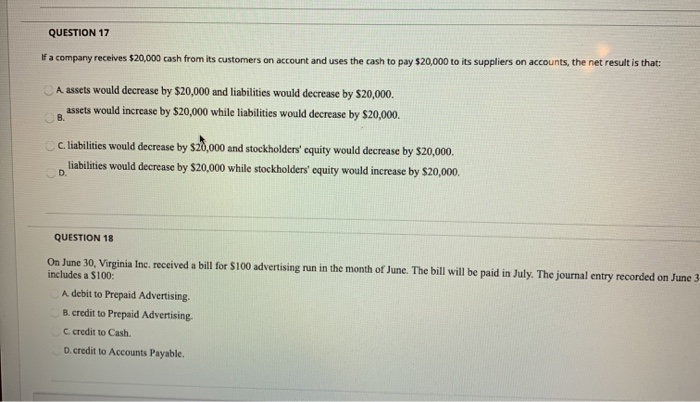

QUESTION 11 Which of the following errors cause net income to be understated? A Depreciation Expense is not recorded. B. Employee wages that have not been paid are not recorded. c. Collection of an accounts receivable is not recorded. D. Revenue that has been earned but not yet collected has not been recorded. QUESTION 12 During 2016, a company provided services for cash of $21,000 and services on credit of $15,000. The company collected accounts receivable of $8,000 and incurred operating expenses of $22,700, S14,000 of which were paid during the year. The amount of net income (loss) for the year is: A $6,300 B. $22,700 C($1,700) D. $13,300 QUESTION 13 Bonnie's Piano School operations for the month of May were limited to the following transactions Click Save and submit to save and submit. Click Save All Answers to see all answers Save All Ars Cias MacBook Air esc & F1 000 20 F2 000 74 at FV @ # A 78 * 2 $ 4 3 % 5 & 7 6 8 9 9 0 Q. W QUESTION 13 Bonnie's Piano School operations for the month of May were limited to the following transactions: Provided $800 of piano lessons to students who paid in cash. Provided $200 of piano lessons on acccent. Collected $600 from students who took piano lessons during April. Paid April's piano rental bill of $200. Received May's piano rental bill of $300 and set it aside for payment in June. Assuming the company uses accrual basis accounting, what is net income for May? A. $700. B. $600. C. $1,200. D. $800. QUESTION 17 If a company receives $20,000 cash from its customers on account and uses the cash to pay $20,000 to its suppliers on accounts, the net result is that: A assets would decrease by $20,000 and liabilities would decrease by $20,000. assets would increase by $20,000 while liabilities would decrease by $20,000. B. C. liabilities would decrease by $20,000 and stockholders' equity would decrease by $20,000 liabilities would decrease by $20,000 while stockholders' equity would increase by $20,000. D QUESTION 18 On June 30, Virginia Inc. received a bill for $100 advertising run in the month of June. The bill will be paid in July. The journal entry recorded on June 3 includes a $100: A. debit to Prepaid Advertising B. credit to Prepaid Advertising C. credit to Cash D.credit to Accounts Payable