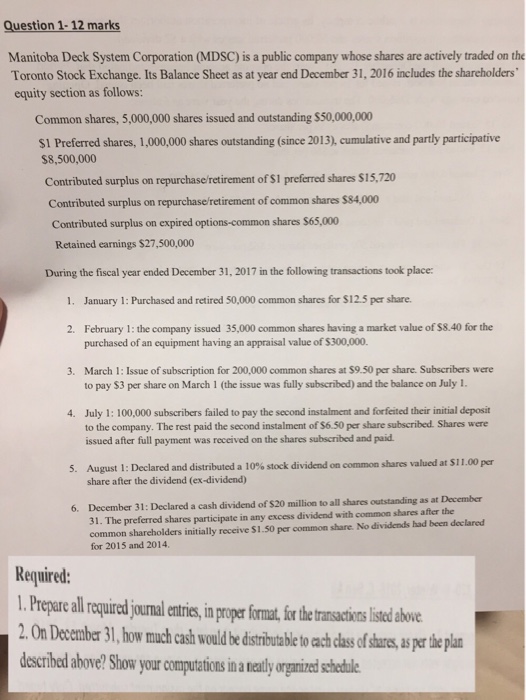

Question 1-12 marks Manitoba Deck System Corporation (MDSC) is a public company whose shares are actively traded on th Toronto Stock Exchange. Its Balance Sheet as at year end December 31, 2016 includes the shareholders equity section as follows: Common shares, 5,000,000 shares issued and outstanding $50,000,000 $1 Preferred shares, 1,000,000 shares outstanding (since 2013), cumulative and partly participative $8,500,000 Contributed surplus on repurchase/retirement of S1 preferred shares $15,720 Contributed surplus on repurchase'retirement of common shares $84,000 Contributed surplus on expired options-common shares $65,000 Retained earnings $27,500,000 During the fiscal year ended December 31, 2017 in the following transactions took place: 1. January 1: Purchased and retired 50,000 common shares for S12.5 per share February 1: the company issued 35,000 common shares having a market value of $8.40 for the purchased of an equipment having an appraisal value of $300,000. 2. March 1: Issue of subscription for 200,000 common shares at $9.50 per share. Subscribers were to pay $3 per share on March 1 (the issue was fully subscribed) and the balance on July L 3. July 1: 100,000 subscribers failed to pay the second instalment and forfeited their initial deposit to the company. The rest paid the second instalment of $6.50 per share subscribed. Shares were issued after full payment was received on the shares subscribed and paid 4. August 1 : Declared and distributed a 10% stock dividend on common shares valued at Si l.00 per share after the dividend (ex-dividend) 5. December 31: Declared a cash dividend of $20 million to all shares outstanding as at December 31. The preferred shares participate in any excess dividend with common shares after the common shareholders initially receive S1.50 per common share. No dividends had been declared 6. for 2015 and 2014. Required: . Prepart all required journal entris,in proper format,for the transcins litedla ove 2. On December 31, how much cash would be distriuabl to ach cass f share,as er thepa describedabove? Show your computations in ne rale Question 1-12 marks Manitoba Deck System Corporation (MDSC) is a public company whose shares are actively traded on th Toronto Stock Exchange. Its Balance Sheet as at year end December 31, 2016 includes the shareholders equity section as follows: Common shares, 5,000,000 shares issued and outstanding $50,000,000 $1 Preferred shares, 1,000,000 shares outstanding (since 2013), cumulative and partly participative $8,500,000 Contributed surplus on repurchase/retirement of S1 preferred shares $15,720 Contributed surplus on repurchase'retirement of common shares $84,000 Contributed surplus on expired options-common shares $65,000 Retained earnings $27,500,000 During the fiscal year ended December 31, 2017 in the following transactions took place: 1. January 1: Purchased and retired 50,000 common shares for S12.5 per share February 1: the company issued 35,000 common shares having a market value of $8.40 for the purchased of an equipment having an appraisal value of $300,000. 2. March 1: Issue of subscription for 200,000 common shares at $9.50 per share. Subscribers were to pay $3 per share on March 1 (the issue was fully subscribed) and the balance on July L 3. July 1: 100,000 subscribers failed to pay the second instalment and forfeited their initial deposit to the company. The rest paid the second instalment of $6.50 per share subscribed. Shares were issued after full payment was received on the shares subscribed and paid 4. August 1 : Declared and distributed a 10% stock dividend on common shares valued at Si l.00 per share after the dividend (ex-dividend) 5. December 31: Declared a cash dividend of $20 million to all shares outstanding as at December 31. The preferred shares participate in any excess dividend with common shares after the common shareholders initially receive S1.50 per common share. No dividends had been declared 6. for 2015 and 2014. Required: . Prepart all required journal entris,in proper format,for the transcins litedla ove 2. On December 31, how much cash would be distriuabl to ach cass f share,as er thepa describedabove? Show your computations in ne rale