Answered step by step

Verified Expert Solution

Question

1 Approved Answer

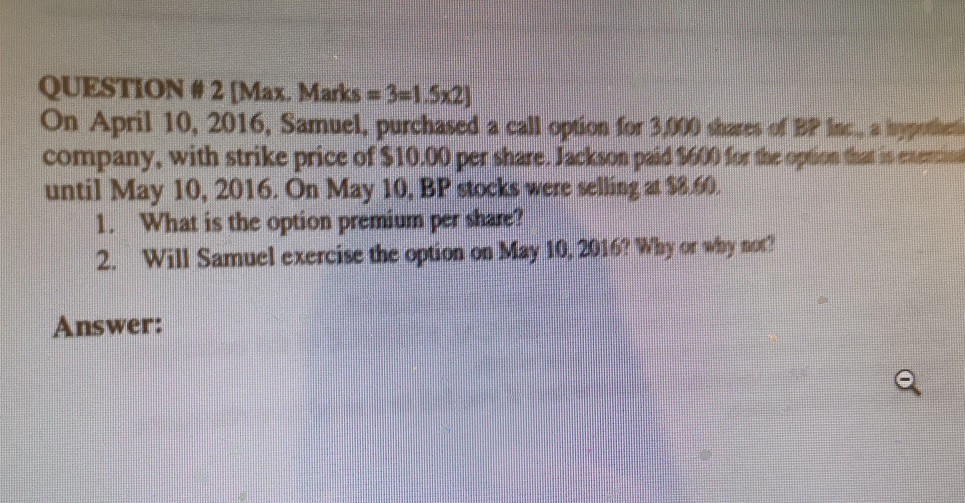

QUESTION 112 [Max, Mark. 3-1.5x21 On April 10, 2016, Samuel, purchased a call option for 3,000 shares of BR Inc. a company, with strike price

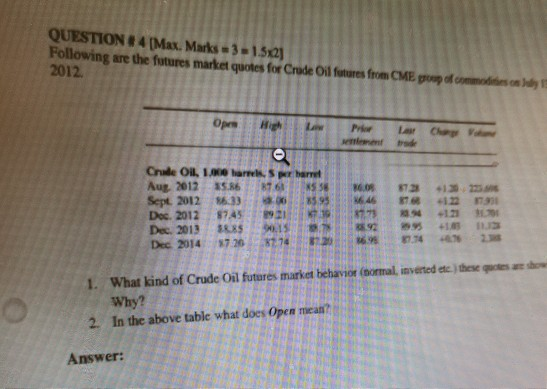

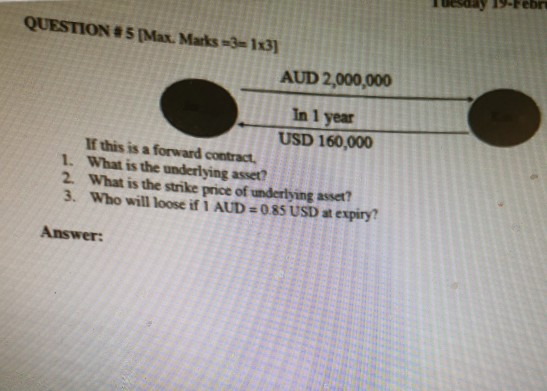

QUESTION 112 [Max, Mark. 3-1.5x21 On April 10, 2016, Samuel, purchased a call option for 3,000 shares of BR Inc. a company, with strike price of $10.00 per share. Jackson paid $600 for the optionu n until May 10, 2016. On May 10, BP stocks were selling at S860. 1. What is the option premium per share? 2. Will Samuel exercise the option on May 10,20169 Why or why sat? Answer: QUESTION 4[Max.Marks -3-150 Following are the fotures market quoles for Crude Oil forures from CME pomp od 2012. s7 20.8774 |120 86( 8774416 Lis Dec 2014 1. What kind of Crude Oil futures market behavior (normal, inverted etc.) these quotes ae show Why? 2. In the above table what does Open mean? Answer: QUESTION # 5 Max. Marks-3-1x3] AUD 2,000,000 In 1 year USD 160,000 If this is a forward contract 1. What is the underlying asset? 2. What is the strike price of underlying asset? 3, who will loose if I AUD 0 85 USD at expiry? Answer: QUESTION # 6 [Max. Marks 31 In what situation forward price is less than the futures price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started