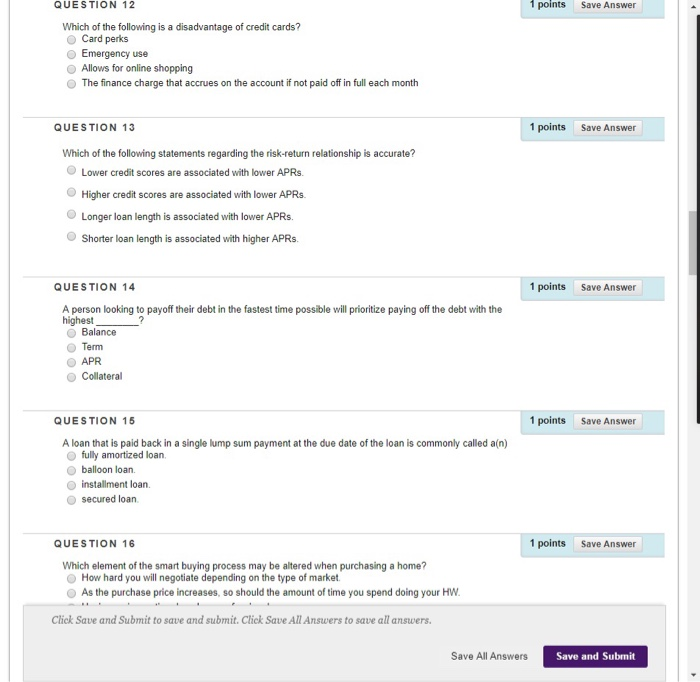

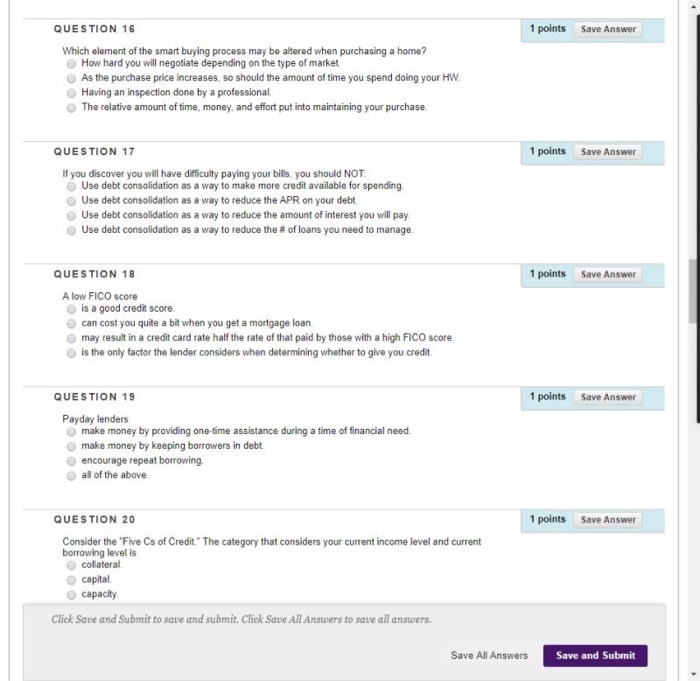

QUESTION 12 1 points Save Answer Which of the following is a disadvantage of credit cards? Card perks Emergency use Allows for online shopping The finance charge that accrues on the account if not paid off in full each month QUESTION 13 1 points Save Answer Which of the following statements regarding the risk-return relationship is accurate? Lower credit scores are associated with lower APRs. Higher credit scores are associated with lower APRs. Longer loan length is associated with lower APRs. Shorter loan length is associated with higher APRs. 1 points Save Answer QUESTION 14 A person looking to payoff their debt in the fastest time possible will prioritize paying off the debt with the highest Balance Term APR Collateral QUESTION 15 1 points Save Answer A loan that is paid back in a single lump sum payment at the due date of the loan is commonly called a(n) fully amortized loan balloon loan. installment loan. secured loan QUESTION 16 1 points Save Answer Which element of the smart buying process may be altered when purchasing a home? How hard you will negotiate depending on the type of market As the purchase price increases, so should the amount of time you spend doing your HW. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit QUESTION 16 1 points Save Answer Which element of the smart buying process may be altered when purchasing a home? How hard you will negotiate depending on the type of market As the purchase price increases so should the amount of time you spend doing your HW. Having an inspection done by a professional. The relative amount of time, money, and effort put into maintaining your purchase QUESTION 17 1 points Save Answer If you discover you will have difficulty paying your bills, you should NOT Use debt consolidation as a way to make more credit available for spending Use debt consolidation as a way to reduce the APR on your debt Use debt consolidation as a way to reduce the amount of interest you will pay Use debt consolidation as a way to reduce the # of loans you need to manage QUESTION 18 1 points Save Answer A low FICO score is a good credit score can cost you quite a bit when you get a mortgage loan may result in a credit card rate half the rate of that paid by those with a high FICO Score is the only factor the lender considers when determining whether to give you credit QUESTION 19 1 points Save Answer Payday lenders make money by providing one-time assistance during a time of financial need make money by keeping borrowers in debt encourage repeat borrowing. al of the above QUESTION 20 1 points Save Answer Consider the "Five Cs of Credit." The category that considers your current income level and current borrowing level is collateral capital capacity Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit