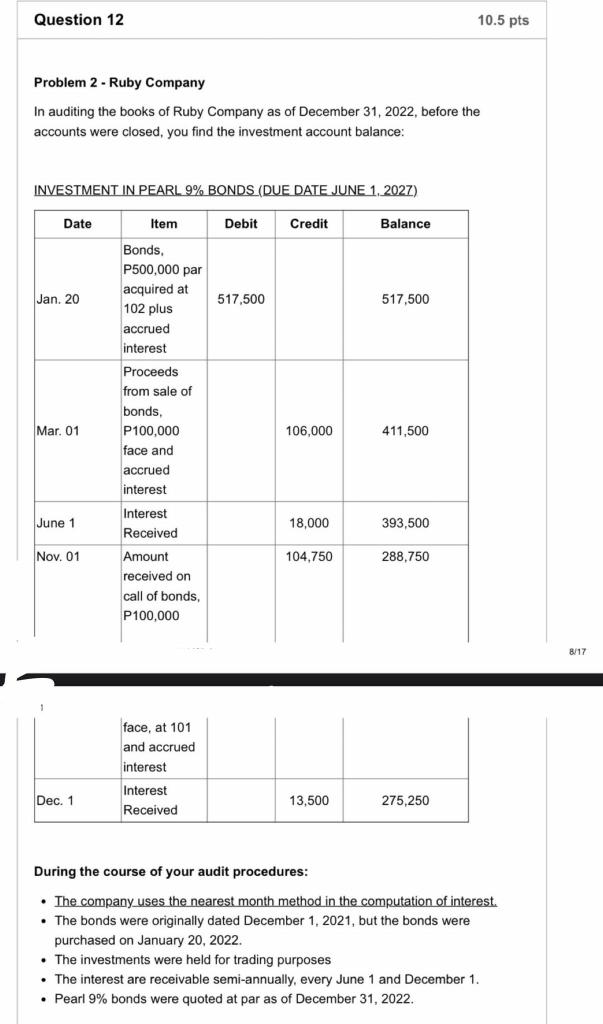

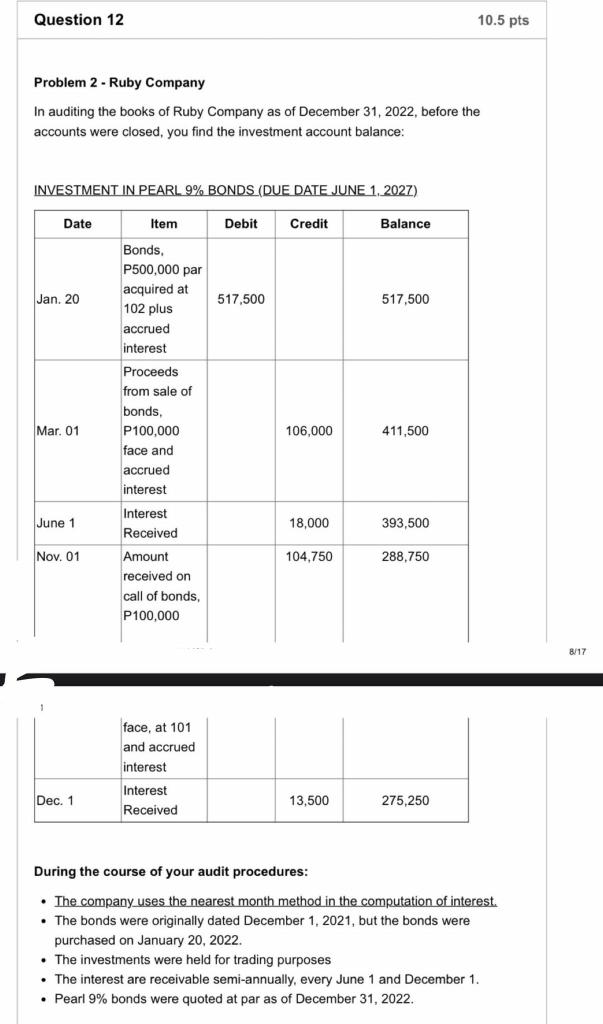

Question 12 10.5 pts Problem 2 - Ruby Company In auditing the books of Ruby Company as of December 31, 2022, before the accounts were closed, you find the investment account balance: INVESTMENT IN PEARL 9% BONDS (DUE DATE JUNE 1. 2027) Date Item Debit Credit Balance Jan. 20 517.500 517,500 Bonds, P500,000 par acquired at 102 plus accrued interest Proceeds from sale of bonds P100,000 face and accrued interest Mar. 01 106,000 411,500 June 1 Interest Received 18,000 393,500 Nov. 01 104.750 288,750 Amount received on call of bonds, P100,000 8/17 face, at 101 and accrued interest Dec. 1 Interest Received 13,500 275,250 During the course of your audit procedures: The company uses the nearest month method in the computation of interest. The bonds were originally dated December 1, 2021, but the bonds were purchased on January 20, 2022. The investments were held for trading purposes The interest are receivable semi-annually, every June 1 and December 1. Pearl 9% bonds were quoted at par as of December 31, 2022. Question 1: How much is the interest income for the year 2022? Question 2: The net gain or loss) on sale for 2022 amounts to? (Use negative sign if net loss) Question 3: The correct amount of investment in Pearl that should be presented in the balance sheet as of December 31, 2022 is? Question 12 10.5 pts Problem 2 - Ruby Company In auditing the books of Ruby Company as of December 31, 2022, before the accounts were closed, you find the investment account balance: INVESTMENT IN PEARL 9% BONDS (DUE DATE JUNE 1. 2027) Date Item Debit Credit Balance Jan. 20 517.500 517,500 Bonds, P500,000 par acquired at 102 plus accrued interest Proceeds from sale of bonds P100,000 face and accrued interest Mar. 01 106,000 411,500 June 1 Interest Received 18,000 393,500 Nov. 01 104.750 288,750 Amount received on call of bonds, P100,000 8/17 face, at 101 and accrued interest Dec. 1 Interest Received 13,500 275,250 During the course of your audit procedures: The company uses the nearest month method in the computation of interest. The bonds were originally dated December 1, 2021, but the bonds were purchased on January 20, 2022. The investments were held for trading purposes The interest are receivable semi-annually, every June 1 and December 1. Pearl 9% bonds were quoted at par as of December 31, 2022. Question 1: How much is the interest income for the year 2022? Question 2: The net gain or loss) on sale for 2022 amounts to? (Use negative sign if net loss) Question 3: The correct amount of investment in Pearl that should be presented in the balance sheet as of December 31, 2022 is