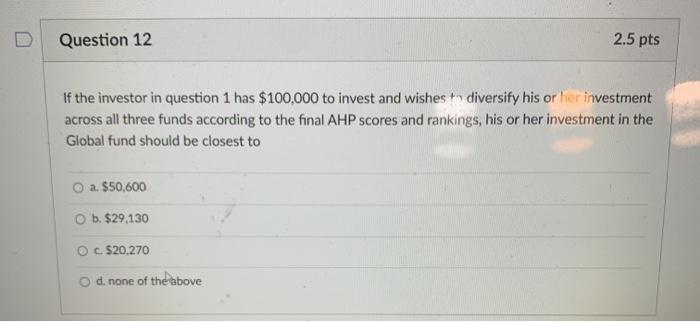

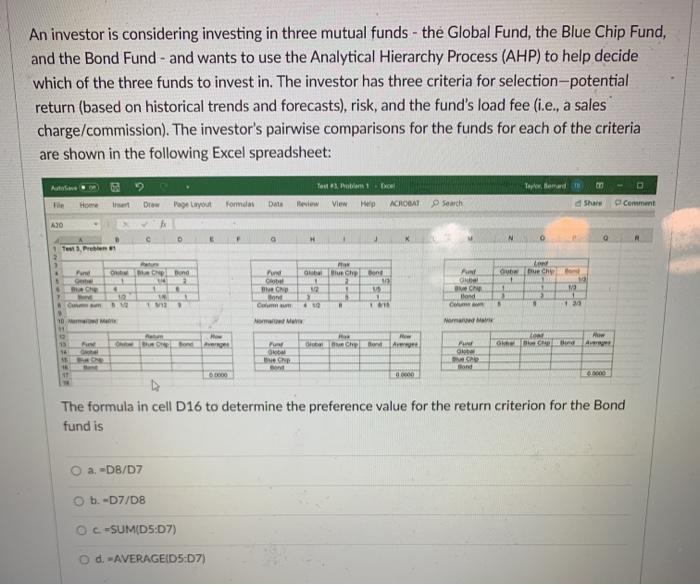

Question 12 2.5 pts If the investor in question 1 has $100,000 to invest and wishes to diversify his or her investment across all three funds according to the final AHP scores and rankings, his or her investment in the Global fund should be closest to O a $50,600 O b. $29,130 O c $20,270 d. none of the above An investor is considering investing in three mutual funds - the Global Fund, the Blue Chip Fund, and the Bond Fund - and wants to use the Analytical Hierarchy Process (AHP) to help decide which of the three funds to invest in. The investor has three criteria for selection-potential return (based on historical trends and forecasts), risk, and the fund's load fee (i.e., a sales charge/commission). The investor's pairwise comparisons for the funds for each of the criteria are shown in the following Excel spreadsheet: Tout po 1 Excel Tayo,emand Draw Page Layout Formulas Date View Help ACROBAT Search d Share Comment A30 Tent Pro Pune MOND Pund Gehe bechy NO w 19 Ch Hond 1 . 1 C 10 m MV Mama 13 Chen OCH A Goal Cho .COM D The formula in cell D16 to determine the preference value for the return criterion for the Bond fund is a. -DB/D7 b.-07/08 C=SUM(D5:07) d. -AVERAGEID5:07) Question 12 2.5 pts If the investor in question 1 has $100,000 to invest and wishes to diversify his or her investment across all three funds according to the final AHP scores and rankings, his or her investment in the Global fund should be closest to O a $50,600 O b. $29,130 O c $20,270 d. none of the above An investor is considering investing in three mutual funds - the Global Fund, the Blue Chip Fund, and the Bond Fund - and wants to use the Analytical Hierarchy Process (AHP) to help decide which of the three funds to invest in. The investor has three criteria for selection-potential return (based on historical trends and forecasts), risk, and the fund's load fee (i.e., a sales charge/commission). The investor's pairwise comparisons for the funds for each of the criteria are shown in the following Excel spreadsheet: Tout po 1 Excel Tayo,emand Draw Page Layout Formulas Date View Help ACROBAT Search d Share Comment A30 Tent Pro Pune MOND Pund Gehe bechy NO w 19 Ch Hond 1 . 1 C 10 m MV Mama 13 Chen OCH A Goal Cho .COM D The formula in cell D16 to determine the preference value for the return criterion for the Bond fund is a. -DB/D7 b.-07/08 C=SUM(D5:07) d. -AVERAGEID5:07)