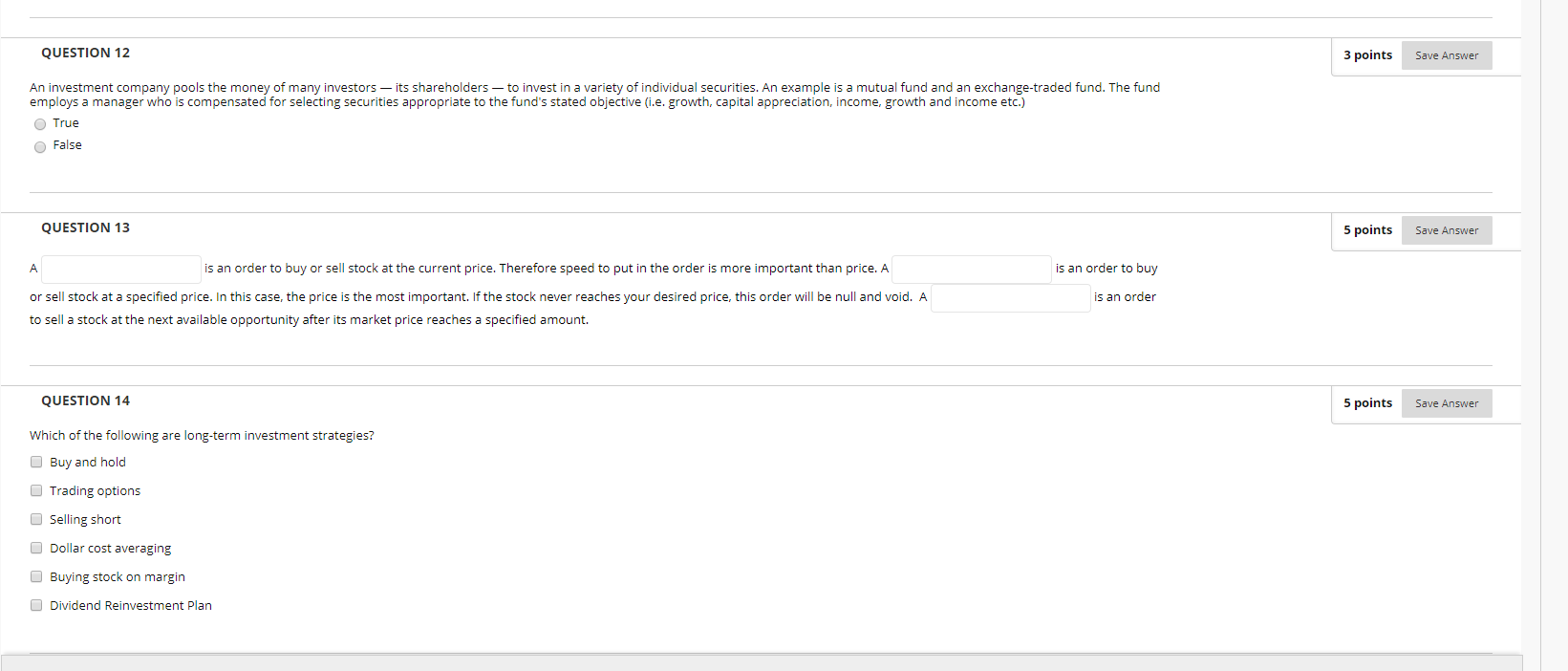

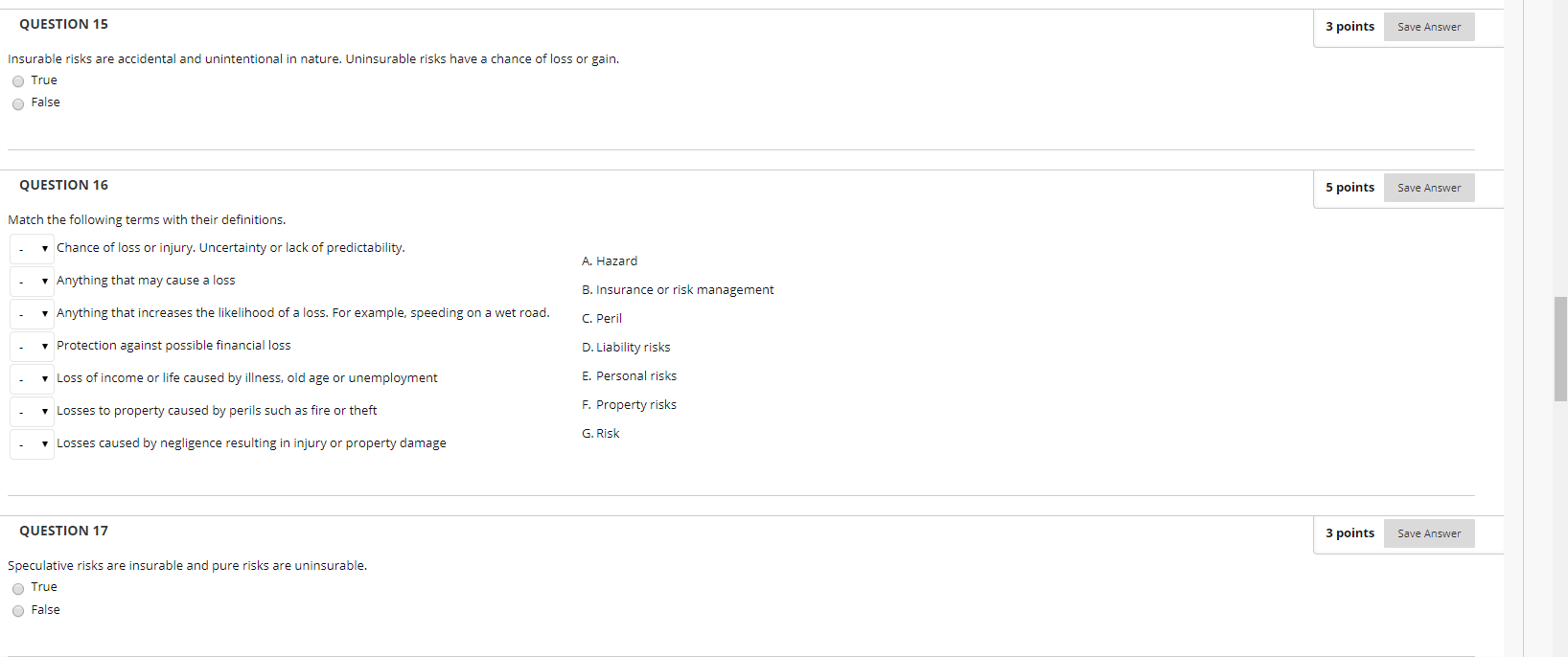

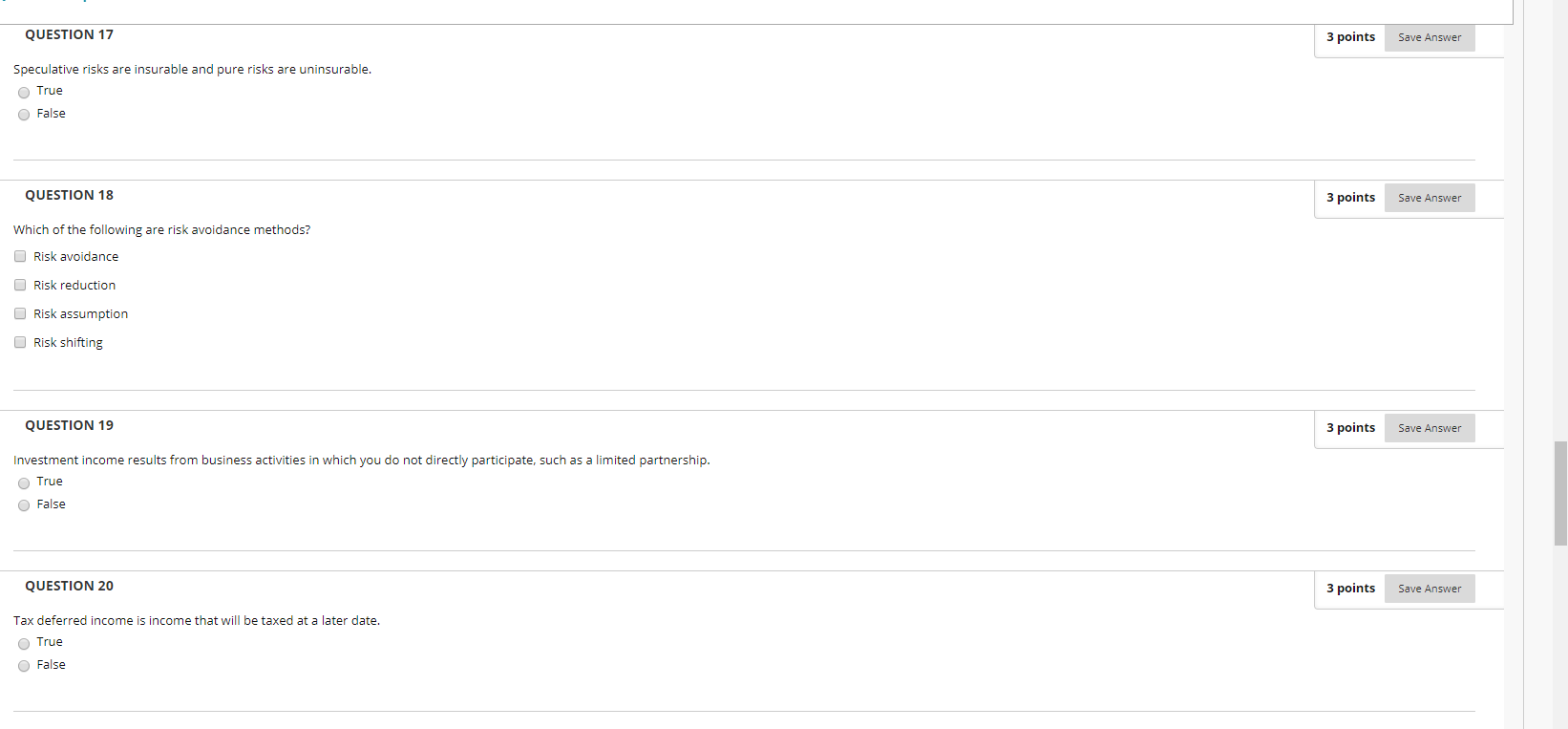

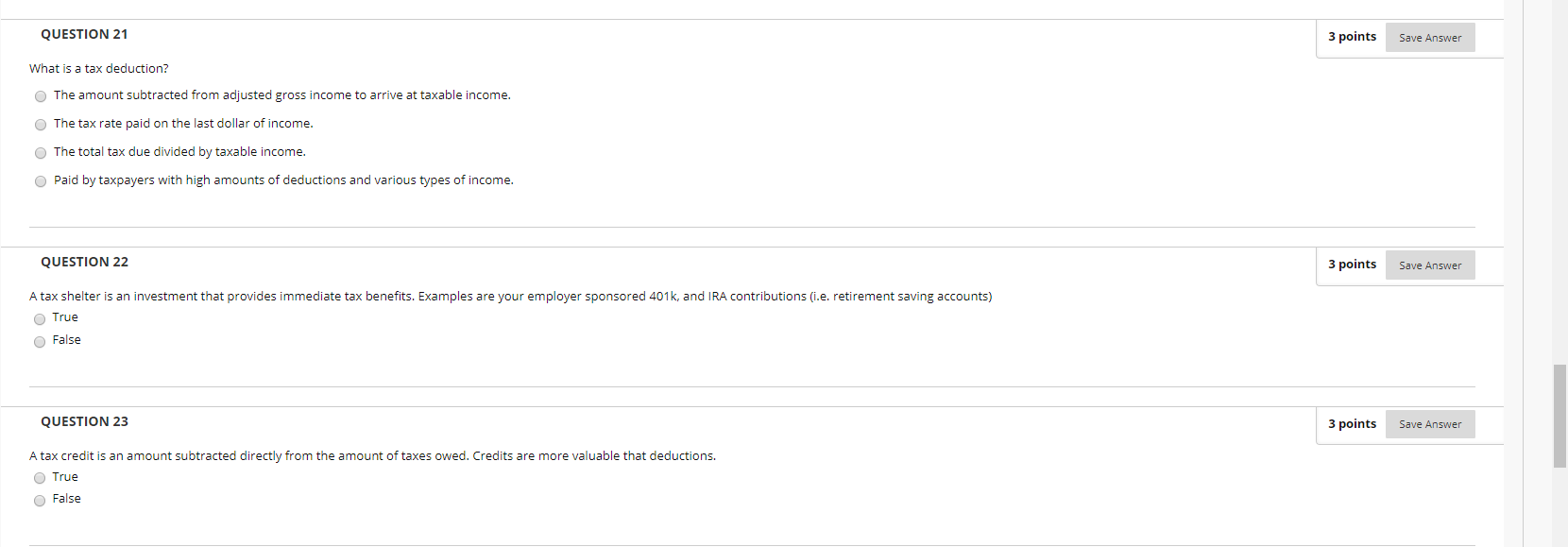

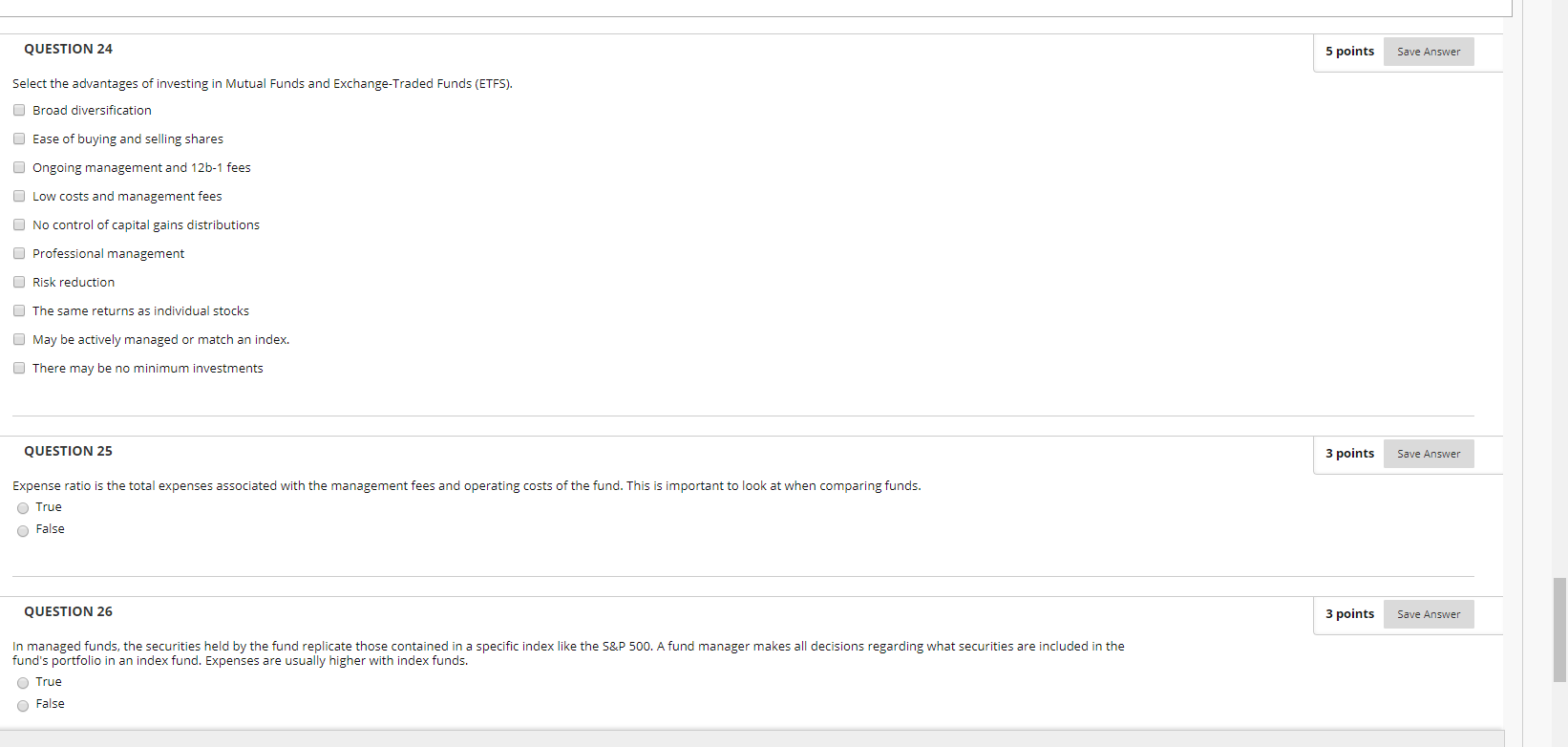

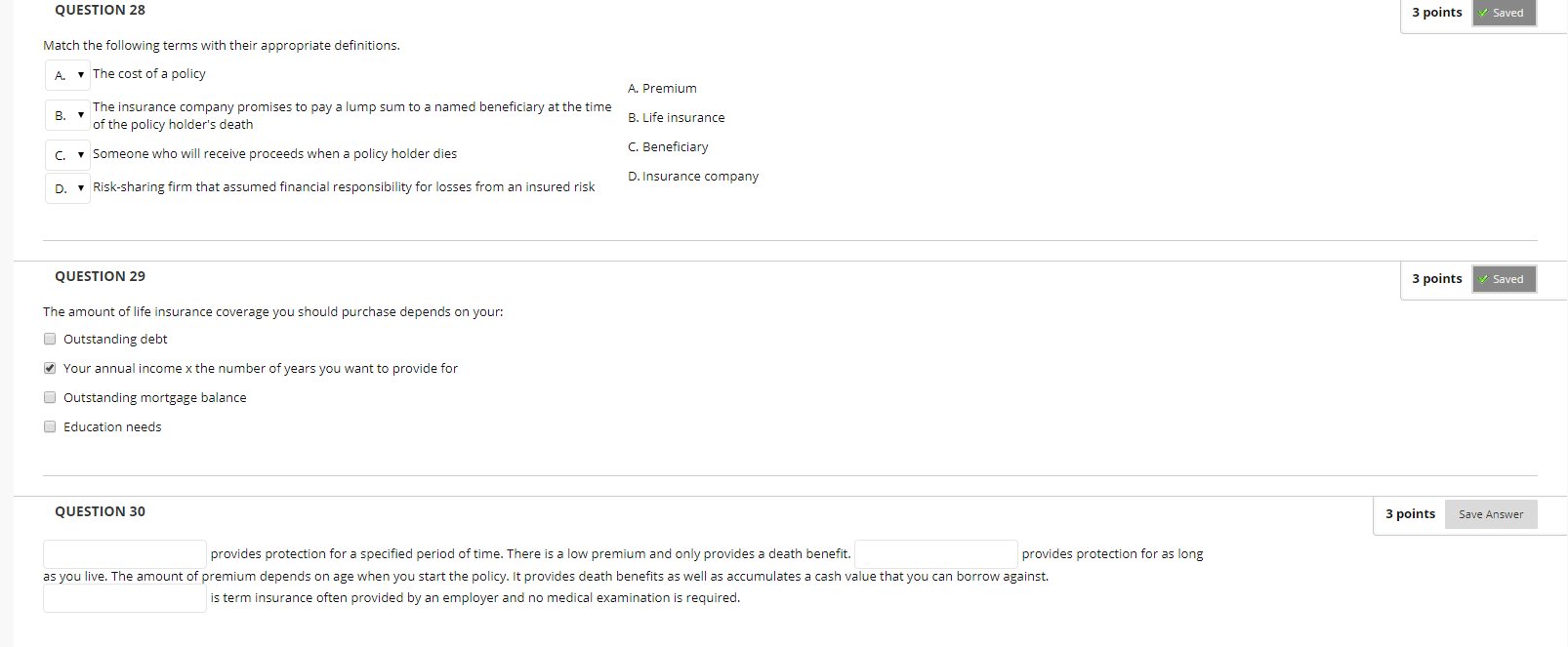

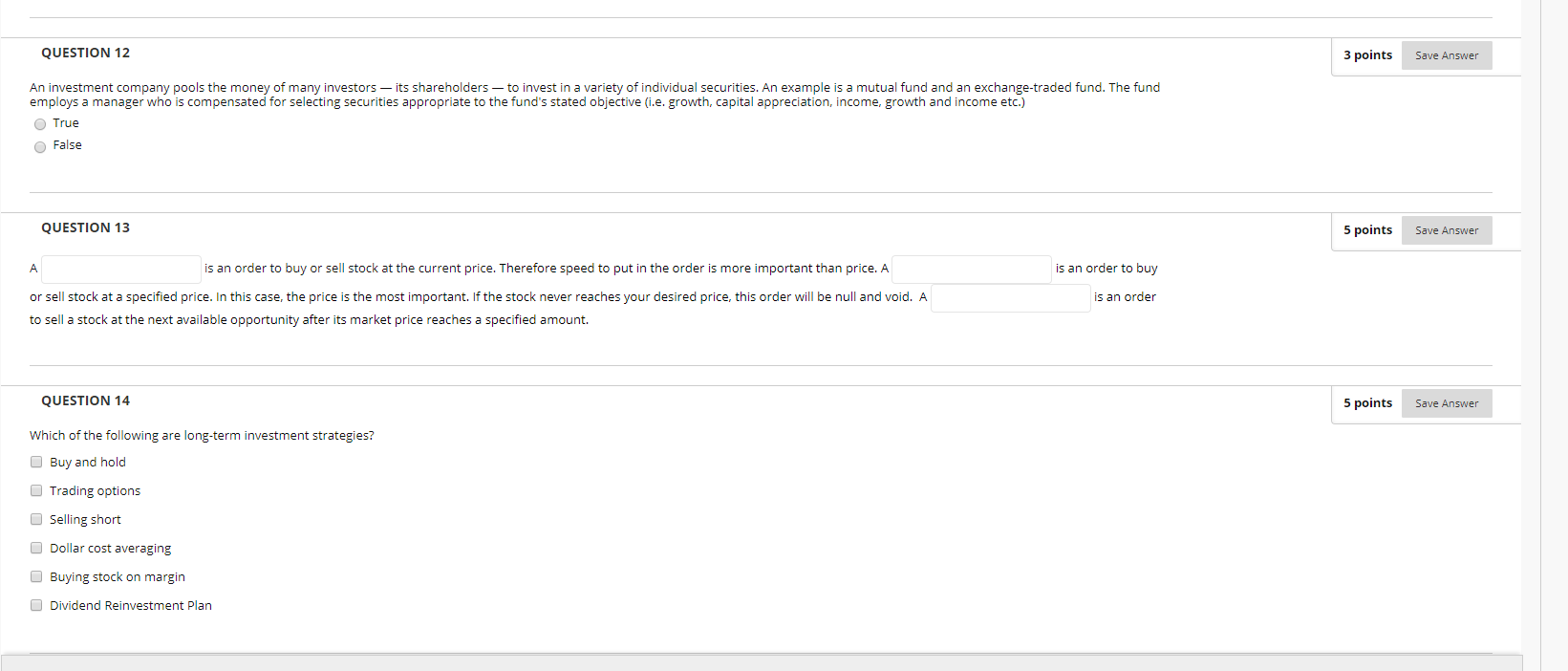

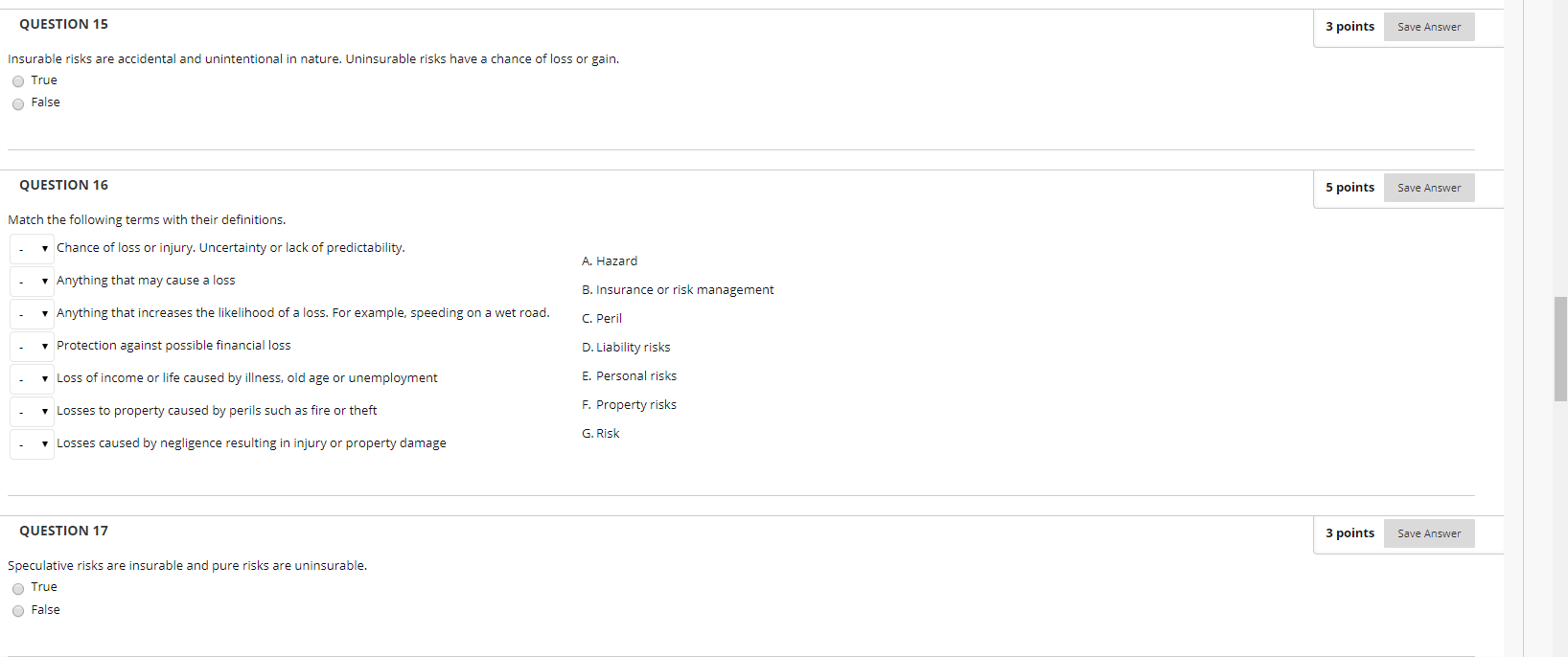

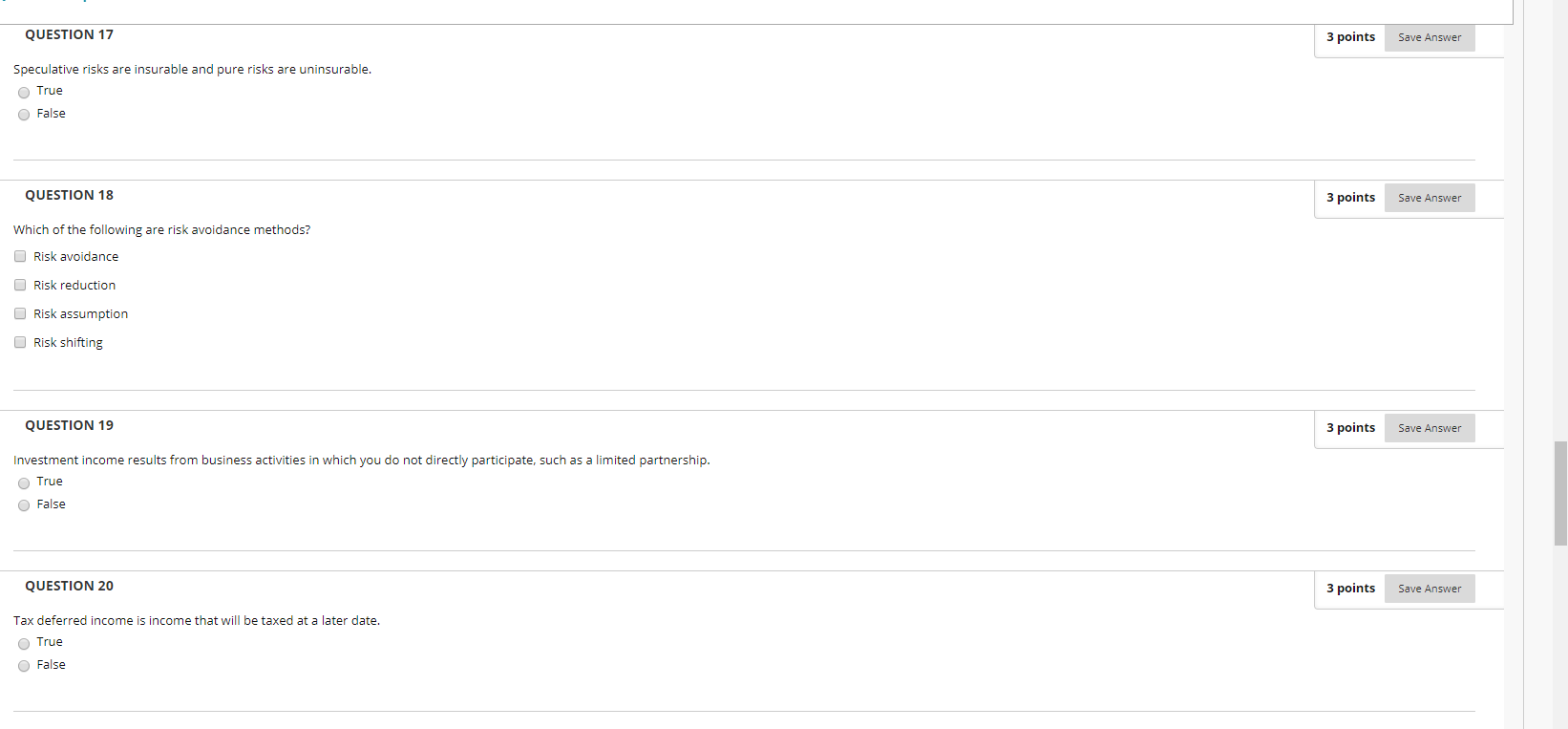

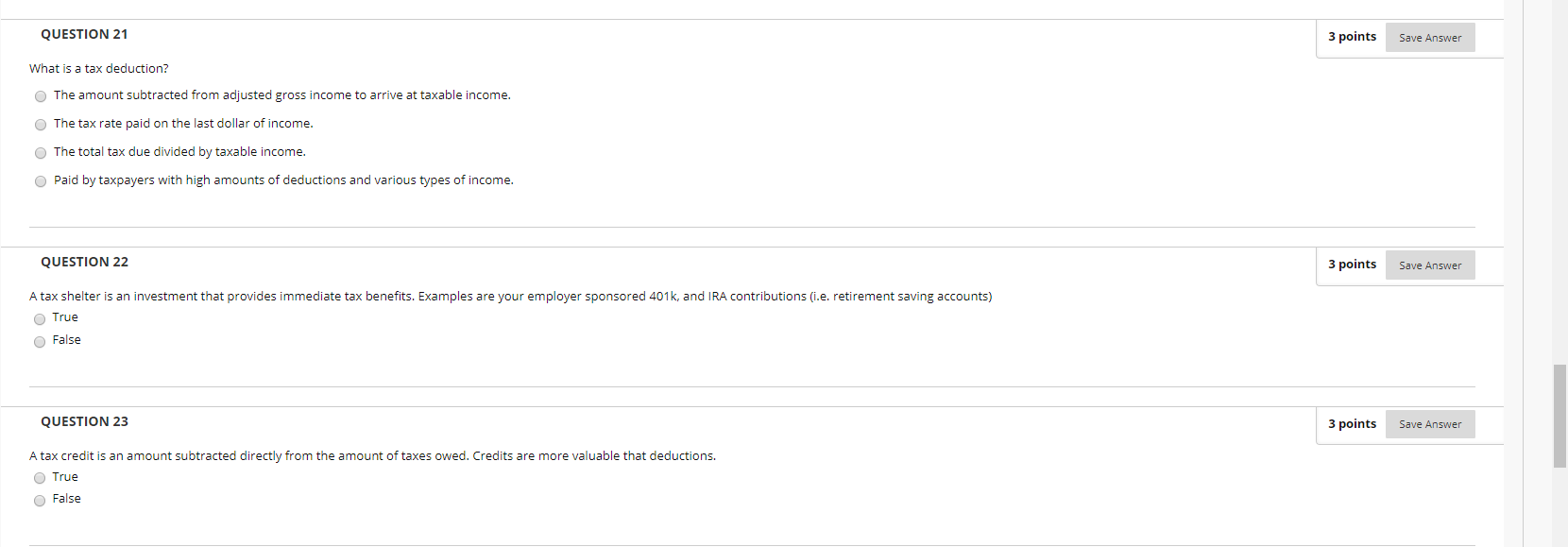

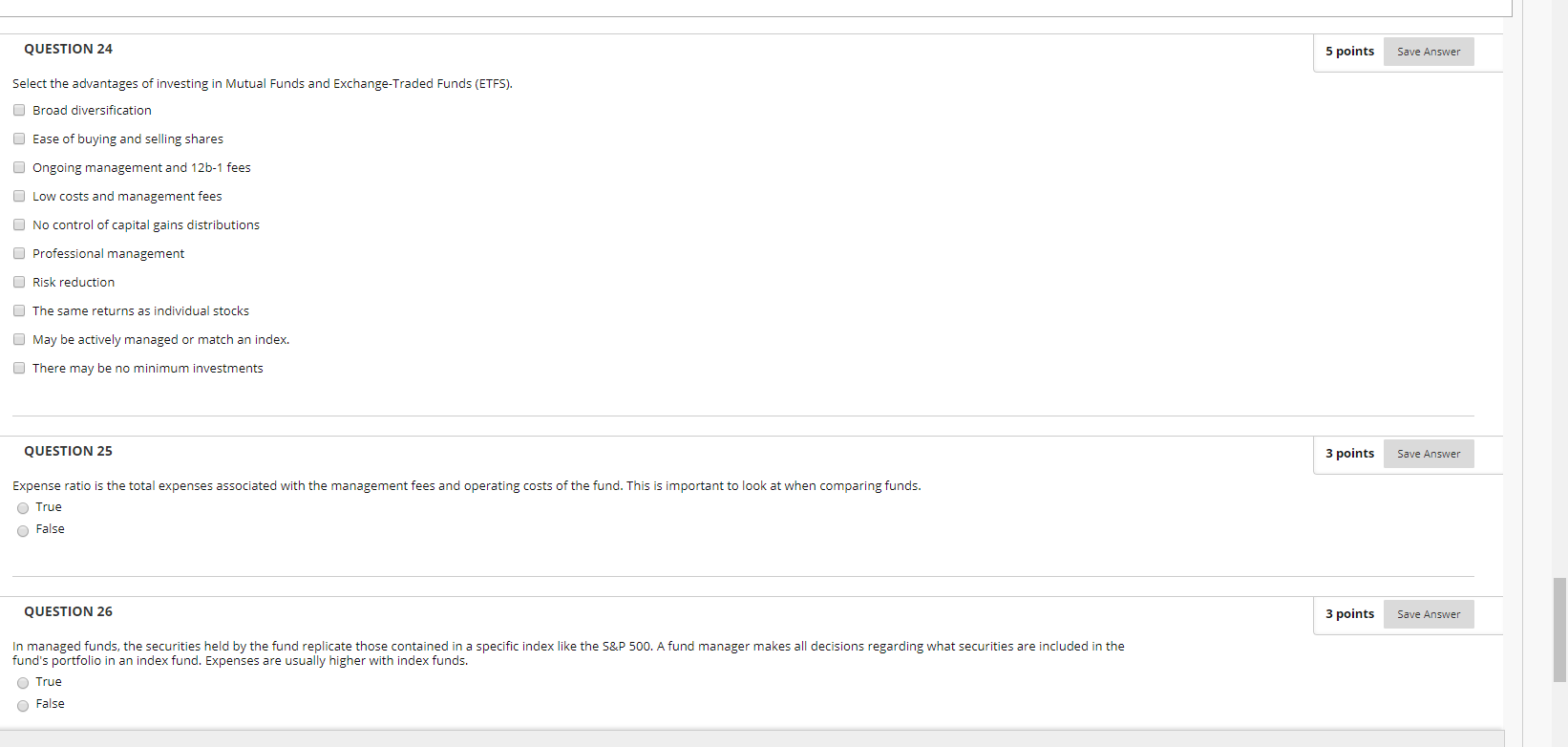

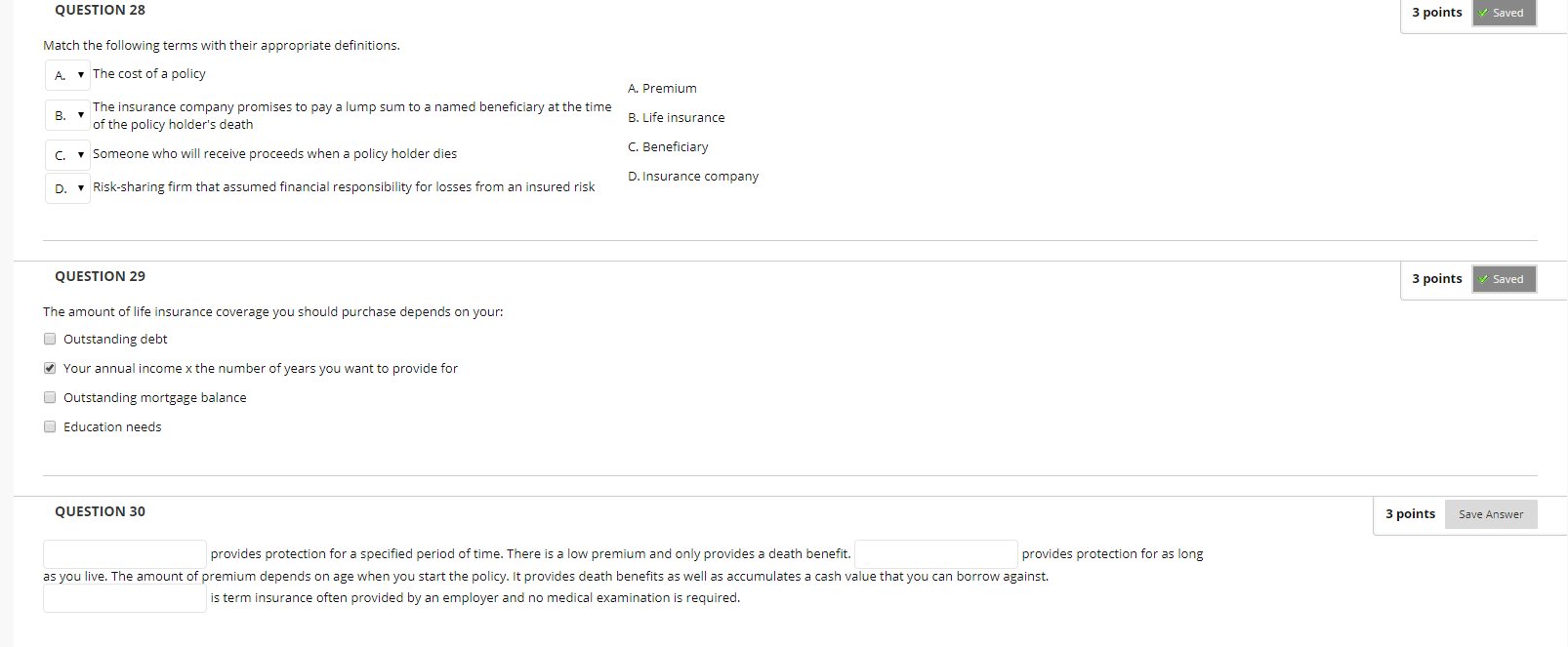

QUESTION 12 3 points Save Answer An investment company pools the money of many investors its shareholders to invest in a variety of individual securities. An example is a mutual fund and an exchange-traded fund. The fund employs a manager who is compensated for selecting securities appropriate to the fund's stated objective (i.e. growth, capital appreciation, income, growth and income etc.) True False QUESTION 13 5 points Save Answer is an order to buy A is an order to buy or sell stock at the current price. Therefore speed to put in the order is more important than price. A or sell stock at a specified price. In this case, the price is the most important. If the stock never reaches your desired price, this order will be null and void. A to sell a stock at the next available opportunity after its market price reaches a specified amount. is an order QUESTION 14 5 points Save Answer Which of the following are long-term investment strategies? Buy and hold Trading options Selling short Dollar cost averaging Buying stock on margin Dividend Reinvestment Plan QUESTION 15 3 points Save Answer Insurable risks are accidental and unintentional in nature. Uninsurable risks have a chance of loss or gain. True False QUESTION 16 5 points Save Answer Match the following terms with their definitions. Chance of loss or injury. Uncertainty or lack of predictability. A. Hazard Anything that may cause a loss B. Insurance or risk management Anything that increases the likelihood of a loss. For example, speeding on a wet road. C. Peril Protection against possible financial loss D. Liability risks Loss of income or life caused by illness, old age or unemployment E. Personal risks Losses to property caused by perils such as fire or theft F. Property risks G. Risk Losses caused by negligence resulting in injury or property damage QUESTION 17 3 points Save Answer Speculative risks are insurable and pure risks are uninsurable. True False QUESTION 17 3 points Save Answer Speculative risks are insurable and pure risks are uninsurable. True O False QUESTION 18 3 points Save Answer Which of the following are risk avoidance methods? Risk avoidance Risk reduction Risk assumption Risk shifting QUESTION 19 3 points Save Answer Investment income results from business activities in which you do not directly participate, such as a limited partnership. True False QUESTION 20 3 points Save Answer Tax deferred income is income that will be taxed at a later date. O True O False QUESTION 21 3 points Save Answer What is a tax deduction? The amount subtracted from adjusted gross income to arrive at taxable income. The tax rate paid on the last dollar of income. The total tax due divided by taxable income. Paid by taxpayers with high amounts of deductions and various types of income. QUESTION 22 3 points Save Answer A tax shelter is an investment that provides immediate tax benefits. Examples are your employer sponsored 401k, and IRA contributions (i.e. retirement saving accounts) True False QUESTION 23 3 points Save Answer A tax credit is an amount subtracted directly from the amount of taxes owed. Credits are more valuable that deductions. O True False QUESTION 24 5 points Save Answer Select the advantages of investing in Mutual Funds and exchange-Traded Funds (ETFS). Broad diversification Ease of buying and selling shares Ongoing management and 12b-1 fees Low costs and management fees No control of capital gains distributions Professional management O Risk reduction The same returns as individual stocks May be actively managed or match an index. There may be no minimum investments QUESTION 25 3 points Save Answer Expense ratio is the total expenses associated with the management fees and operating costs of the fund. This is important to look at when comparing funds. O True False QUESTION 26 3 points Save Answer In managed funds, the securities held by the fund replicate those contained in a specific index like the S&P 500. A fund manager makes all decisions regarding what securities are included in the fund's portfolio in an index fund. Expenses are usually higher with index funds. True False QUESTION 28 3 points Saved Match the following terms with their appropriate definitions. The cost of a policy A. A. Premium B. The insurance company promises to pay a lump sum to a named beneficiary at the time of the policy holder's death B. Life insurance C. Beneficiary C. Someone who will receive proceeds when a policy holder dies D. Insurance company D. Risk-sharing firm that assumed financial responsibility for losses from an insured risk QUESTION 29 3 points Saved The amount of life insurance coverage you should purchase depends on your: Outstanding debt Your annual income x the number of years you want to provide for Outstanding mortgage balance O Education needs QUESTION 30 3 points Save Answer provides protection for a specified period of time. There is a low premium and only provides a death benefit. provides protection for as long as you live. The amount of premium depends on age when you start the policy. It provides death benefits as well as accumulates a cash value that you can borrow against. is term insurance often provided by an employer and no medical examination is required