Answered step by step

Verified Expert Solution

Question

1 Approved Answer

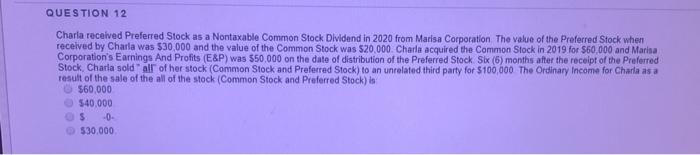

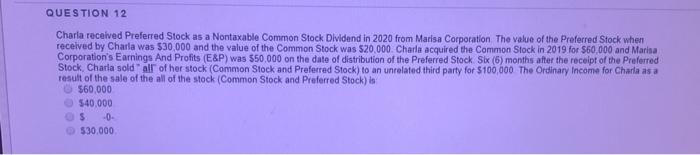

QUESTION 12 Charla received Preferred Stock as a Nontaxable Common Stock Dividend in 2020 from Marisa Corporation The value of the Preferred Stock when received

QUESTION 12 Charla received Preferred Stock as a Nontaxable Common Stock Dividend in 2020 from Marisa Corporation The value of the Preferred Stock when received by Charla was $30,000 and the value of the Common Stock was $20,000. Charla acquired the Common Stock in 2019 for $60,000 and Marisa Corporation's Earnings And Profits (E&P) was 550,000 on the date of distribution of the Preferred Stock. Six (6) months after the receipt of the Preferred Stock Charla sold all of her stock (Common Stock and Preferred Stock) to an unrelated third party for $100,000 The Ordinary Income for Charta as a result of the sale of the all of the stock (Common Stock and Preferred Stock) is $60,000 540,000 OS 530.000

QUESTION 12 Charla received Preferred Stock as a Nontaxable Common Stock Dividend in 2020 from Marisa Corporation The value of the Preferred Stock when received by Charla was $30,000 and the value of the Common Stock was $20,000. Charla acquired the Common Stock in 2019 for $60,000 and Marisa Corporation's Earnings And Profits (E&P) was 550,000 on the date of distribution of the Preferred Stock. Six (6) months after the receipt of the Preferred Stock Charla sold all of her stock (Common Stock and Preferred Stock) to an unrelated third party for $100,000 The Ordinary Income for Charta as a result of the sale of the all of the stock (Common Stock and Preferred Stock) is $60,000 540,000 OS 530.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started