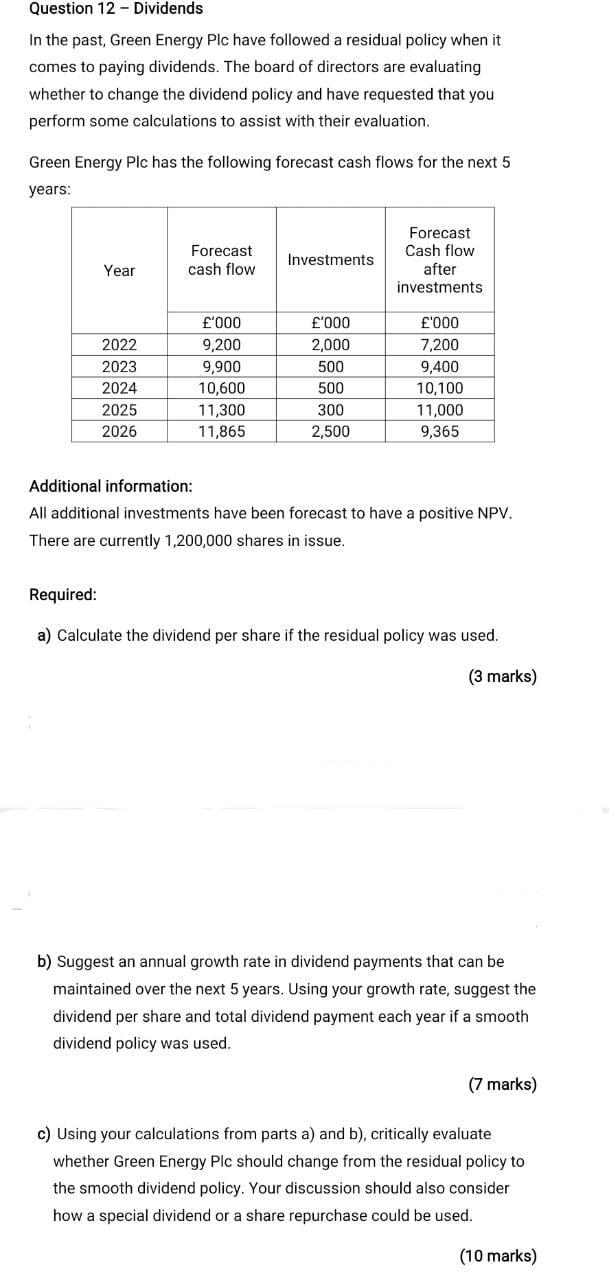

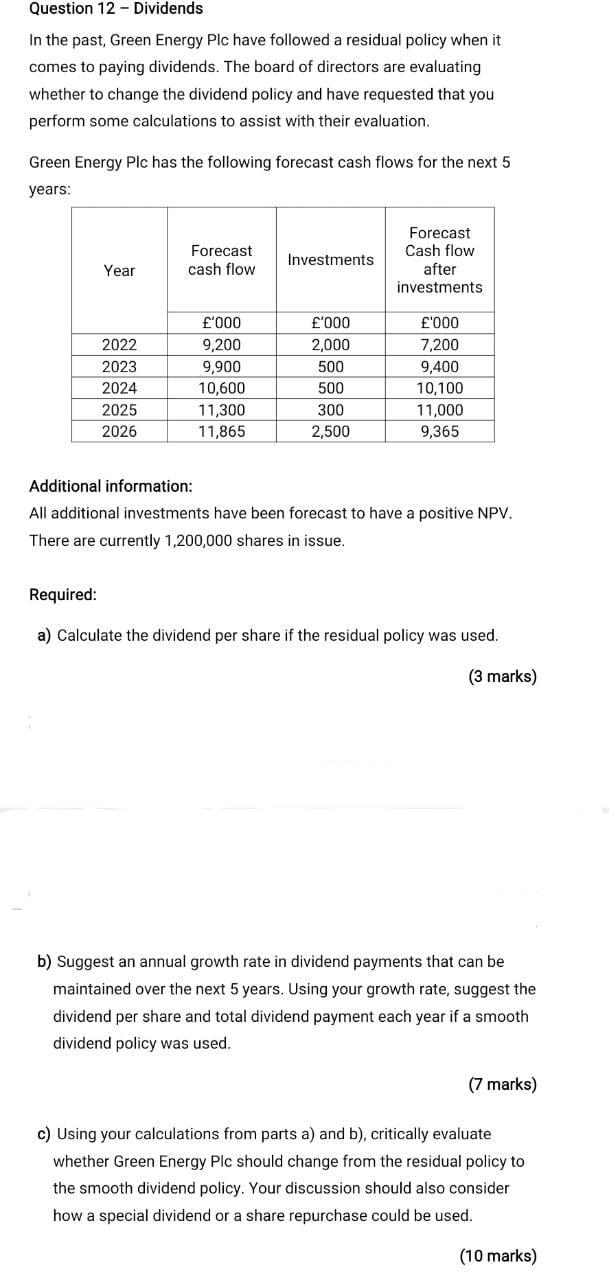

Question 12 Dividends In the past, Green Energy Plc have followed a residual policy when it comes to paying dividends. The board of directors are evaluating whether to change the dividend policy and have requested that you perform some calculations to assist with their evaluation. Green Energy Plc has the following forecast cash flows for the next 5 years: Forecast Cash flow Forecast cash flow Investments Year after investments '000 '000 '000 2022 9,200 2,000 7,200 2023 9,900 500 9,400 2024 10,600 500 10,100 2025 11,300 300 11,000 2026 11,865 2,500 9,365 Additional information: All additional investments have been forecast to have a positive NPV. There are currently 1,200,000 shares in issue. Required: a) Calculate the dividend per share if the residual policy was used. (3 marks) b) Suggest an annual growth rate in dividend payments that can be maintained over the next 5 years. Using your growth rate, suggest the dividend per share and total dividend payment each year if a smooth dividend policy was used. (7 marks) c) Using your calculations from parts a) and b), critically evaluate whether Green Energy Plc should change from the residual policy to the smooth dividend policy. Your discussion should also consider how a special dividend or a share repurchase could be used. (10 marks) Question 12 Dividends In the past, Green Energy Plc have followed a residual policy when it comes to paying dividends. The board of directors are evaluating whether to change the dividend policy and have requested that you perform some calculations to assist with their evaluation. Green Energy Plc has the following forecast cash flows for the next 5 years: Forecast Cash flow Forecast cash flow Investments Year after investments '000 '000 '000 2022 9,200 2,000 7,200 2023 9,900 500 9,400 2024 10,600 500 10,100 2025 11,300 300 11,000 2026 11,865 2,500 9,365 Additional information: All additional investments have been forecast to have a positive NPV. There are currently 1,200,000 shares in issue. Required: a) Calculate the dividend per share if the residual policy was used. (3 marks) b) Suggest an annual growth rate in dividend payments that can be maintained over the next 5 years. Using your growth rate, suggest the dividend per share and total dividend payment each year if a smooth dividend policy was used. (7 marks) c) Using your calculations from parts a) and b), critically evaluate whether Green Energy Plc should change from the residual policy to the smooth dividend policy. Your discussion should also consider how a special dividend or a share repurchase could be used. (10 marks)