Question

Question 12 Divisional Performance Measures Company QR Ltd has one head office, and two divisions, Division Q & Division R. The two divisions operate in

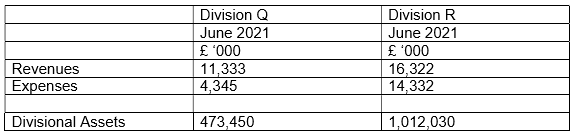

Question 12 Divisional Performance Measures Company QR Ltd has one head office, and two divisions, Division Q & Division R. The two divisions operate in nearly identical markets and both serve external customers only. The June profit for 2021 for the two divisions is as follows:  The companys cost of capital is 10%. The company has also set a target ROI of 15%. QR Head Office calculates the divisional performance measures based on annualised net profit, after all costs have been taken into account. A) Calculate the ROI and RI for both divisions [4 Marks] B) Q have invested heavily in staff training and a new website during 2021. They have estimated that the total cost expensed was 500,000, and that they will benefit from this over the next five years. R are much more established and do have any similar costs. Calculate the EVA for Q. [4 Marks]

The companys cost of capital is 10%. The company has also set a target ROI of 15%. QR Head Office calculates the divisional performance measures based on annualised net profit, after all costs have been taken into account. A) Calculate the ROI and RI for both divisions [4 Marks] B) Q have invested heavily in staff training and a new website during 2021. They have estimated that the total cost expensed was 500,000, and that they will benefit from this over the next five years. R are much more established and do have any similar costs. Calculate the EVA for Q. [4 Marks]

C) The company have identified a new project that will require 100m of investment. Due to spending on advertising and training in the first year however the project will only just breakeven in 2022, then generate profits of 20m per annul for the next four years. The leadership of both divisions are unhappy with the proposal. Briefly explain why the two divisions might not want to proceed and discuss the implications if the group were to use EVA to measure performance instead.

please note that the profit is for June not for the whole year

I hope that the answer is printed, not handwritten, and that the solution is not copied from other questions. I also hope for an answer as soon as possible.

\begin{tabular}{|l|l|l|} \hline & Division Q & Division R \\ \hline & June 2021 & June 2021 \\ \hline & 000 & 000 \\ \hline Revenues & 11,333 & 16,322 \\ \hline Expenses & 4,345 & 14,332 \\ \hline & & \\ \hline Divisional Assets & 473,450 & 1,012,030 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started