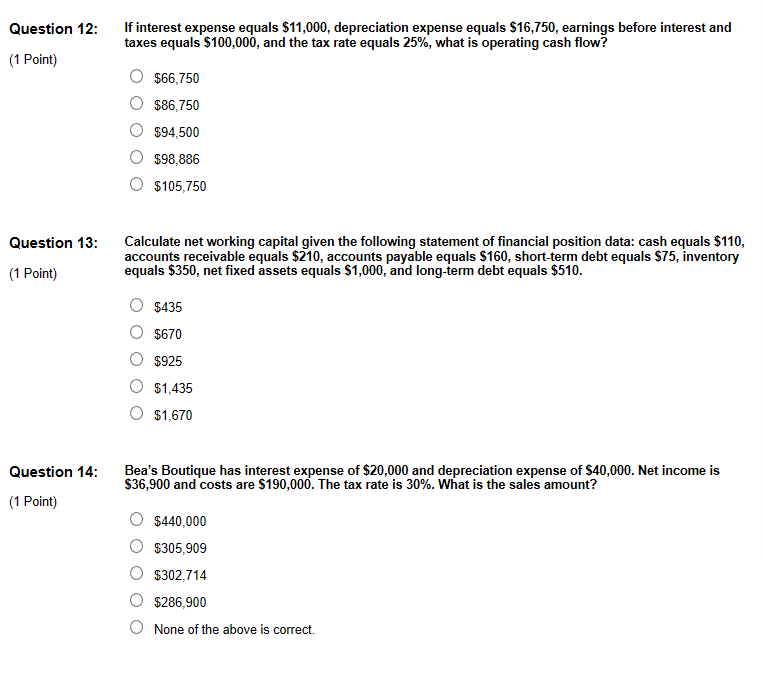

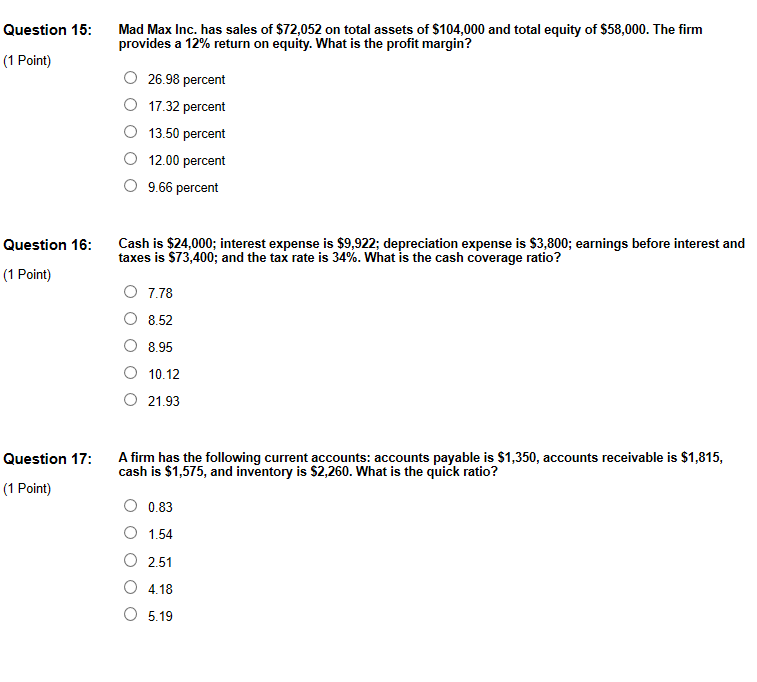

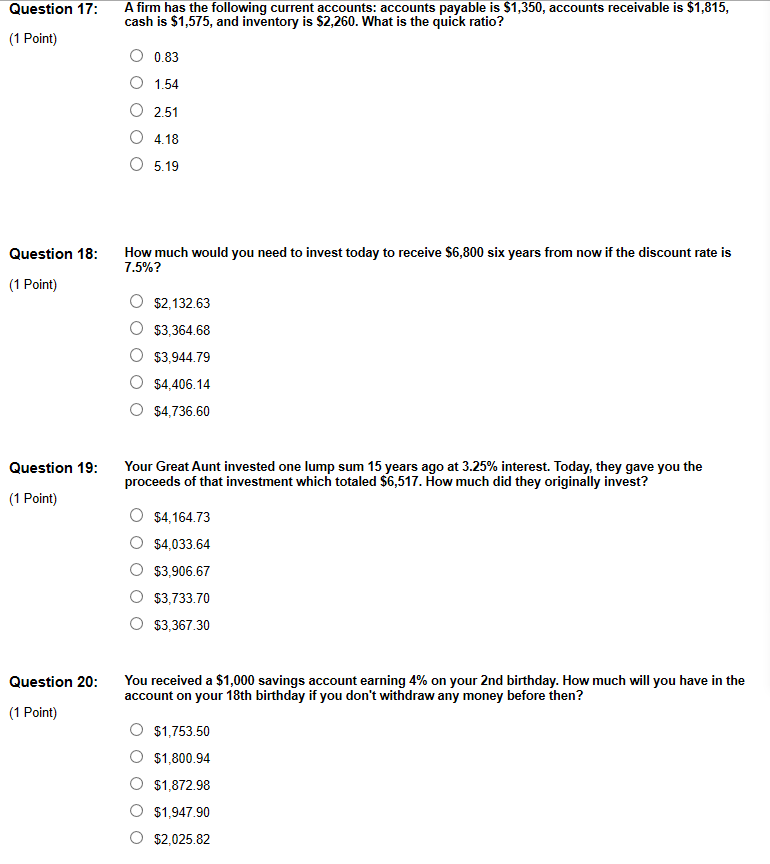

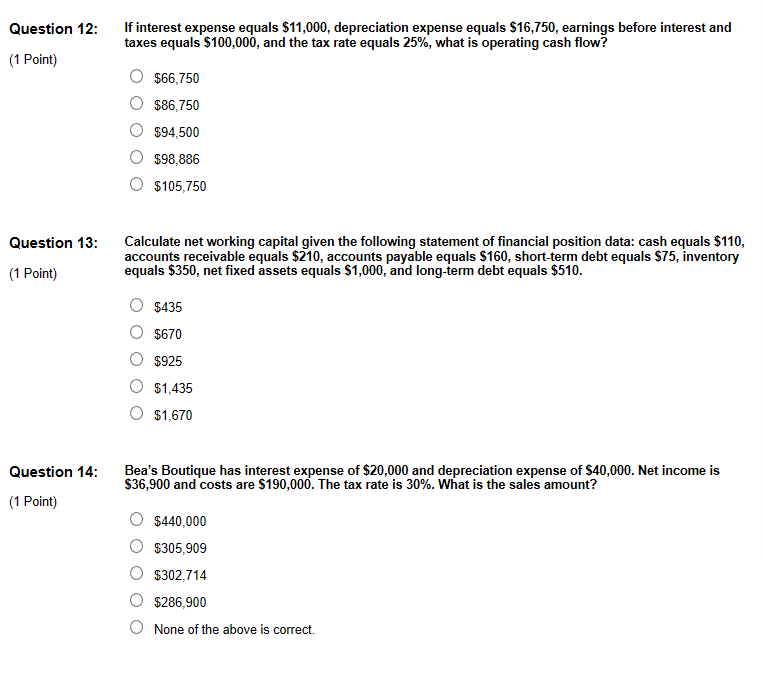

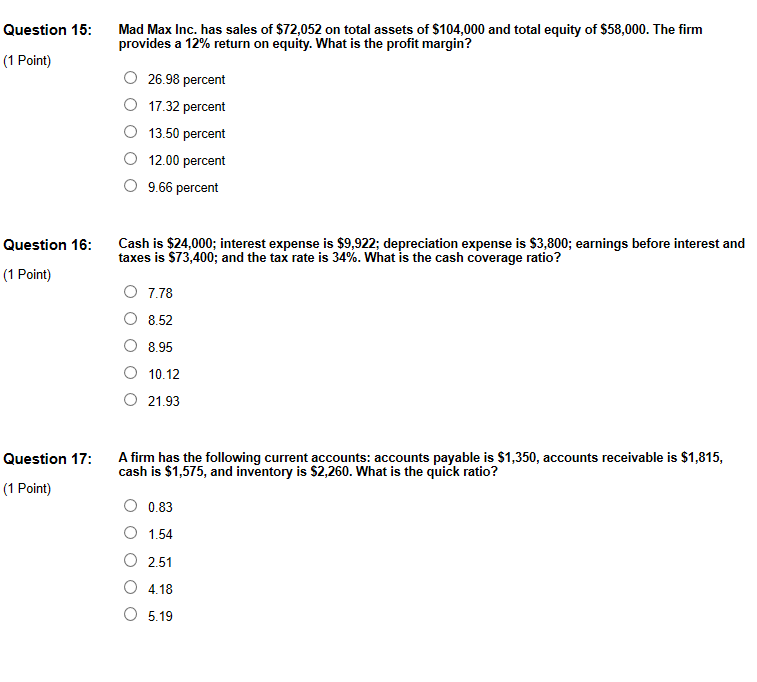

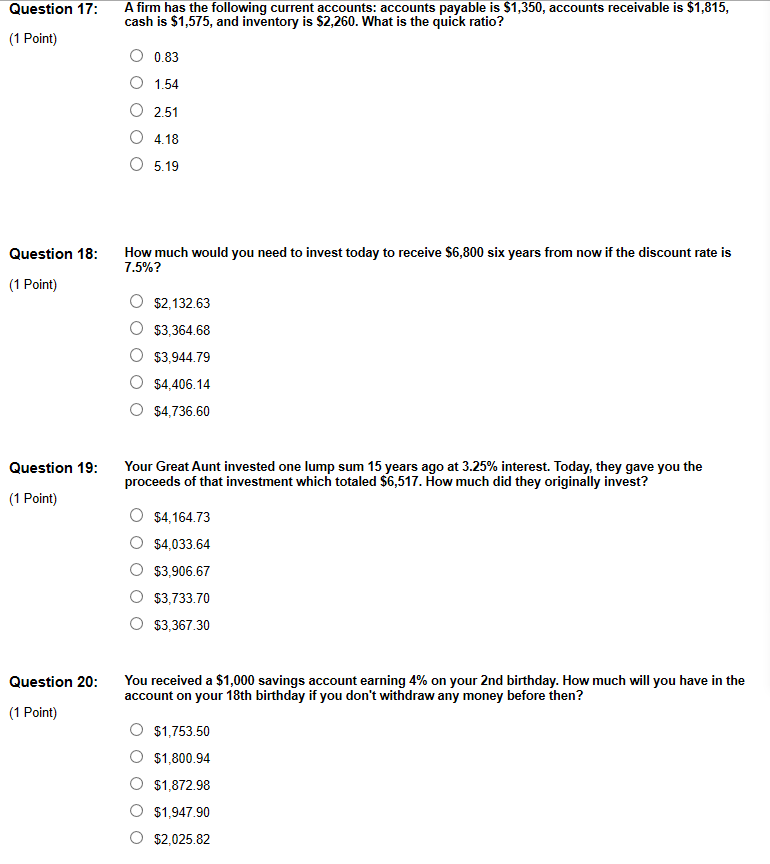

Question 12: If interest expense equals $11,000, depreciation expense equals $16,750, earnings before interest and taxes equals $100,000, and the tax rate equals 25%, what is operating cash flow? (1 Point) $66,750 $86,750 $94,500 $98,886 $105,750 Question 13: Calculate net working capital given the following statement of financial position data: cash equals $110, accounts receivable equals $210, accounts payable equals $160, short-term debt equals $75, inventory equals $350, net fixed assets equals $1,000, and long-term debt equals $510. (1 Point) $435 $670 $925 $1,435 $1,670 Question 14: (1 Point) Bea's Boutique has interest expense of $20,000 and depreciation expense of $40,000. Net income is $36,900 and costs are $190,000. The tax rate is 30%. What is the sales amount? $440,000 $305,909 $302,714 $286,900 None of the above is correct. Question 15: Mad Max Inc. has sales of $72,052 on total assets of $104,000 and total equity of $58,000. The firm provides a 12% return on equity. What is the profit margin? (1 Point) 26.98 percent 17.32 percent 13.50 percent 12.00 percent 9.66 percent Question 16: (1 Point) Cash is $24,000; interest expense is $9,922; depreciation expense is $3,800; earnings before interest and taxes is $73,400; and the tax rate is 34%. What is the cash coverage ratio? O 7.78 8.52 8.95 O 10.12 21.93 Question 17: (1 Point) A firm has the following current accounts: accounts payable is $1,350, accounts receivable is $1,815, cash is $1,575, and inventory is $2,260. What is the quick ratio? O 0.83 O 1.54 O 2.51 04.18 05.19 Question 17: A firm has the following current accounts: accounts payable is $1,350, accounts receivable is $1,815, cash is $1,575, and inventory is $2,260. What is the quick ratio? (1 Point) 0.83 1.54 2.51 4.18 5.19 Question 18: How much would you need to invest today to receive $6,800 six years from now if the discount rate is 7.5%? (1 Point) $2,132.63 $3,364.68 $3,944.79 $4,406.14 $4,736.60 Question 19: Your Great Aunt invested one lump sum 15 years ago at 3.25% interest. Today, they gave you the proceeds of that investment which totaled $6,517. How much did they originally invest? (1 Point) $4.164.73 $4,033.64 $3,906.67 $3,733.70 $3,367.30 Question 20: You received a $1,000 savings account earning 4% on your 2nd birthday. How much will you have in the account on your 18th birthday if you don't withdraw any money before then? (1 Point) $1,753.50 $1,800.94 $1,872.98 $1,947.90 $2,025.82