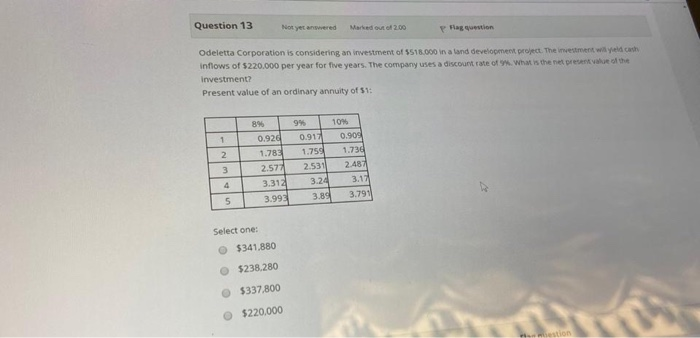

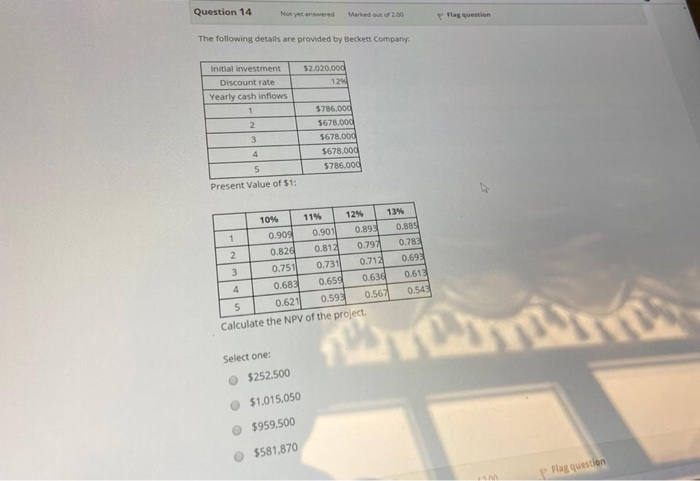

Question 12 New yet arwered Marked out of 2.00 Mag question Poseidon Marine Stores Company manufactures special metallic materials and decorative songs for my ches that require highly skilled labor. Poseidon uses standard costs to prepare its Mexible budget. For the test quarter of the year.deed me and direct labor standards for one of their popular products were as follows: Direct materials: 3 pounds per unit: 53 per pound Direct labor: 5 hours per unit: $15 per hour Poseidon produced 5000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the direct labor cost variance was 58000 F. Which of the following is a logical explanation for this variance? Select one: The company paid a lower cost per hour for labor than allowed by the standards. The company paid a lower cost for the direct materials than allowed by the standards The company used a lower quantity of direct materials than allowed by the standards The company used fewer labor hours than allowed by the standards as question Question 13 Not yet angered Marked out of 200 plag question Odeletta Corporation is considering an investment of 5518.000 in a land development project. The investment weath inflows of $220.000 per year for five years. The company uses a discount rate of what is the nel present of the investment? Present value of an ordinary annuity of 51: 1 2. 89 0.92 1.785 2.577 3.312 9% 0.91 1.754 2.531 3.24 101 0.909 1.73 2.487 3.17 3.791 3 4 5 3.993 Select one: $341,880 $238.280 $337.800 $220,000 hestion Question 14 Not yet answered Marked out of 2.00 Ma question The following details are provided by Beckett Company 52.020.000 124 Initial investment Discount rate Yearly cash inflows 1 2 3 5786.000 5678,000 $678,000 $678.000 $786.000 4 5 Present Value of 51: 13% 0.89 10% 119 12% 0.909 0.901 2 0.82 0.812 0.797 3 0.751 0.731 0.71 4 0.683 0.659 0.636 0.621 0.593 0.567 Calculate the NPV of the project 0.889 0.783 0.693 0.618 0.545 5 Select one: $252.500 $1,015.050 $959.500 $581,870 Flag question Question 15 Nor yet answered Marked out of 2.00 P Flag question At the internal rate of return, the present value of net cash inflows will equal the Select one: average operating income profit from the project initial cost of the investment residual value Marked out of 2.00 p Flag question Not yet answered Question 16 Cash flows used in net present value and internal rate of return analyses ignore Select one: residual value depreciation expense future cost savings future increased sales Flag question 200