Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 of 15. Andrew and Rachel occasionally use an online rental platform to advertise and rent their personal residence when they travel out

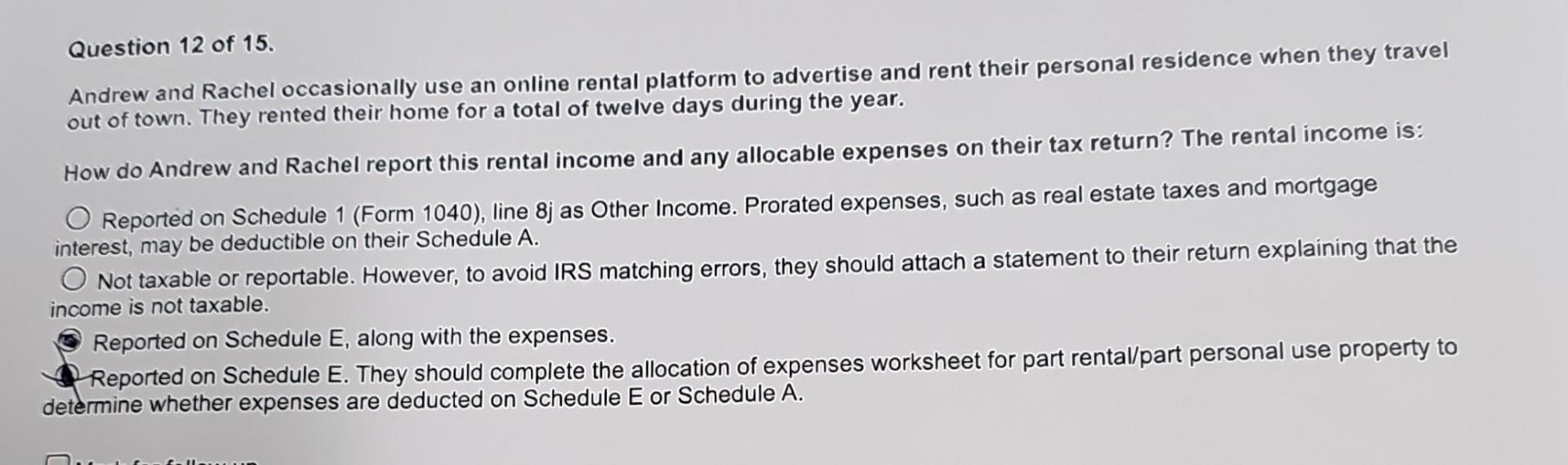

Question 12 of 15. Andrew and Rachel occasionally use an online rental platform to advertise and rent their personal residence when they travel out of town. They rented their home for a total of twelve days during the year. How do Andrew and Rachel report this rental income and any allocable expenses on their tax return? The rental income is: O Reported on Schedule 1 (Form 1040), line 8j as Other Income. Prorated expenses, such as real estate taxes and mortgage interest, may be deductible on their Schedule A. O Not taxable or reportable. However, to avoid IRS matching errors, they should attach a statement to their return explaining that the income is not taxable. Reported on Schedule E, along with the expenses. Reported on Schedule E. They should complete the allocation of expenses worksheet for part rental/part personal use property to determine whether expenses are deducted on Schedule E or Schedule A. Question 13 of 15. Noelle placed a rental property in service on February 1, 2022. On June 1, she had a retaining wall installed. What is the depreciation recovery period for the retaining wall? 5 years. 7 years. 15 years. O 27.5 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer 12 Correct Choice ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started