Answered step by step

Verified Expert Solution

Question

1 Approved Answer

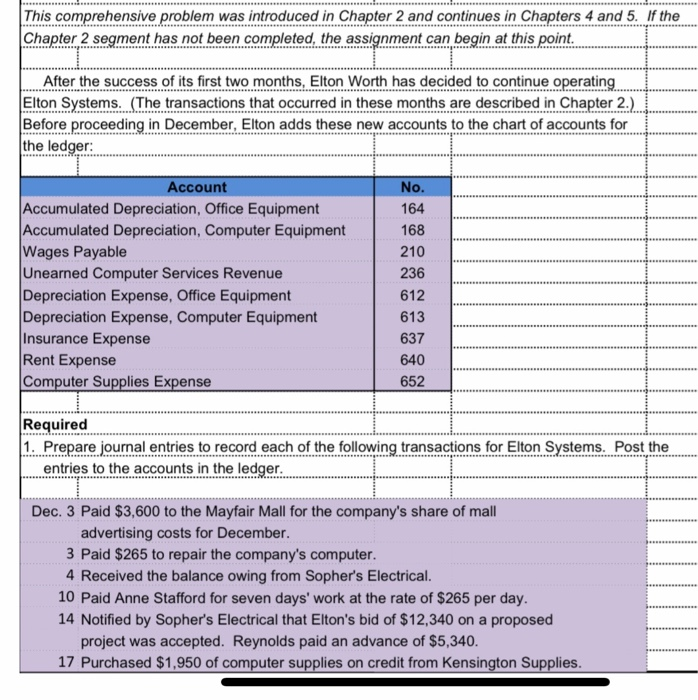

Question 1&2 pleaseThanks This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not

Question 1&2 pleaseThanks

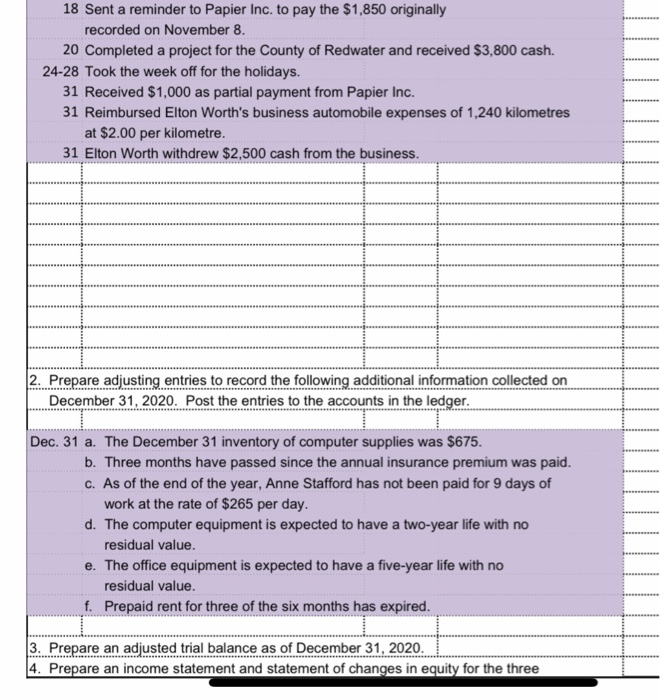

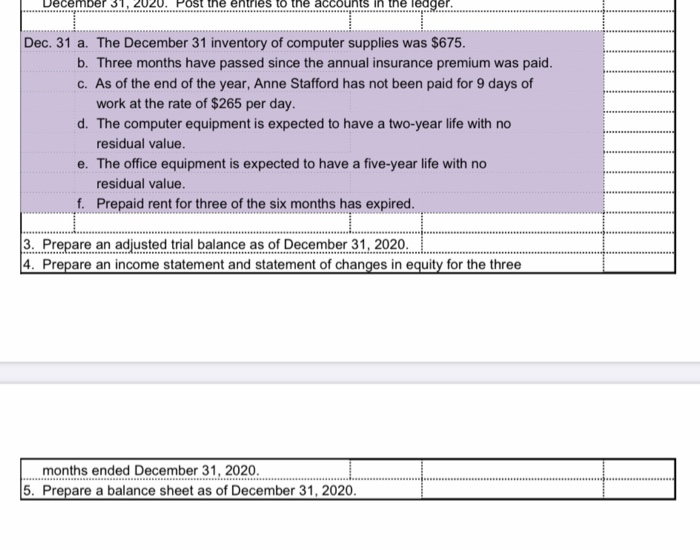

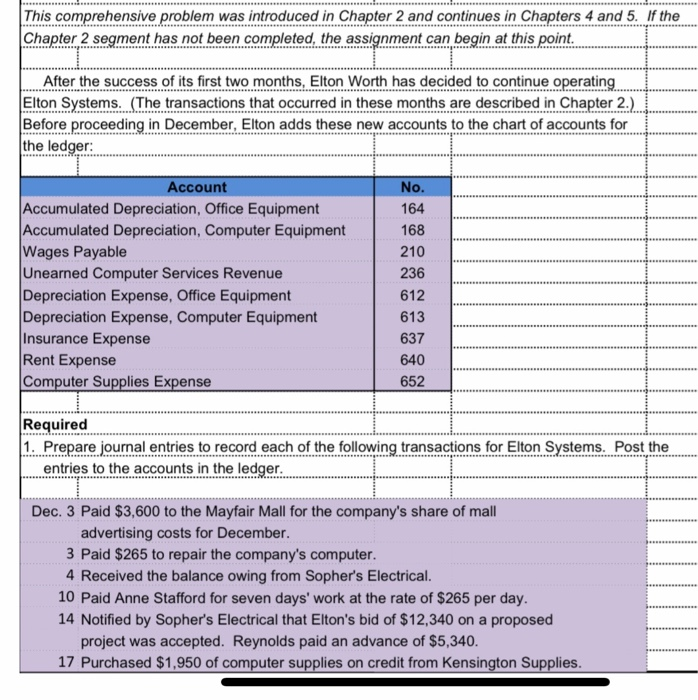

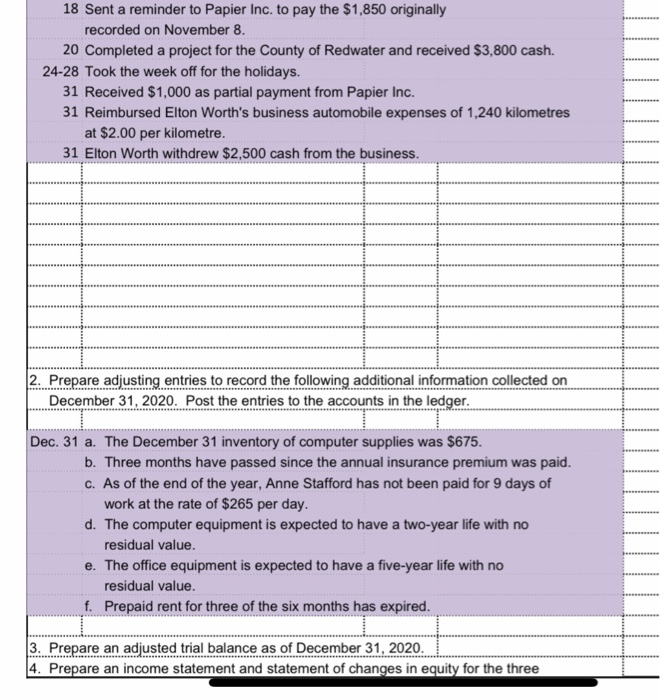

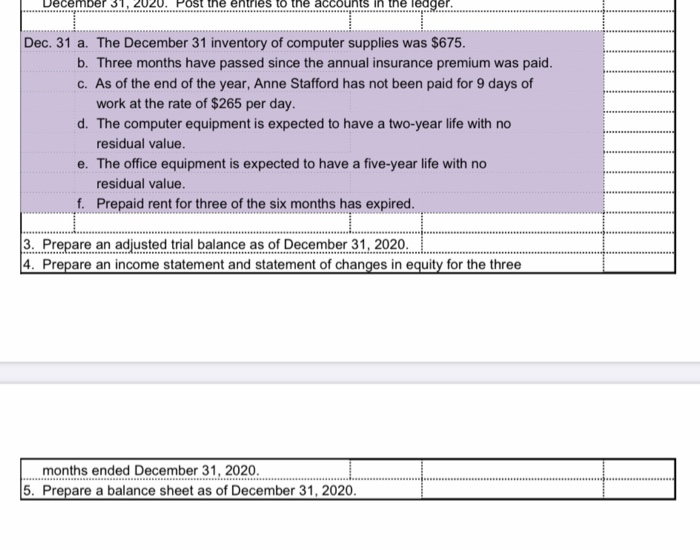

This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not been completed, the assignment can begin at this point. After the success of its first two months, Elton Worth has decided to continue operating Elton Systems. (The transactions that occurred in these months are described in Chapter 2.) Before proceeding in December, Elton adds these new accounts to the chart of accounts for the ledger: No. 164 168 210 236 Account Accumulated Depreciation, Office Equipment Accumulated Depreciation, Computer Equipment Wages Payable Unearned Computer Services Revenue Depreciation Expense, Office Equipment Depreciation Expense, Computer Equipment Insurance Expense Rent Expense Computer Supplies Expense 612 613 637 640 652 Required 1. Prepare journal entries to record each of the following transactions for Elton Systems. Post the entries to the accounts in the ledger. Dec. 3 Paid $3,600 to the Mayfair Mall for the company's share of mall advertising costs for December. 3 Paid $265 to repair the company's computer. 4 Received the balance owing from Sopher's Electrical. 10 Paid Anne Stafford for seven days' work at the rate of $265 per day. 14 Notified by Sopher's Electrical that Elton's bid of $12,340 on a proposed project was accepted. Reynolds paid an advance of $5,340. 17 Purchased $1,950 of computer supplies on credit from Kensington Supplies. 18 Sent a reminder to Papier Inc. to pay the $1,850 originally recorded on November 8. 20 Completed a project for the County of Redwater and received $3,800 cash 24-28 Took the week off for the holidays. 31 Received $1,000 as partial payment from Papier Inc. 31 Reimbursed Elton Worth's business automobile expenses of 1,240 kilometres at $2.00 per kilometre. 31 Elton Worth withdrew $2,500 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger Dec. 31 a. The December 31 inventory of computer supplies was $675. b. Three months have passed since the annual insurance premium was paid. C. As of the end of the year, Anne Stafford has not been paid for 9 days of work at the rate of $265 per day. d. The computer equipment is expected to have a two-year life with no residual value. e. The office equipment is expected to have a five-year life with no residual value. f. Prepaid rent for three of the six months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement and statement of changes in equity for the three December 31, 2020. Post the entries to the accounts in the ledger Dec. 31 a. The December 31 inventory of computer supplies was $675. b. Three months have passed since the annual insurance premium was paid. C. As of the end of the year, Anne Stafford has not been paid for 9 days of work at the rate of $265 per day. d. The computer equipment is expected to have a two-year life with no residual value. e. The office equipment is expected to have a five-year life with no residual value. f. Prepaid rent for three of the six months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020. 5. Prepare a balance sheet as of December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started