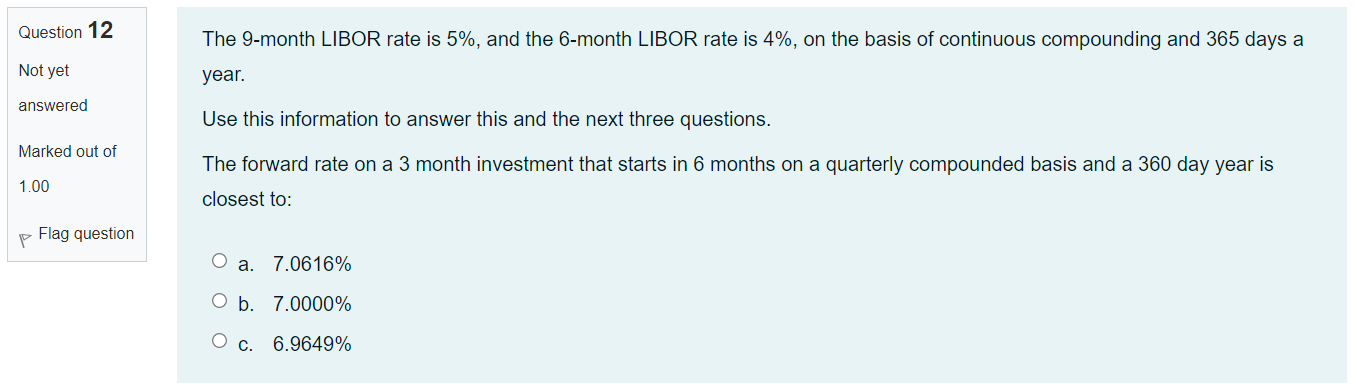

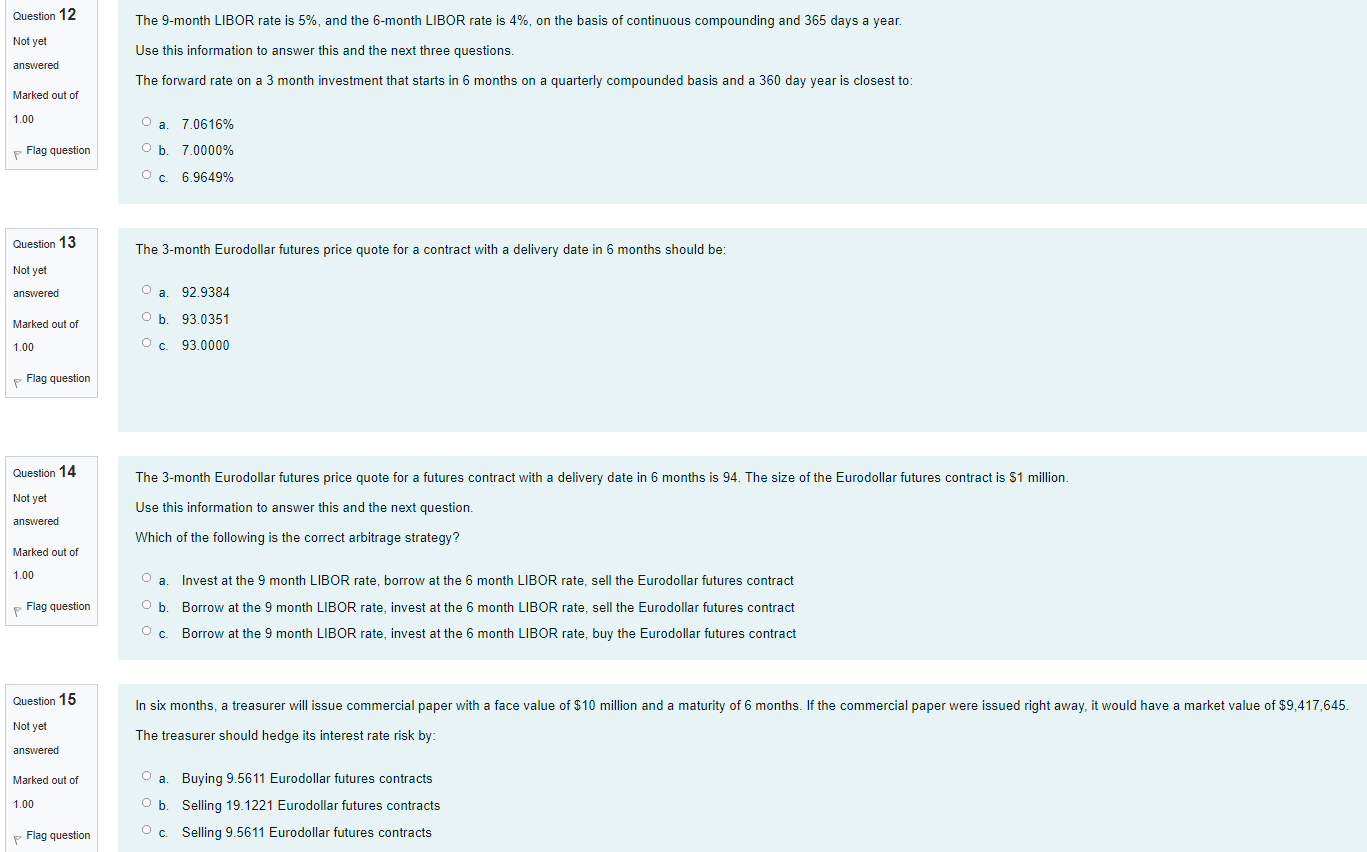

Question 12 The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. Not yet answered Use this information to answer this and the next three questions. Marked out of 1.00 The forward rate on a 3 month investment that starts in 6 months on a quarterly compounded basis and a 360 day year is closest to: p Flag question O a. 7.0616% O b. 7.0000% O c. 6.9649% Question 12 Not yet The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. Use this information to answer this and the next three questions. The forward rate on a 3 month investment that starts in 6 months on a quarterly compounded basis and a 360 day year is closest to: answered Marked out of 1.00 O a 7,0616% p Flag question Ob 7.0000% 6.9649% Question 13 The 3-month Eurodollar futures price quote for a contract with a delivery date in 6 months should be: Not yet answered O a. 92.9384 Marked out of 1.00 Ob. 93.0351 Oc. 93.0000 Flag question Question 14 The 3-month Eurodollar futures price quote for a futures contract with a delivery date in 6 months is 94. The size of the Eurodollar futures contract is $1 million. Not yet Use this information to answer this and the next question. answered Which of the following is the correct arbitrage strategy? Marked out of 1.00 0 a. p Flag question O. Invest at the 9 month LIBOR rate, borrow at the 6 month LIBOR rate, sell the Eurodollar futures contract Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, sell the Eurodollar futures contract Borrow at the 9 month LIBOR rate, invest at the 6 month LIBOR rate, buy the Eurodollar futures contract Oc. Question 15 In six months treasurer will issue commercial paper with a face value of $10 million and a maturity of 6 months. If the commercial paper were issued right away, it would have a market value of $9,417,645. Not yet The treasurer should hedge its interest rate risk by: answered Marked out of O a. Buying 9.5611 Eurodollar futures contracts 1.00 O b. Selling 19.1221 Eurodollar futures contracts Oc Selling 9.5611 Eurodollar futures contracts p Flag