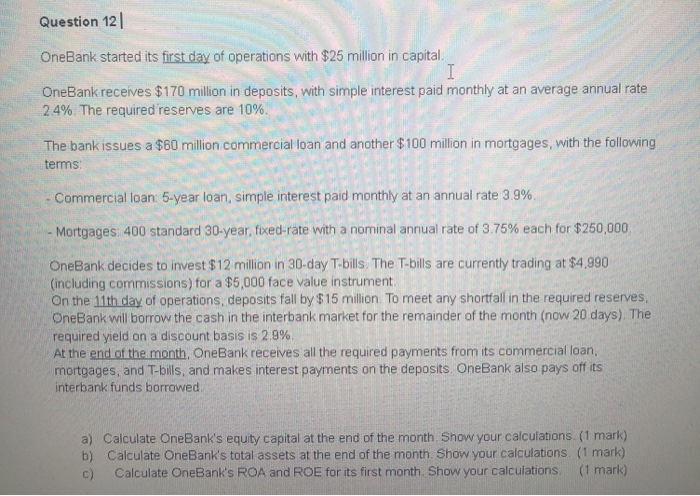

Question 121 OneBank started its first day of operations with $25 million in capital. I OneBank receives $170 million in deposits, with simple interest paid monthly at an average annual rate 2.4%. The required reserves are 10%. The bank issues a $60 million commercial loan and another $100 million in mortgages, with the following terms - Commercial loan: 5-year loan, simple interest paid monthly at an annual rate 3.9% - Mortgages: 41 standard 30-year, fixed-rate with a nominal annual rate of 3.75% each for $250,000 OneBank decides to invest $12 million in 30-day T-bills. The T-bills are currently trading at $4.990 (including commissions) for a $5,000 face value instrument. On the 11th day of operations, deposits fall by $15 million. To meet any shortfall in the required reserves, OneBank will borrow the cash in the interbank market for the remainder of the month (now 20 days). The required yield on a discount basis is 2.9% At the end of the month, OneBank receives all the required payments from its commercial loan, mortgages, and T-bills, and makes interest payments on the deposits. OneBank also pays off its interbank funds borrowed a) Calculate OneBank's equity capital at the end of the month. Show your calculations (1 mark) b) Calculate OneBank's total assets at the end of the month. Show your calculations. (1 mark) c) Calculate OneBank's ROA and ROE for its first month. Show your calculations (1 mark) Question 121 OneBank started its first day of operations with $25 million in capital. I OneBank receives $170 million in deposits, with simple interest paid monthly at an average annual rate 2.4%. The required reserves are 10%. The bank issues a $60 million commercial loan and another $100 million in mortgages, with the following terms - Commercial loan: 5-year loan, simple interest paid monthly at an annual rate 3.9% - Mortgages: 41 standard 30-year, fixed-rate with a nominal annual rate of 3.75% each for $250,000 OneBank decides to invest $12 million in 30-day T-bills. The T-bills are currently trading at $4.990 (including commissions) for a $5,000 face value instrument. On the 11th day of operations, deposits fall by $15 million. To meet any shortfall in the required reserves, OneBank will borrow the cash in the interbank market for the remainder of the month (now 20 days). The required yield on a discount basis is 2.9% At the end of the month, OneBank receives all the required payments from its commercial loan, mortgages, and T-bills, and makes interest payments on the deposits. OneBank also pays off its interbank funds borrowed a) Calculate OneBank's equity capital at the end of the month. Show your calculations (1 mark) b) Calculate OneBank's total assets at the end of the month. Show your calculations. (1 mark) c) Calculate OneBank's ROA and ROE for its first month. Show your calculations (1 mark)