question 123 is for the data below plz let me know if you have other questions

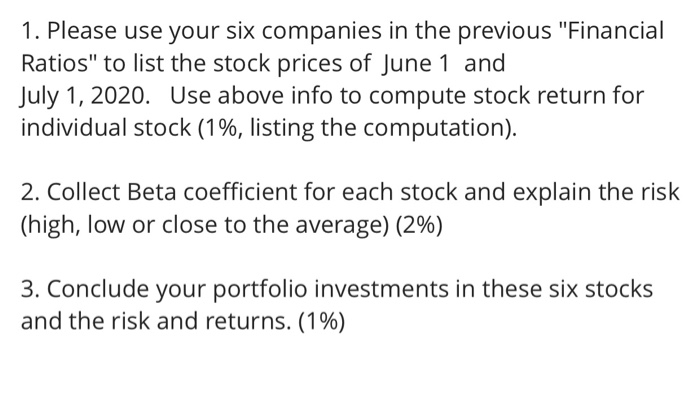

1. Please use your six companies in the previous "Financial Ratios" to list the stock prices of June 1 and July 1, 2020. Use above info to compute stock return for individual stock (1%, listing the computation). 2. Collect Beta coefficient for each stock and explain the risk (high, low or close to the average) (2%) 3. Conclude your portfolio investments in these six stocks and the risk and returns. (1%) Answer: I am taking 5 companies' Ratios as on December 31, 2019: Ratios as on Dec. 31, 2019 General Ratio name Amazon Walmart IBM Motors AT&T Explanation Amazon's and IBM's current ratio is Current 1.097 .794 better because it is above 1. It means 1.02 .88 .79 ratio Amazon and IBM are more liquid than other 3 companies. Amazon, Walmart and AT&T's Debt equity debt/equity ratio is lower than 1 hence .3773 .88 2.99 2.24 .80 these are in better position. Higher ratio debt/equity ratio is not good for companies. Amazon's and Walmart's Asset turnover Asset is better than other three companies, turnover 1.245 2.215 .5069 .602 .328 higher the ratio is good that means ratio company is able to utilize its assets to generate sales. Profit IBM's profit margin is the highest 4.13 2.84 12.22 4.79 7.67 among all, it has better profitability than margin other 4 companies. Price to Amazon's P/E ratio is the highest, higher earning 86.29 P/E is not good if it cannot provide 22.06 12.68 7.99 20.57 higher earnings. Lower P/E ratio means ratio that the share is cheaper. Amazon's price to book value ratio is the Market to 16.28 3.98 5.67 1.11 book ratio 1.40 highest because its market capitalization and current price are the highest. Closing stock price $2471.04 $123.96 $124.89 $26.94 $30.93 as on Junel 1. Please use your six companies in the previous "Financial Ratios" to list the stock prices of June 1 and July 1, 2020. Use above info to compute stock return for individual stock (1%, listing the computation). 2. Collect Beta coefficient for each stock and explain the risk (high, low or close to the average) (2%) 3. Conclude your portfolio investments in these six stocks and the risk and returns. (1%) Answer: I am taking 5 companies' Ratios as on December 31, 2019: Ratios as on Dec. 31, 2019 General Ratio name Amazon Walmart IBM Motors AT&T Explanation Amazon's and IBM's current ratio is Current 1.097 .794 better because it is above 1. It means 1.02 .88 .79 ratio Amazon and IBM are more liquid than other 3 companies. Amazon, Walmart and AT&T's Debt equity debt/equity ratio is lower than 1 hence .3773 .88 2.99 2.24 .80 these are in better position. Higher ratio debt/equity ratio is not good for companies. Amazon's and Walmart's Asset turnover Asset is better than other three companies, turnover 1.245 2.215 .5069 .602 .328 higher the ratio is good that means ratio company is able to utilize its assets to generate sales. Profit IBM's profit margin is the highest 4.13 2.84 12.22 4.79 7.67 among all, it has better profitability than margin other 4 companies. Price to Amazon's P/E ratio is the highest, higher earning 86.29 P/E is not good if it cannot provide 22.06 12.68 7.99 20.57 higher earnings. Lower P/E ratio means ratio that the share is cheaper. Amazon's price to book value ratio is the Market to 16.28 3.98 5.67 1.11 book ratio 1.40 highest because its market capitalization and current price are the highest. Closing stock price $2471.04 $123.96 $124.89 $26.94 $30.93 as on Junel