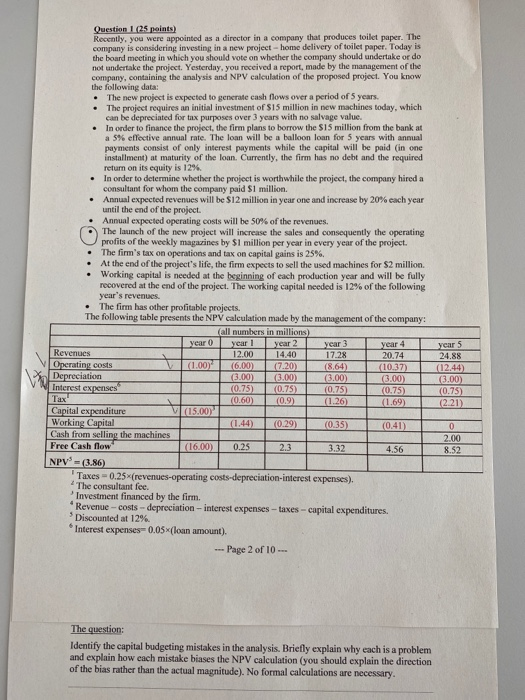

Question 125 points) Recently, you were appointed as a director in a company that produces toilet paper. The company is considering investing in a new project-home delivery of toilet paper. Today is the board meeting in which you should vote on whether the company should undertake or do not undertake the project. Yesterday, you received a report, made by the management of the company, containing the analysis and NPV calculation of the proposed project. You know the following data The new project is expected to generatie cash flows over a period of 5 years. The project requires an initial investment of S15 million in new machines today, which can be depreciated for tax purposes over 3 years with no salvage value. In order to finance the project, the firm plans to borrow the S15 million from the bank at a 596 effective annual rate. The loan will be a balloon loan for 5 years with annual payments consist of only interest payments while the capital will be paid in one installment) at maturity of the loan. Currently, the firm has no debt and the required return on its equity is 1296 In order to determine whether the project is worthwhile the project, the company hired a consultant for whom the company paid $1 million Annual expected revenues will be $12 million in year one and increase by 20% cach year until the end of the project. Annual expected operating costs will be 50% of the revenues. The launch of the new project will increase the sales and consequently the operating profits of the weekly magazines by $1 million per year in every year of the project. The firm's tax on operations and tax on capital gains is 25%, At the end of the project's life, the firm expects to sell the used machines for $2 million Working capital is needed at the beginning of each production year and will be fully recovered at the end of the project. The working capital needed is 12% of the following year's revenues The firm has other profitable projects. The following table presents the NPV calculation made by the management of the company: (all numbers in millions) year 0 year 1 year 2 year 3 year 4 Revenues 12.00 14.40 17.28 20.74 Operating costs (1.007 (6,00) 07.20) (8,64) (10.37) Depreciation (3.00) (3.00) (100) (3.00) Interest expenses (0.75) (0.75) (0.75) (0.75) Tex (0.60) (0.9) (1.26) (1.69) Capital expenditure (15.00) Working Capital 1.44) (0.29) (0.35) (0.41) Cash from selling the machines Free Cash flow 1 6.00) 0.25 2.3 3.32 4.56 NPV = (3.86) Taxes - 0.25 (revenues-operating costs-depreciation interest expenses). The consultant fee. Investment financed by the firm. * Revenue -costs-depreciation-interest expenses - taxes - capital expenditures. Discounted at 12% * Interest expenses-0.05x(loan amount) - Page 2 of 10 - year 5 24.88 (12.44) (3.00) (0.75) 221) 0 2.00 8.52 The question: Identify the capital budgeting mistakes in the analysis. Briefly explain why each is a problem and explain how each mistake biases the NPV calculation (you should explain the direction of the bias rather than the actual magnitude). No formal calculations are necessary