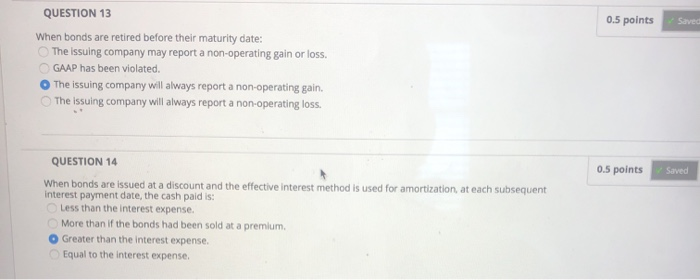

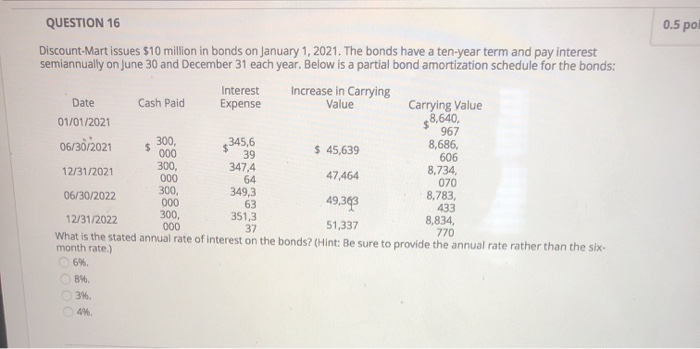

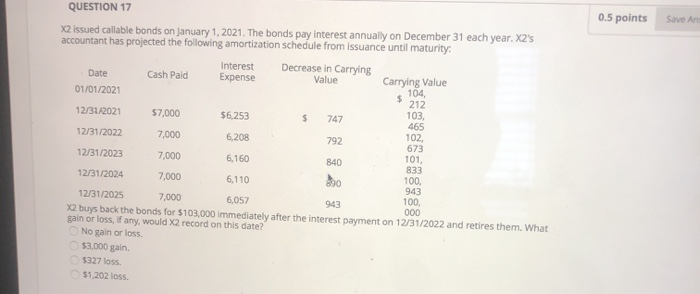

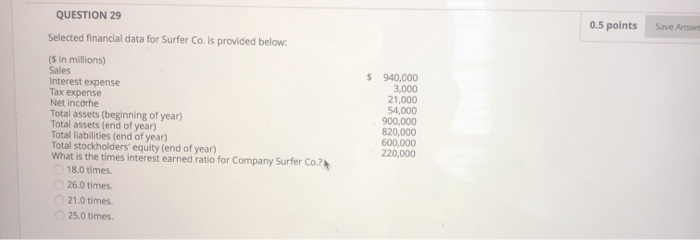

QUESTION 13 0.5 points Saved When bonds are retired before their maturity date: The issuing company may report a non-operating gain or loss. GAAP has been violated The issuing company will always report a non-operating gain. The issuing company will always report a non-operating loss. QUESTION 14 0.5 points Saved When bonds are issued at a discount and the effective interest method is used for amortization at each subsequent interest payment date, the cash paid is: Less than the interest expense. More than if the bonds had been sold at a premium O Greater than the interest expense. Equal to the interest expense. QUESTION 16 0.5 poi Discount-Mart issues $10 million in bonds on January 1, 2021. The bonds have a ten-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: 967 5 000 $345,6 Interest Increase in Carrying Date Cash Paid Expense Value Carrying Value 01/01/2021 8,640, 06/30/2021 300, $ 45,639 8,686, 39 606 300, 347,4 12/31/2021 8,734 000 64 47,464 070 06/30/2022 300, 349,3 8,783 000 49,393 63 433 12/31/2022 351,3 000 51,337 8,834, 770 What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six- month rate.) 6% 8% 3%. 4%. 300. QUESTION 17 X2 issued callable bonds on January 1, 2021. The bonds pay interest annually on December 31 each year. X2's accountant has projected the following amortization schedule from issuance until maturity 0.5 points Save and 104 Interest Decrease in Carrying Date Cash Paid Expense Value Carrying Value 01/01/2021 212 12/31/2021 $7,000 $6,253 747 103, 465 12/31/2022 7,000 6,208 102, 673 12/31/2023 7,000 101. 6,160 840 833 12/31/2024 7,000 100 6,110 12/31/2025 7,000 100 6,057 943 X2 buys back the bonds for $103,000 immediately after the interest payment on 12/31/2022 and retires them. What 000 gain or loss, if any, would X2 record on this date? No gain or loss. $3.000 gain. $327 loss. 51,202 loss. 390 943 QUESTION 29 0.5 points Save Answe Selected financial data for Surfer Co. is provided below: $ ($ in millions) Sales Interest expense Tax expense Net Income Total assets (beginning of year) Total assets (end of year) Total liabilities (end of year) Total stockholders' equity (end of year) What is the times interest earned ratio for Company Surfer Co.? 18.0 times. 26.0 times 21.0 times 25.0 times. 940,000 3,000 21,000 54,000 900,000 820,000 600,000 220,000