Answered step by step

Verified Expert Solution

Question

1 Approved Answer

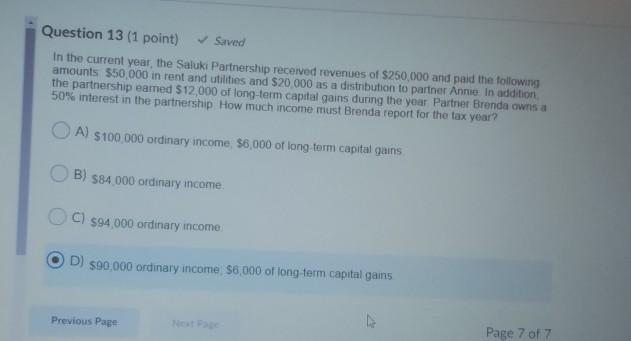

Question 13 (1 point) & Saved In the current year, the Saluki Partnership received revenues of $250,000 and paid the following amounts $50.000 in rent

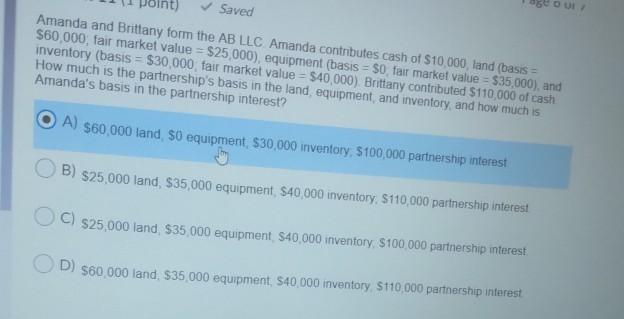

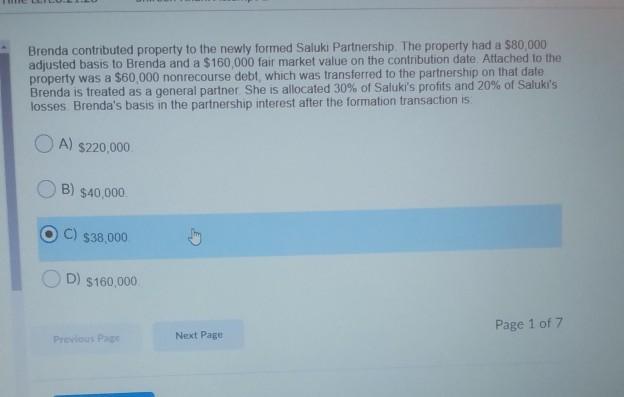

Question 13 (1 point) & Saved In the current year, the Saluki Partnership received revenues of $250,000 and paid the following amounts $50.000 in rent and utilities and $20,000 as a distnbution to partner Annie. In addition the partnership eamed $12,000 of long-term capital gains during the year Partner Brenda owns a 50% interest in the partnership. How much income must Brenda report for the tax year? A) $100,000 ordinary income $6.000 of long term capital gains B) $84.000 ordinary income C) $94,000 ordinary income D) 590,000 ordinary income $6,000 of long term capital gains Previous Page Page 7 of 7 Saved Amanda and Brittany form the AB LLC Amanda contributes cash of $10,000, land (basis = $60,000, fair market value = $25,000), equipment (basis = $0 fair market value = $35.000), and inventory (basis = $30,000 fair market value = $40,000) Brittany contributed $110,000 of cash How much is the partnership's basis in the land equipment and inventory and how much is Amanda's basis in the partnership interest? A) $60,000 land, SO equipment, $30,000 inventory S100,000 partnership interest B) $25,000 land, $35,000 equipment, $40,000 inventory. $110,000 partnership interest C) $25,000 land, $35.000 equipment, $40.000 inventory, $100.000 partnership interest D) $60.000 land, $35.000 equipment, S40,000 inventory S10,000 partnership interest Brenda contributed property to the newly formed Saluki Partnership. The property had a $80,000 adjusted basis to Brenda and a $160,000 fair market value on the contribution date Attached to the property was a $60.000 nonrecourse debt which was transferred to the partnership on that date Brenda is treated as a general partner. She is allocated 30% of Saluki's profits and 20% of Saluki's losses Brenda's basis in the partnership interest after the formation transaction is O A) $220,000 B) $40,000 $38,000 be D) $160,000 Page 1 of 7 Previous Pace Next Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started