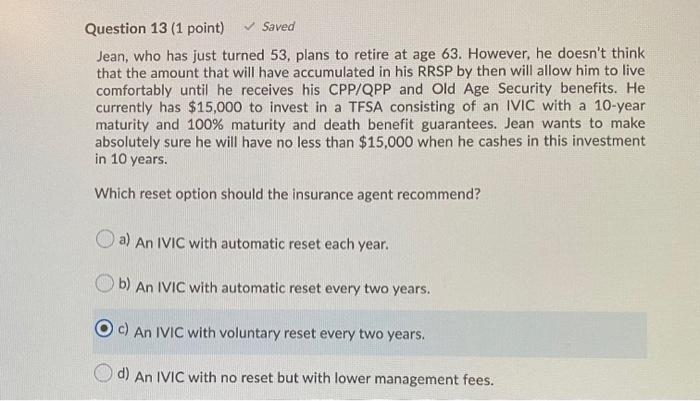

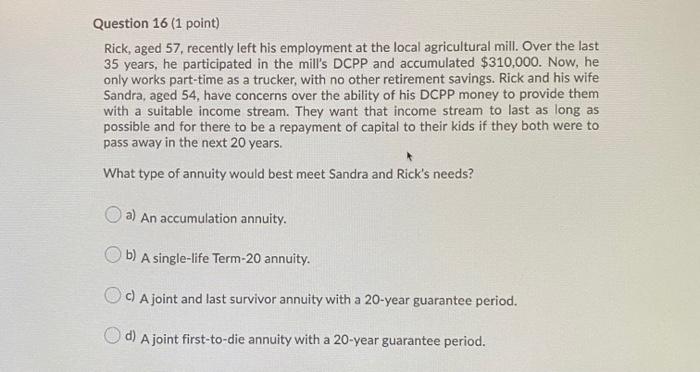

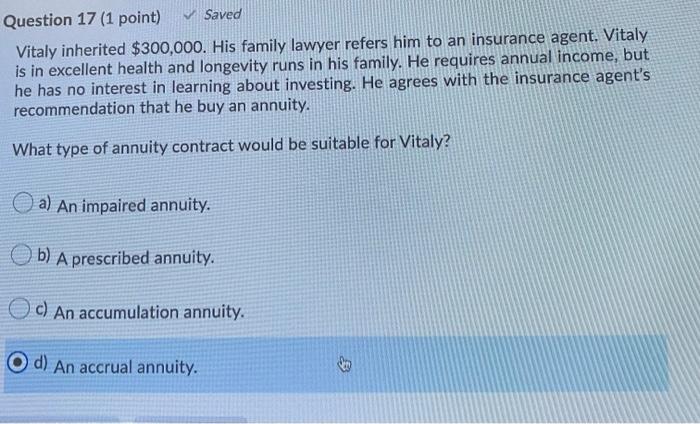

Question 13 (1 point) Saved Jean, who has just turned 53, plans to retire at age 63. However, he doesn't think that the amount that will have accumulated in his RRSP by then will allow him to live comfortably until he receives his CPP/QPP and Old Age Security benefits. He currently has $15,000 to invest in a TFSA consisting of an IVIC with a 10-year maturity and 100% maturity and death benefit guarantees. Jean wants to make absolutely sure he will have no less than $15,000 when he cashes in this investment in 10 years. Which reset option should the insurance agent recommend? a) An IVIC with automatic reset each year. b) An IVIC with automatic reset every two years. c) An IVIC with voluntary reset every two years. d) An IVIC with no reset but with lower management fees. Question 16 (1 point) Rick, aged 57 recently left his employment at the local agricultural mill. Over the last 35 years, he participated in the mill's DCPP and accumulated $310,000. Now, he only works part-time as a trucker, with no other retirement savings. Rick and his wife Sandra, aged 54, have concerns over the ability of his DCPP money to provide them with a suitable income stream. They want that income stream to last as long as possible and for there to be a repayment of capital to their kids if they both were to pass away in the next 20 years. What type of annuity would best meet Sandra and Rick's needs? a) An accumulation annuity. b) A single-life Term-20 annuity. c) A joint and last survivor annuity with a 20-year guarantee period. d) Ajoint first-to-die annuity with a 20-year guarantee period. Question 17 (1 point) Saved Vitaly inherited $300,000. His family lawyer refers him to an insurance agent. Vitaly is in excellent health and longevity runs in his family. He requires annual income, but he has no interest in learning about investing. He agrees with the insurance agent's recommendation that he buy an annuity. What type of annuity contract would be suitable for Vitaly? a) An impaired annuity. b) A prescribed annuity. ) c) An accumulation annuity. O d) An accrual annuity. 20