Answered step by step

Verified Expert Solution

Question

1 Approved Answer

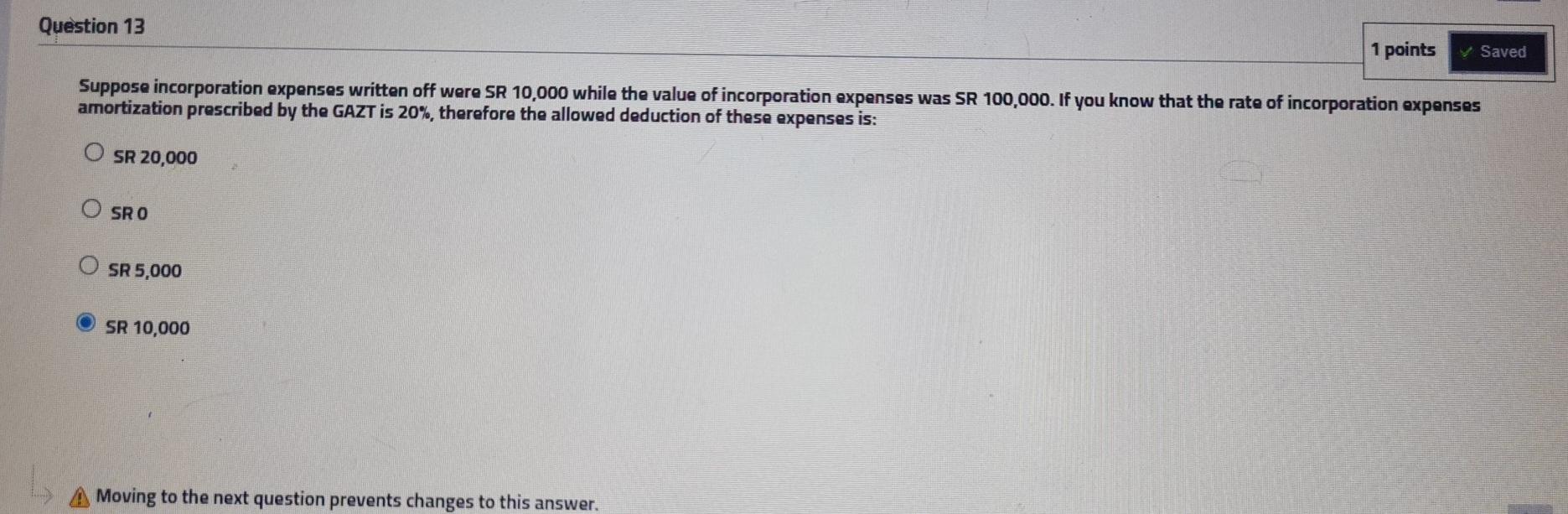

Question 13 1 points Saved Suppose incorporation expenses written off were SR 10,000 while the value of incorporation expenses was SR 100,000. If you know

Question 13 1 points Saved Suppose incorporation expenses written off were SR 10,000 while the value of incorporation expenses was SR 100,000. If you know that the rate of incorporation expenses amortization prescribed by the GAZT is 20%, therefore the allowed deduction of these expenses is: SR 20,000 O SRO O SR5,000 SR 10,000 A Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started