Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 13 12. If Lott was recently been approached by its supplier with a new quantity discount program, and Lott determines that the optimal order

question 13

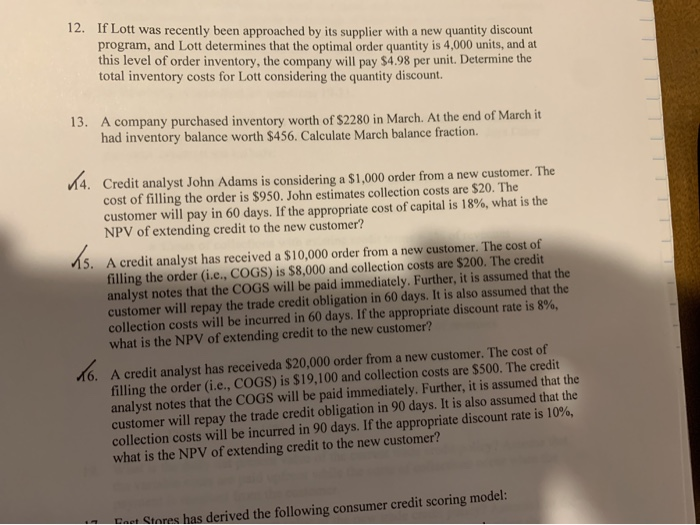

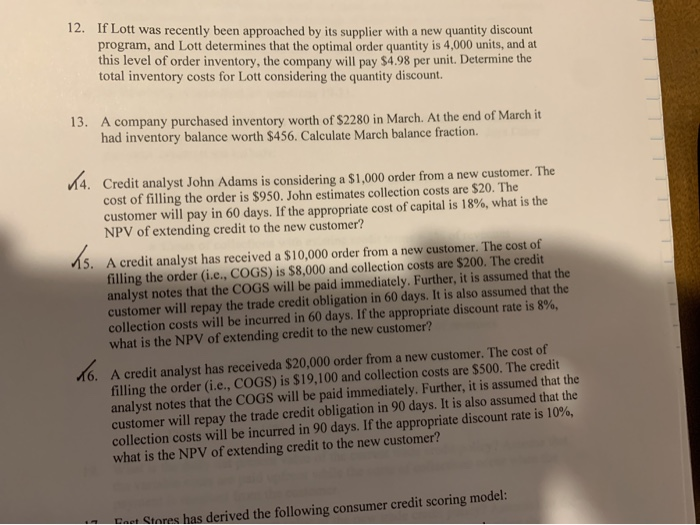

12. If Lott was recently been approached by its supplier with a new quantity discount program, and Lott determines that the optimal order quantity is 4,000 units, and at this level of order inventory, the company will pay $4.98 per unit. Determine the total inventory costs for Lott considering the quantity discount. 13. A company purchased inventory worth of $2280 in March. At the end of March it had inventory balance worth $456. Calculate March balance fraction. hs. K4. Credit analyst John Adams is considering a $1,000 order from a new customer. The cost of filling the order is $950. John estimates collection costs are $20. The customer will pay in 60 days. If the appropriate cost of capital is 18%, what is the NPV of extending credit to the new customer? A credit analyst has received a $10,000 order from a new customer. The cost of filling the order (i.e., COGS) is $8,000 and collection costs are $200. The credit analyst notes that the COGS will be paid immediately. Further, it is assumed that the customer will repay the trade credit obligation in 60 days. It is also assumed that the collection costs will be incurred in 60 days. If the appropriate discount rate is 8%, what is the NPV of extending credit to the new customer? 16. A credit analyst has receiveda $20,000 order from a new customer. The cost of filling the order (i.e., COGS) is $19,100 and collection costs are $500. The credit analyst notes that the COGS will be paid immediately. Further, it is assumed that the customer will repay the trade credit obligation in 90 days. It is also assumed that the collection costs will be incurred in 90 days. If the appropriate discount rate is 10%, what is the NPV of extending credit to the new customer? Pet Stores has derived the following consumer credit scoring model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started