Answered step by step

Verified Expert Solution

Question

1 Approved Answer

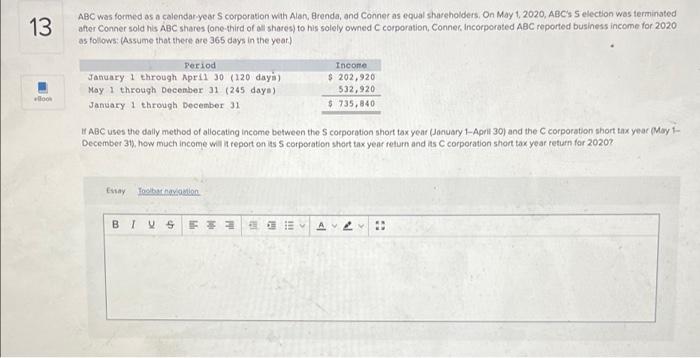

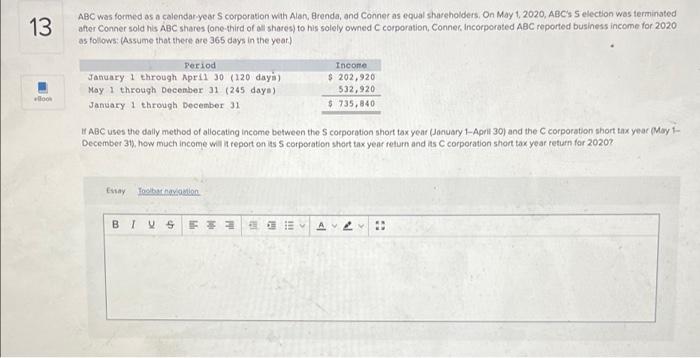

Question 13 13 ABC was formed as a calendar years corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's Selection

Question 13

13 ABC was formed as a calendar years corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's Selection was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year) Period Income January 1 through April 30 (120 days) $ 202,920 May 1 through December 31 (245 days) 532,920 January 1 through December 31 $ 735,840 IT ABC uses the daily method of allocating Income between the corporation short tax year acuary 1-April 30) and the corporation short tax year (May 1- December 39. how much Income will report on its corporation short tax yeur return and its corporation short tax year return for 2020? Essay Tony Mon BTV 2 EA21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started