Answered step by step

Verified Expert Solution

Question

1 Approved Answer

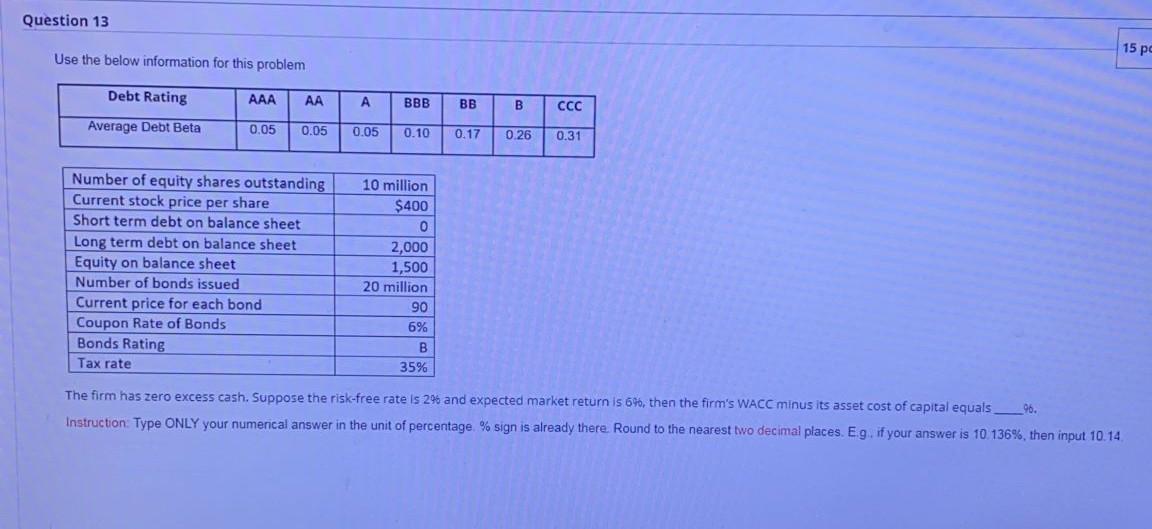

Question 13 15 pc Use the below information for this problem Debt Rating AAA A BBB BB B CCC Average Debt Beta 0.05 0.05 0.05

Question 13 15 pc Use the below information for this problem Debt Rating AAA A BBB BB B CCC Average Debt Beta 0.05 0.05 0.05 0.10 0.17 0.26 0.31 Number of equity shares outstanding Current stock price per share Short term debt on balance sheet Long term debt on balance sheet Equity on balance sheet Number of bonds issued Current price for each bond Coupon Rate of Bonds Bonds Rating Tax rate 10 million $400 0 2,000 1,500 20 million 90 6% B 35% The firm has zero excess cash. Suppose the risk-free rate is 29 and expected market return is 6%, then the firm's WACC minus its asset cost of capital equals_%. Instruction Type ONLY your numerical answer in the unit of percentage. % sign is already there. Round to the nearest two decimal places. Eg. if your answer is 10.136%, then input 10.14 Question 13 15 pc Use the below information for this problem Debt Rating AAA A BBB BB B CCC Average Debt Beta 0.05 0.05 0.05 0.10 0.17 0.26 0.31 Number of equity shares outstanding Current stock price per share Short term debt on balance sheet Long term debt on balance sheet Equity on balance sheet Number of bonds issued Current price for each bond Coupon Rate of Bonds Bonds Rating Tax rate 10 million $400 0 2,000 1,500 20 million 90 6% B 35% The firm has zero excess cash. Suppose the risk-free rate is 29 and expected market return is 6%, then the firm's WACC minus its asset cost of capital equals_%. Instruction Type ONLY your numerical answer in the unit of percentage. % sign is already there. Round to the nearest two decimal places. Eg. if your answer is 10.136%, then input 10.14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started