Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 13 (2 points) If a firm has a break-even point of 20,000 units and the contribution margin on the firm's single product is

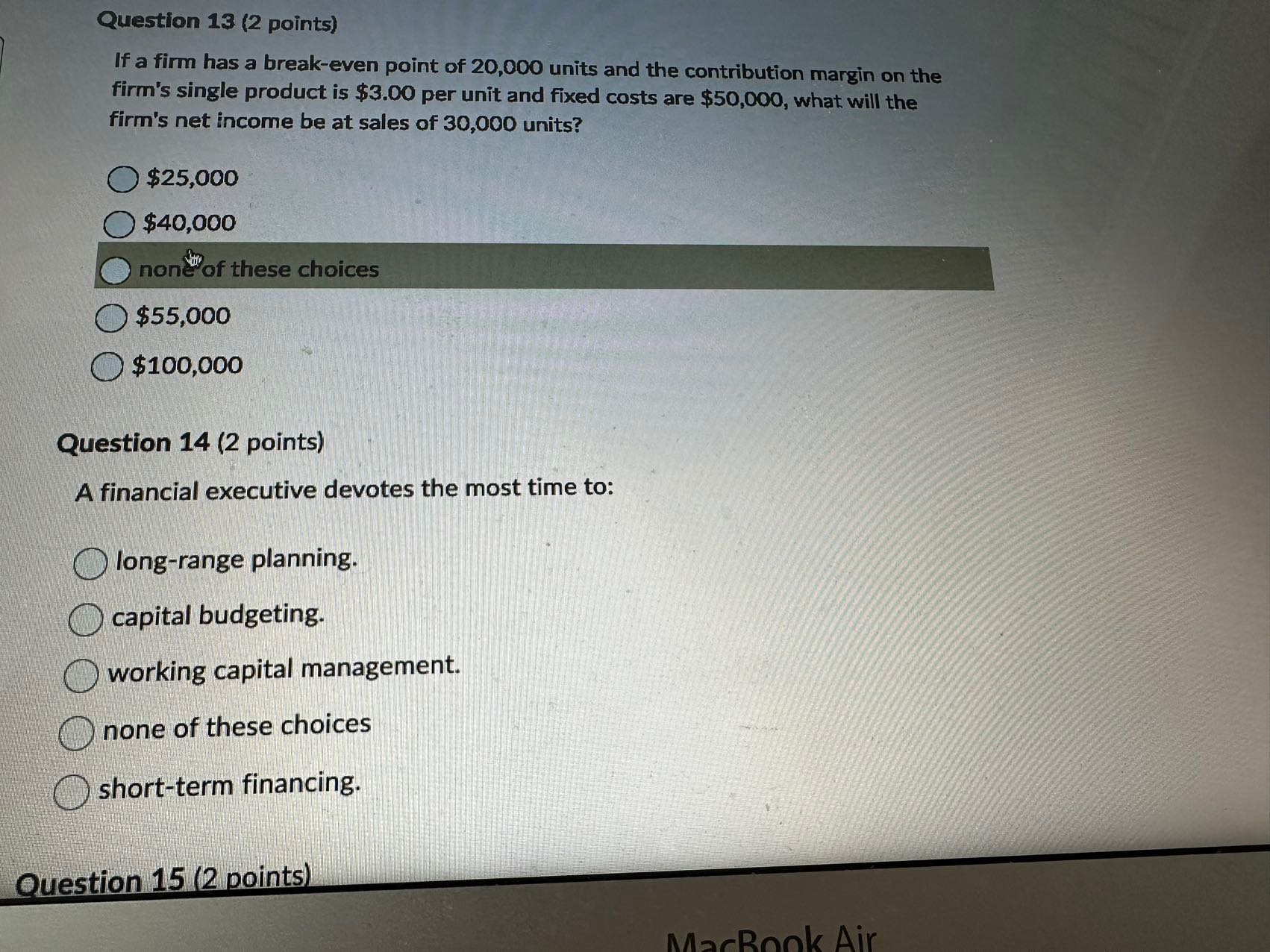

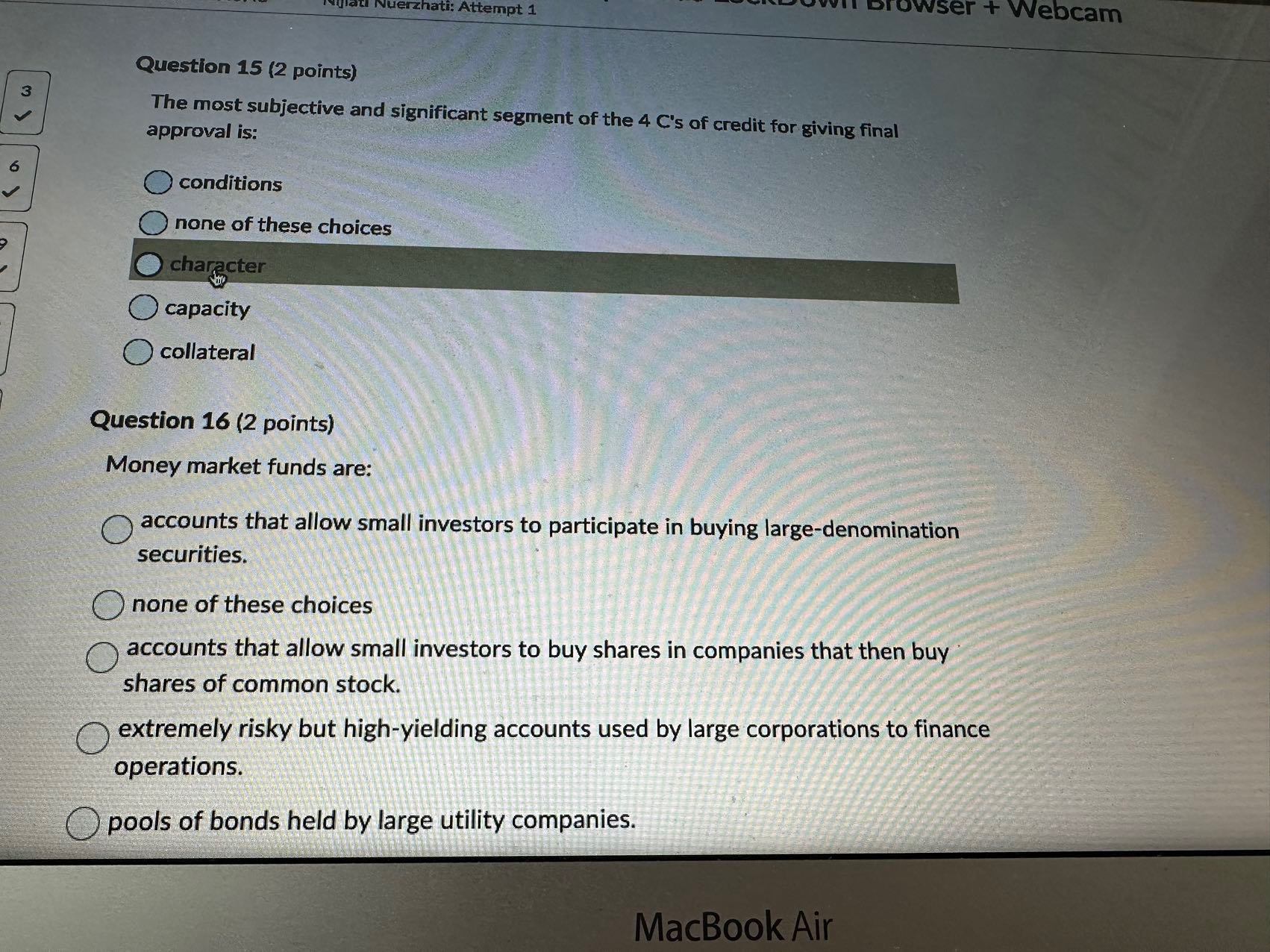

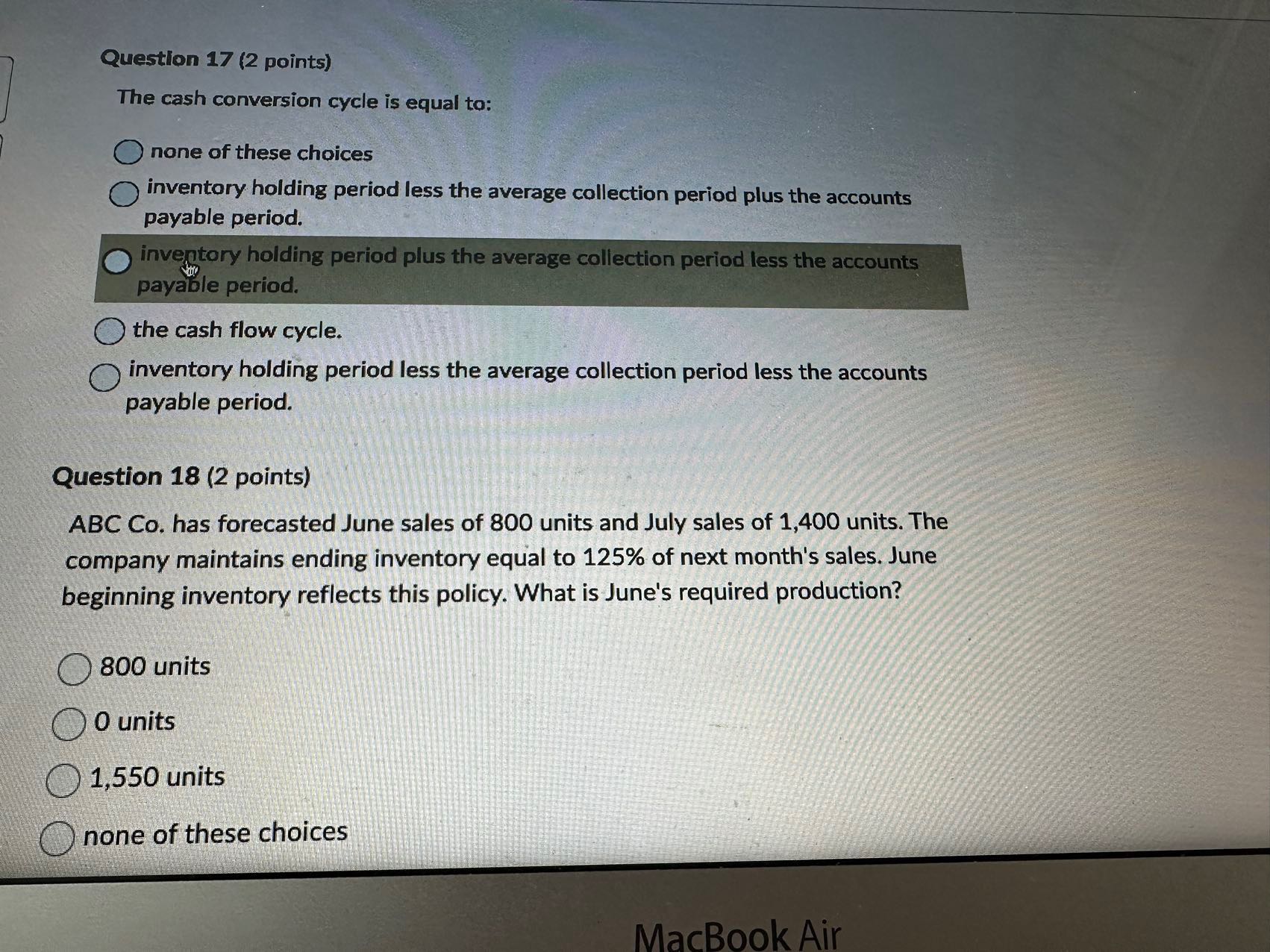

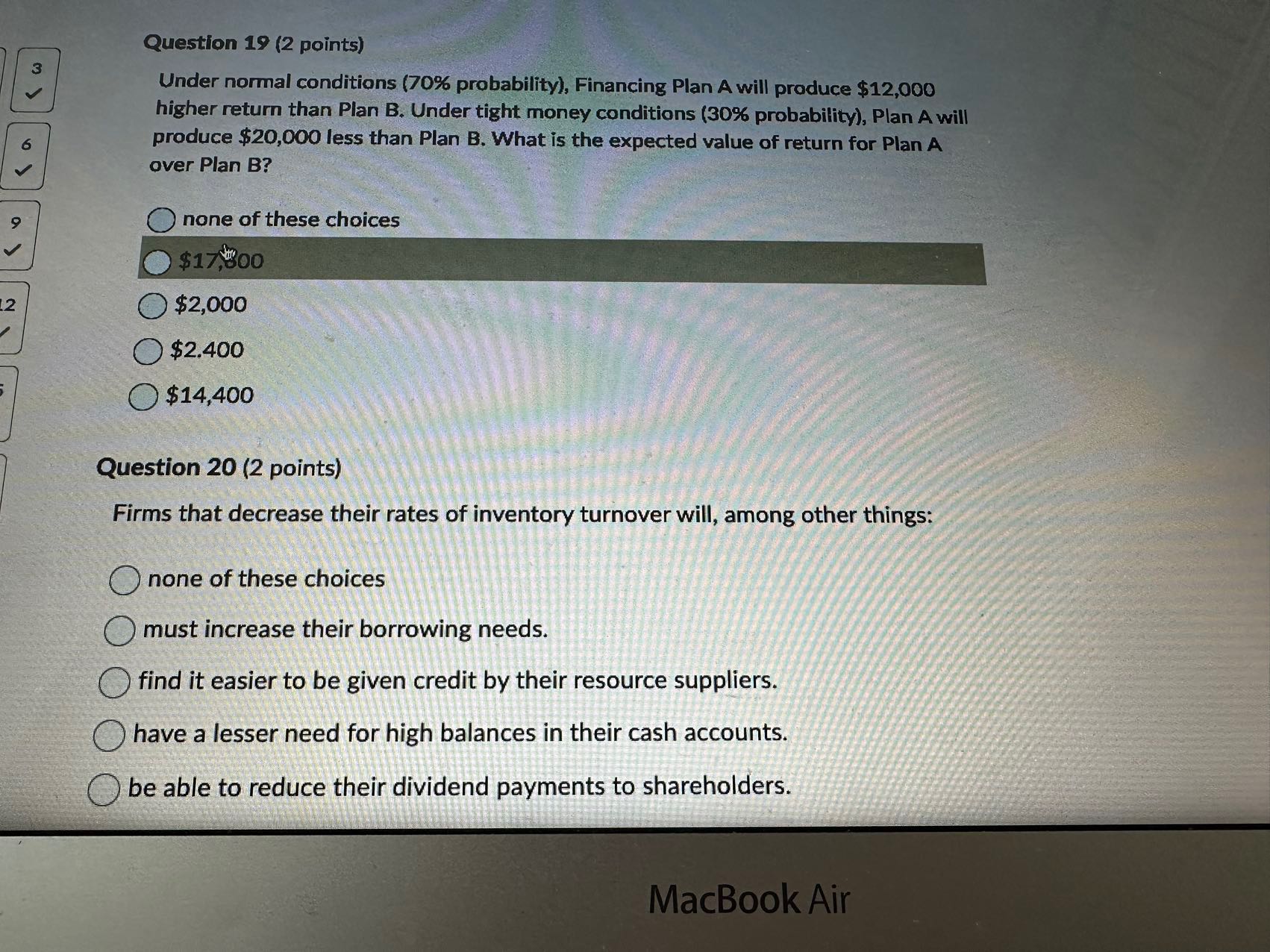

Question 13 (2 points) If a firm has a break-even point of 20,000 units and the contribution margin on the firm's single product is $3.00 per unit and fixed costs are $50,000, what will the firm's net income be at sales of 30,000 units? $25,000 $40,000 none of these choices $55,000 $100,000 Question 14 (2 points) A financial executive devotes the most time to: long-range planning. capital budgeting. working capital management. none of these choices short-term financing. Question 15 (2 points) MacBook Air 6 Nuerzhati: Attempt 1 Question 15 (2 points) The most subjective and significant segment of the 4 C's of credit for giving final approval is: conditions none of these choices character capacity collateral + Webcam Question 16 (2 points) Money market funds are: accounts that allow small investors to participate in buying large-denomination securities. none of these choices accounts that allow small investors to buy shares in companies that then buy shares of common stock. extremely risky but high-yielding accounts used by large corporations to finance operations. pools of bonds held by large utility companies. MacBook Air Question 17 (2 points) The cash conversion cycle is equal to: none of these choices inventory holding period less the average collection period plus the accounts payable period. inventory holding period plus the average collection period less the accounts payable period. the cash flow cycle. inventory holding period less the average collection period less the accounts payable period. Question 18 (2 points) ABC Co. has forecasted June sales of 800 units and July sales of 1,400 units. The company maintains ending inventory equal to 125% of next month's sales. June beginning inventory reflects this policy. What is June's required production? 800 units O units 1,550 units none of these choices MacBook Air 3 > Question 19 (2 points) Under normal conditions (70% probability), Financing Plan A will produce $12,000 higher return than Plan B. Under tight money conditions (30% probability), Plan A will produce $20,000 less than Plan B. What is the expected value of return for Plan A over Plan B? none of these choices $17,000 12 $2,000 $2.400 $14,400 Question 20 (2 points) Firms that decrease their rates of inventory turnover will, among other things: none of these choices must increase their borrowing needs. find it easier to be given credit by their resource suppliers. have a lesser need for high balances in their cash accounts. be able to reduce their dividend payments to shareholders. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve each question step by step Question 13 Net income calculation 1 Breakeven point in units 20000 units 2 Contribution margin per unit 300 3 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started