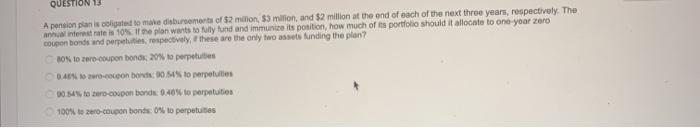

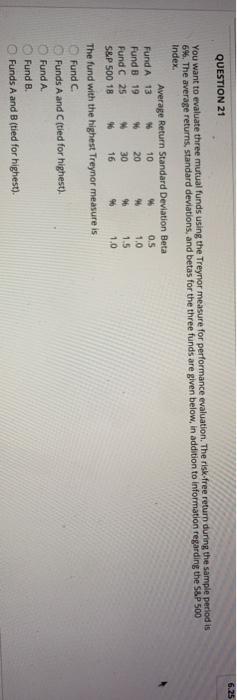

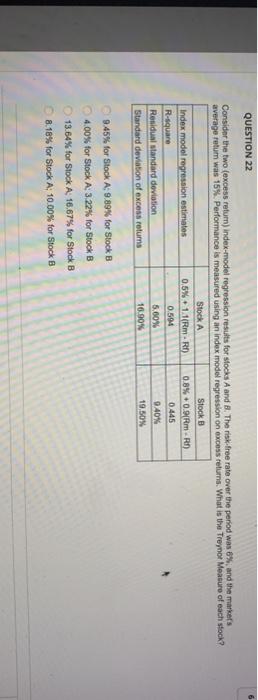

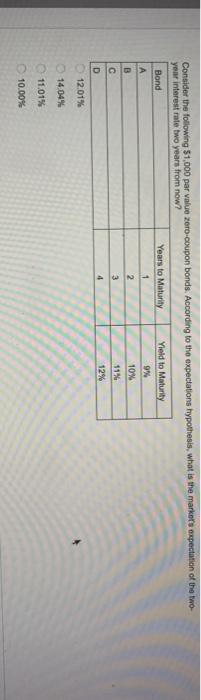

QUESTION 13 A pension plan is coligated to make disbursements of $2 million, 53 milion, and $2 million at the end of each of the next three years, respectively. The an interest rate is 10% of the plan wants to fully fund and immunize its position, how much of its portfolio should it alloonte to one year Zero coupon bonds and perpetuis respectively, these are the only two asset funding the plan? BON to zero coupon bonds, 20% to perpetubes 0.46% 1 con bon 0.5% to perpetuis 004 to 2-coupon bonds 0.40% to perpetuities 100% to zero-coupon bonds: 0% to perpetuites 6.25 QUESTION 21 You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index Average Return Standard Deviation Beta Fund A13 10 0.5 Fund B 19 * 20 9 1,0 Fund C 25 30 1.5 S&P 500 18 46 16 % 1.0 The fund with the highest Treynor measure is Fund Funds A and C (tied for highest). Fund A Fund B. Funds A and B (tied for highest). 6 QUESTION 22 Consider the two (excess retum) index-model regression results for stocks A and 8. The risk free rate over the period was 6% and the markers average retum was 15%. Performance is measured using an index model regression on excess returns. What is the Treynor Meature of each stock? Stock A Stock Index model regression estimates 0.5% +1.1(Rm-R) 0.8%+0.9[Rm-RI) R-square 0.594 0445 Residual standard deviation 5,60% 9.40% Standard deviation of excess returns 10.90% 19.50% 9.45% for Stock A: 9.89% for Stock B 4.00% for Stock A: 3.22% for Stock B 13.64% for Stock A, 16.67% for Stock B 8.18% for Stock A: 10.00% for Stock B Consider the following 51.000 par value zoro-coupon bonds. According to the expectations hypothesis, what is the market's expectation of the two year interest rate two years from now? Bond Years to Maturity Yield to Maturity A 1 9% B 2 10% C 3 11% D 4 12% 12.01% 14.04% 11.01% 10.00% QUESTION 13 A pension plan is coligated to make disbursements of $2 million, 53 milion, and $2 million at the end of each of the next three years, respectively. The an interest rate is 10% of the plan wants to fully fund and immunize its position, how much of its portfolio should it alloonte to one year Zero coupon bonds and perpetuis respectively, these are the only two asset funding the plan? BON to zero coupon bonds, 20% to perpetubes 0.46% 1 con bon 0.5% to perpetuis 004 to 2-coupon bonds 0.40% to perpetuities 100% to zero-coupon bonds: 0% to perpetuites 6.25 QUESTION 21 You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index Average Return Standard Deviation Beta Fund A13 10 0.5 Fund B 19 * 20 9 1,0 Fund C 25 30 1.5 S&P 500 18 46 16 % 1.0 The fund with the highest Treynor measure is Fund Funds A and C (tied for highest). Fund A Fund B. Funds A and B (tied for highest). 6 QUESTION 22 Consider the two (excess retum) index-model regression results for stocks A and 8. The risk free rate over the period was 6% and the markers average retum was 15%. Performance is measured using an index model regression on excess returns. What is the Treynor Meature of each stock? Stock A Stock Index model regression estimates 0.5% +1.1(Rm-R) 0.8%+0.9[Rm-RI) R-square 0.594 0445 Residual standard deviation 5,60% 9.40% Standard deviation of excess returns 10.90% 19.50% 9.45% for Stock A: 9.89% for Stock B 4.00% for Stock A: 3.22% for Stock B 13.64% for Stock A, 16.67% for Stock B 8.18% for Stock A: 10.00% for Stock B Consider the following 51.000 par value zoro-coupon bonds. According to the expectations hypothesis, what is the market's expectation of the two year interest rate two years from now? Bond Years to Maturity Yield to Maturity A 1 9% B 2 10% C 3 11% D 4 12% 12.01% 14.04% 11.01% 10.00%