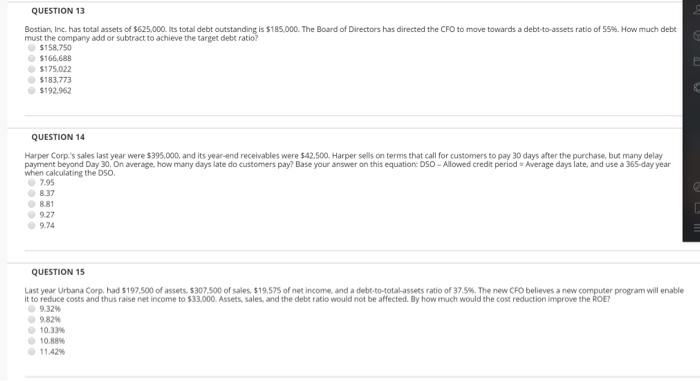

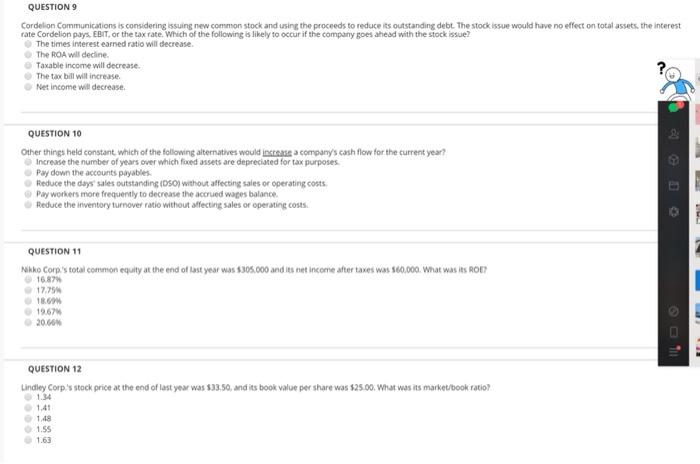

QUESTION 13 Bostian, Inc. has total assets of $625,000. Its total debt outstanding is $185.000. The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%. How much debt must the company add or subtract to achieve the target debt ratio? $158.750 $166.688 5125.022 $183,773 $192.962 QUESTION 14 Harper Corp's sales last year were $395.000, and its year-end receivables were $42.500. Harper sells on terms that call for customers to pay 30 days after the purchase, but many delay payment beyond Day 30. On average, how many days late do customers pay? Base your answer on this equation DSO - Allowed credit period Average days late and use a 365-day year When calculating the 50. 7.95 837 8.81 9.22 9.74 QUESTION 15 Last year Urbana Corp, had 5197.500 of assets. $307.500 of sales. 519,575 of net income, and a debt-to-total-assets ratio of 3754. The new CFO believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. Assets sales, and the debt ratio would not be affected. By how much would the cost reduction improve the ROET 9.32 9824 10.33% 10. 11.42% QUESTION 9 Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets. the interest rate Cordelion pays. EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue? The times interest earned ratio will decrease The ROA will decine. Taxable income will decrease. The tax bill will increase Net Income will decrease QUESTION 10 Other things held constant which of the following alternatives would increase a company's cash flow for the current year? Increase the number of years over which foved assets are depreciated for tax purposes Pay down the accounts payables Reduce the days sales outstanding (DS) without affecting sales or operating costs. Pay workers more frequently to decrease the accrued wapes balance Reduce the inventory turnover ratio without affecting sales or operating costs. QUESTION 11 Nikko Corp's total common equity at the end of last year was $305.000 and its net income after taxes was 560.000. What was its ROBY 16.87 12.79 18.60 19.67 20.60 QUESTION 12 Lindley Corp's stock price at the end of last year was $23.50, and its book value per share was $25.00. What was its market/book ratio? 1.55 1.63