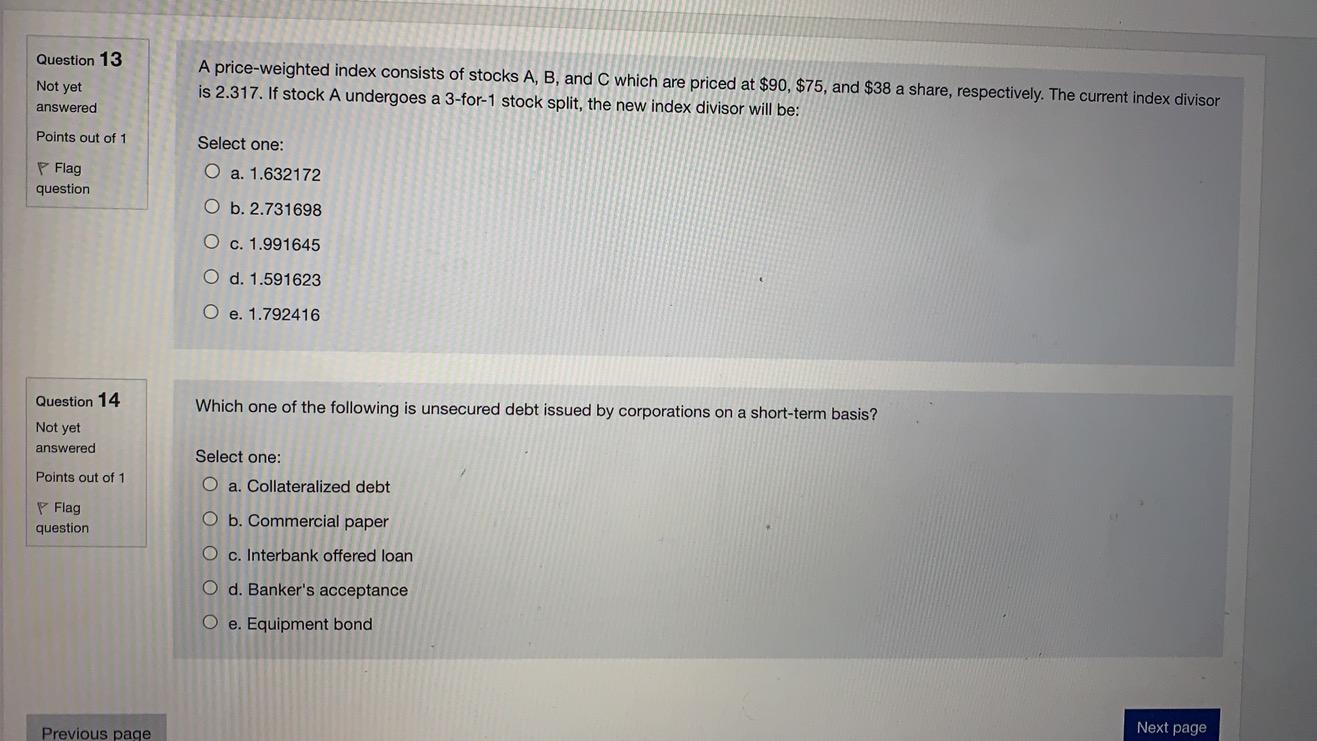

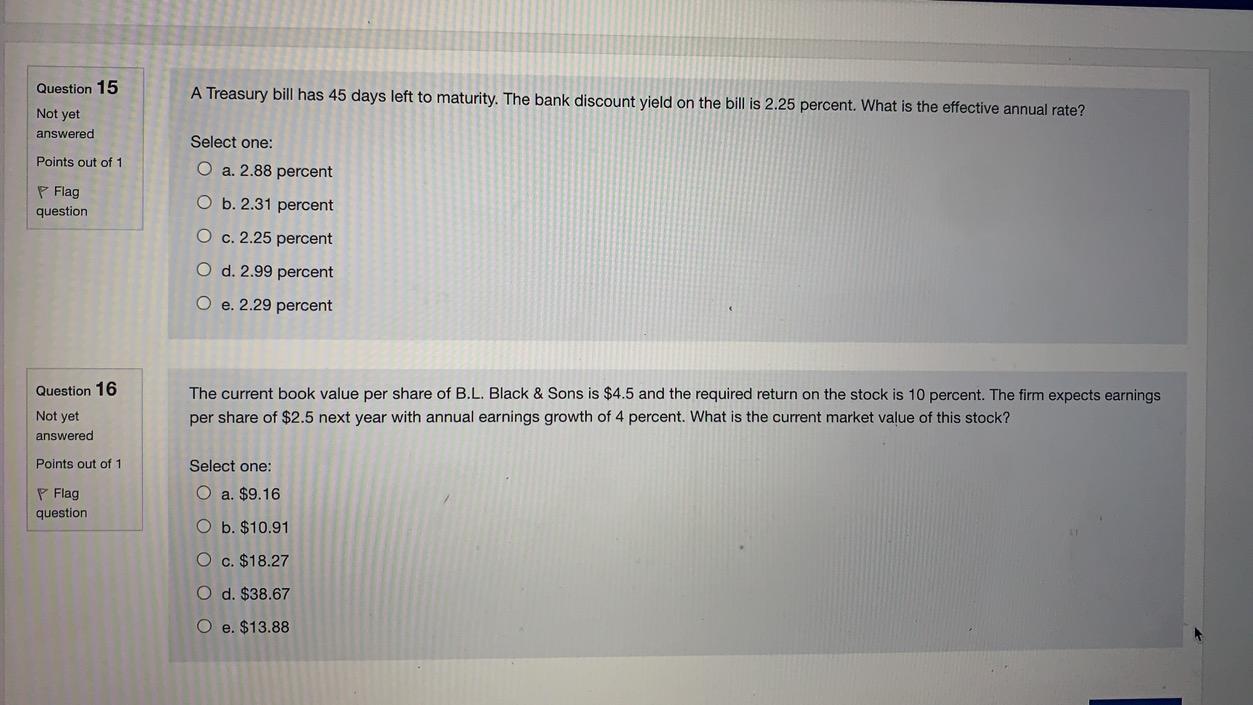

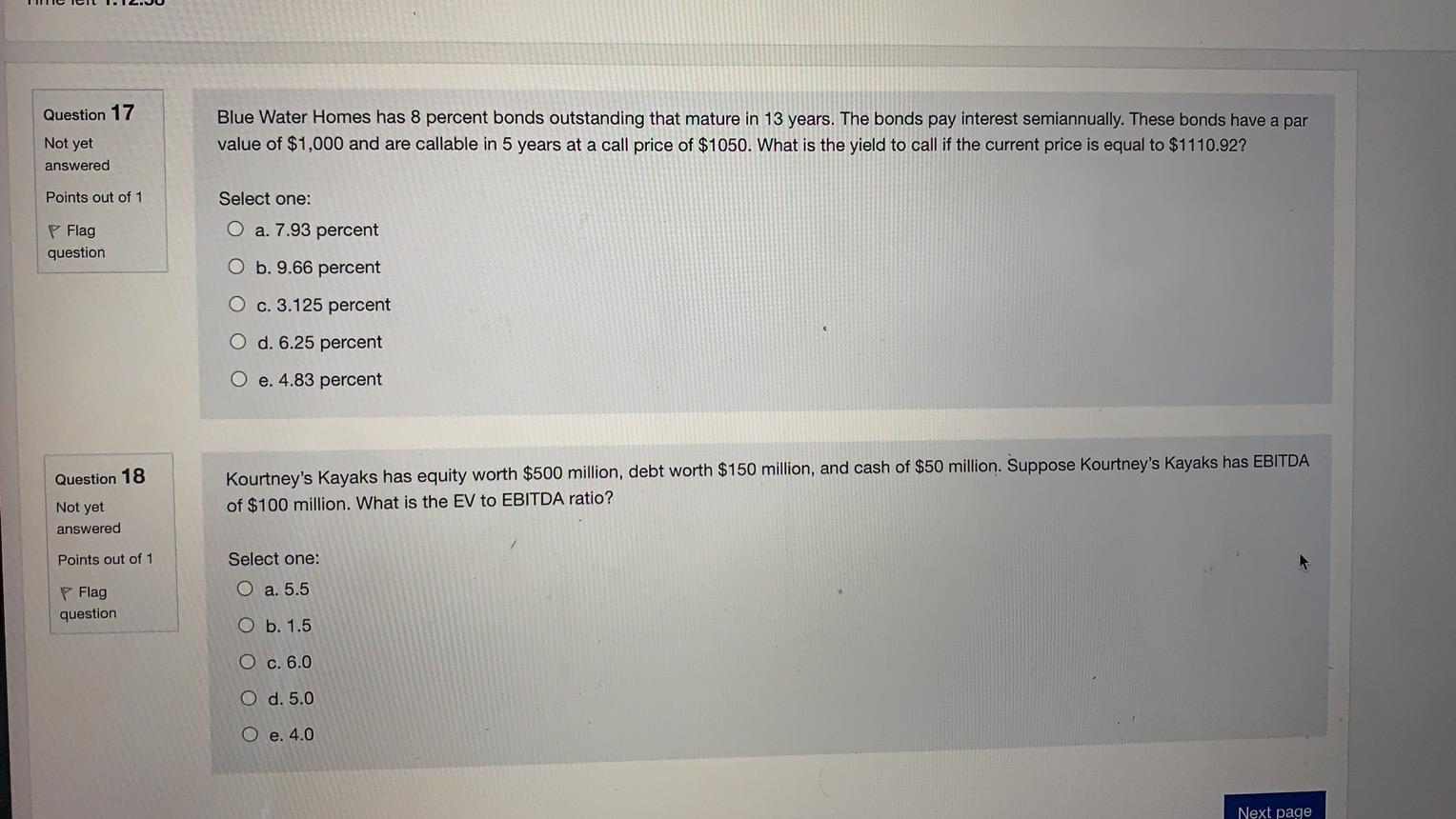

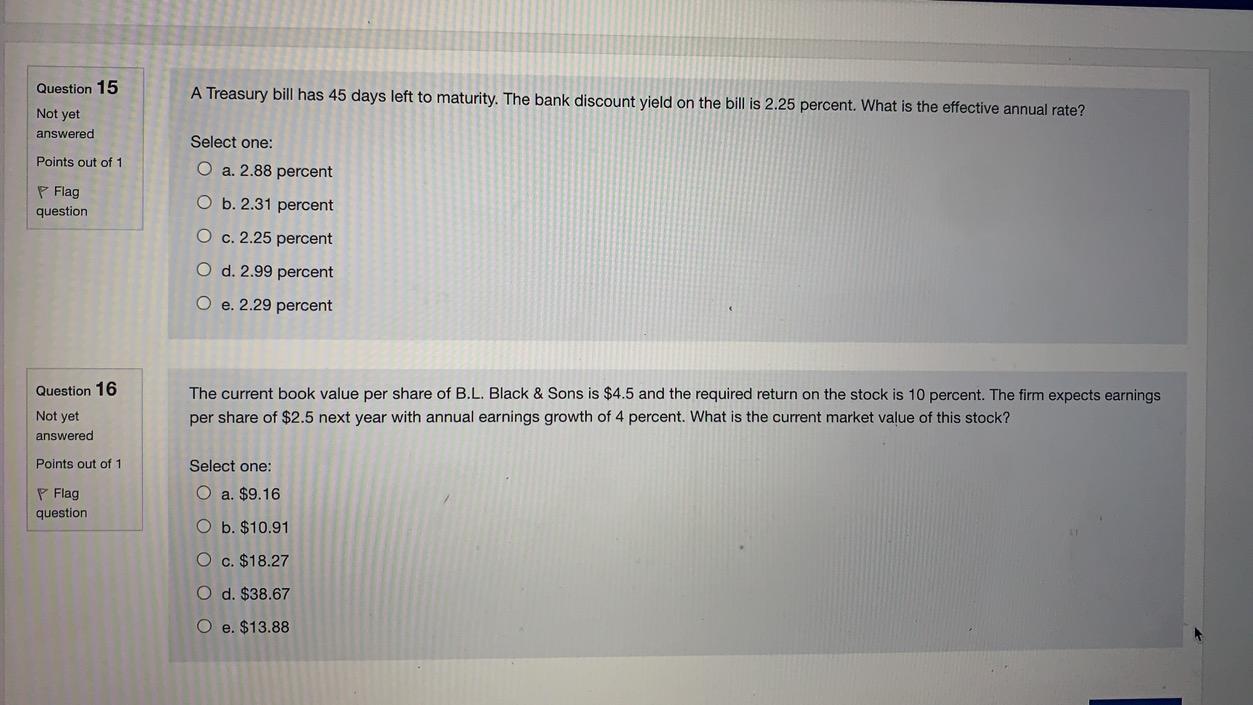

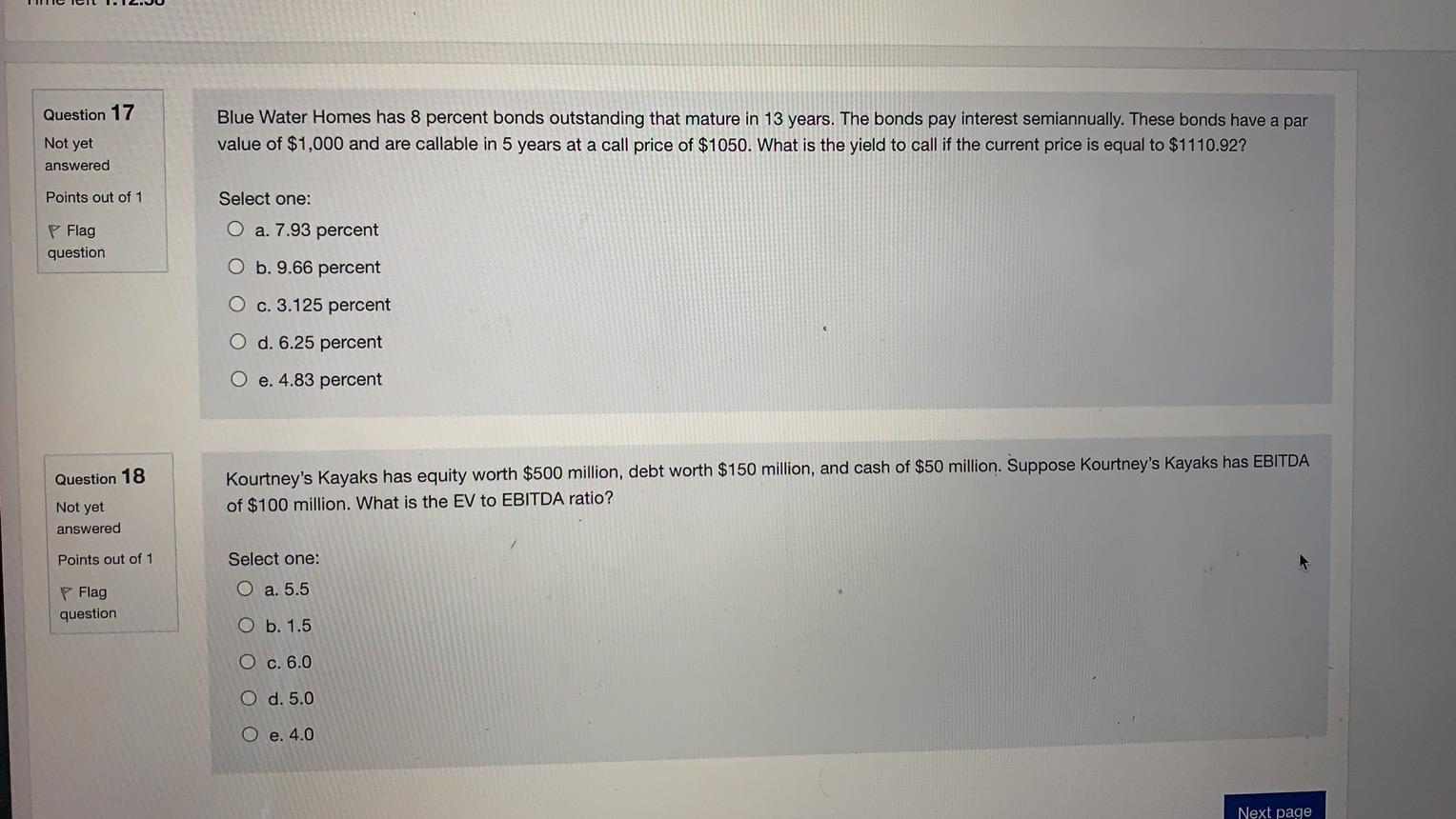

Question 13 Not yet answered A price-weighted index consists of stocks A, B, and C which are priced at $90, $75, and $38 a share, respectively. The current index divisor is 2.317. If stock A undergoes a 3-for-1 stock split, the new index divisor will be: Points out of 1 Select one: P Flag question O a. 1.632172 O b. 2.731698 O c. 1.991645 O d. 1.591623 O e. 1.792416 Question 14 Which one of the following is unsecured debt issued by corporations on a short-term basis? Not yet answered Points out of 1 Select one: O a. Collateralized debt Flag question O b. Commercial paper O c. Interbank offered loan O d. Banker's acceptance O e. Equipment bond Previous page Next page Question 15 A Treasury bill has 45 days left to maturity. The bank discount yield on the bill is 2.25 percent. What is the effective annual rate? Not yet answered Points out of 1 Select one: O a. 2.88 percent P Flag question O b. 2.31 percent O c. 2.25 percent O d. 2.99 percent O e. 2.29 percent Question 16 The current book value per share of B.L. Black & Sons is $4.5 and the required return on the stock is 10 percent. The firm expects earnings per share of $2.5 next year with annual earnings growth of 4 percent. What is the current market value of this stock? Not yet answered Points out of 1 Select one: O a. $9.16 P Flag question O b. $10.91 O c. $18.27 O d. $38.67 O e. $13.88 Question 17 Blue Water Homes has 8 percent bonds outstanding that mature in 13 years. The bonds pay interest semiannually. These bonds have a par value of $1,000 and are callable in 5 years at a call price of $1050. What is the yield to call if the current price is equal to $1110.92? Not yet answered Points out of 1 Select one: O a. 7.93 percent P Flag question O b. 9.66 percent O c. 3.125 percent O d. 6.25 percent O e. 4.83 percent Question 18 Kourtney's Kayaks has equity worth $500 million, debt worth $150 million, and cash of $50 million. Suppose Kourtney's Kayaks has EBITDA of $100 million. What is the EV to EBITDA ratio? Not yet answered Points out of 1 Select one: O a. 5.5 P Flag question O b. 1.5 O c. 6.0 O d. 5.0 O e. 4.0 Next page