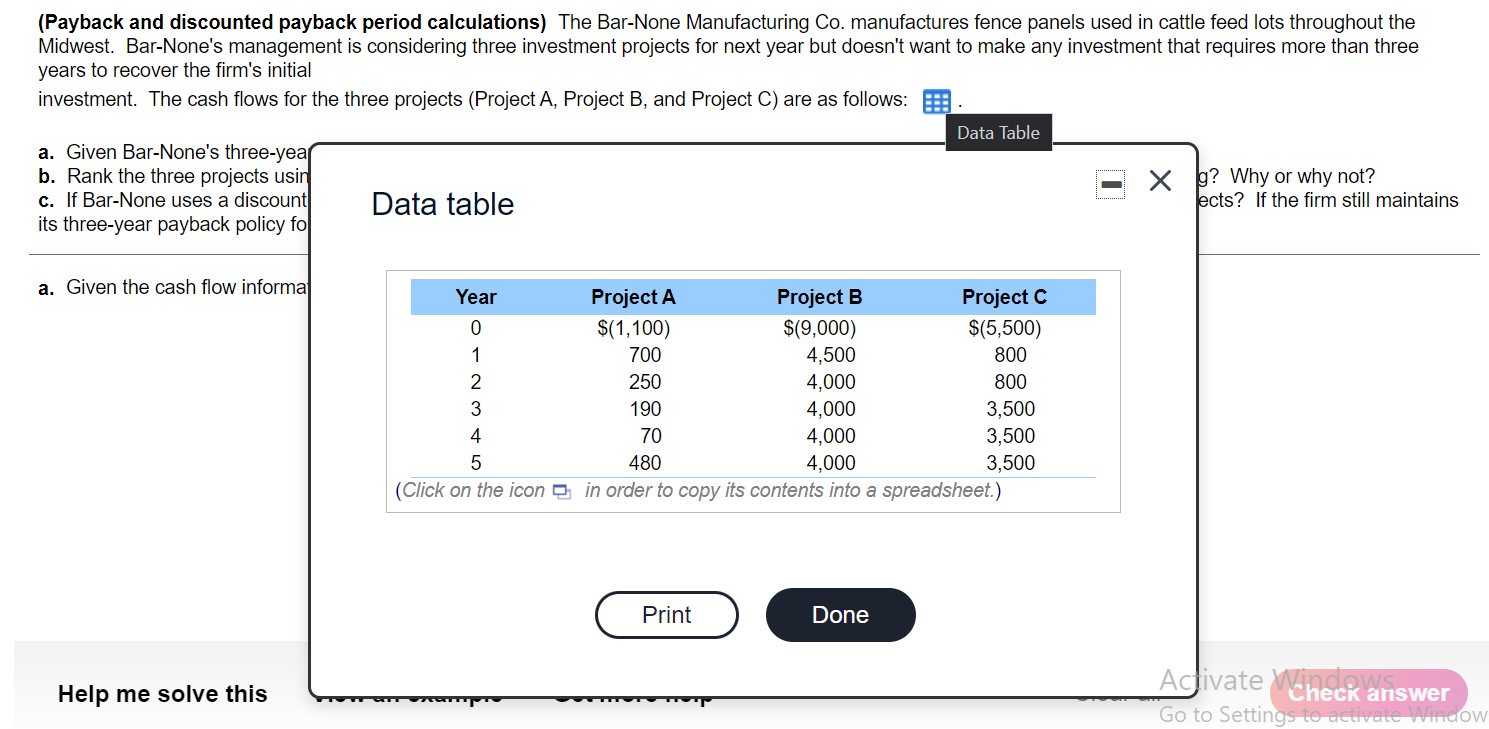

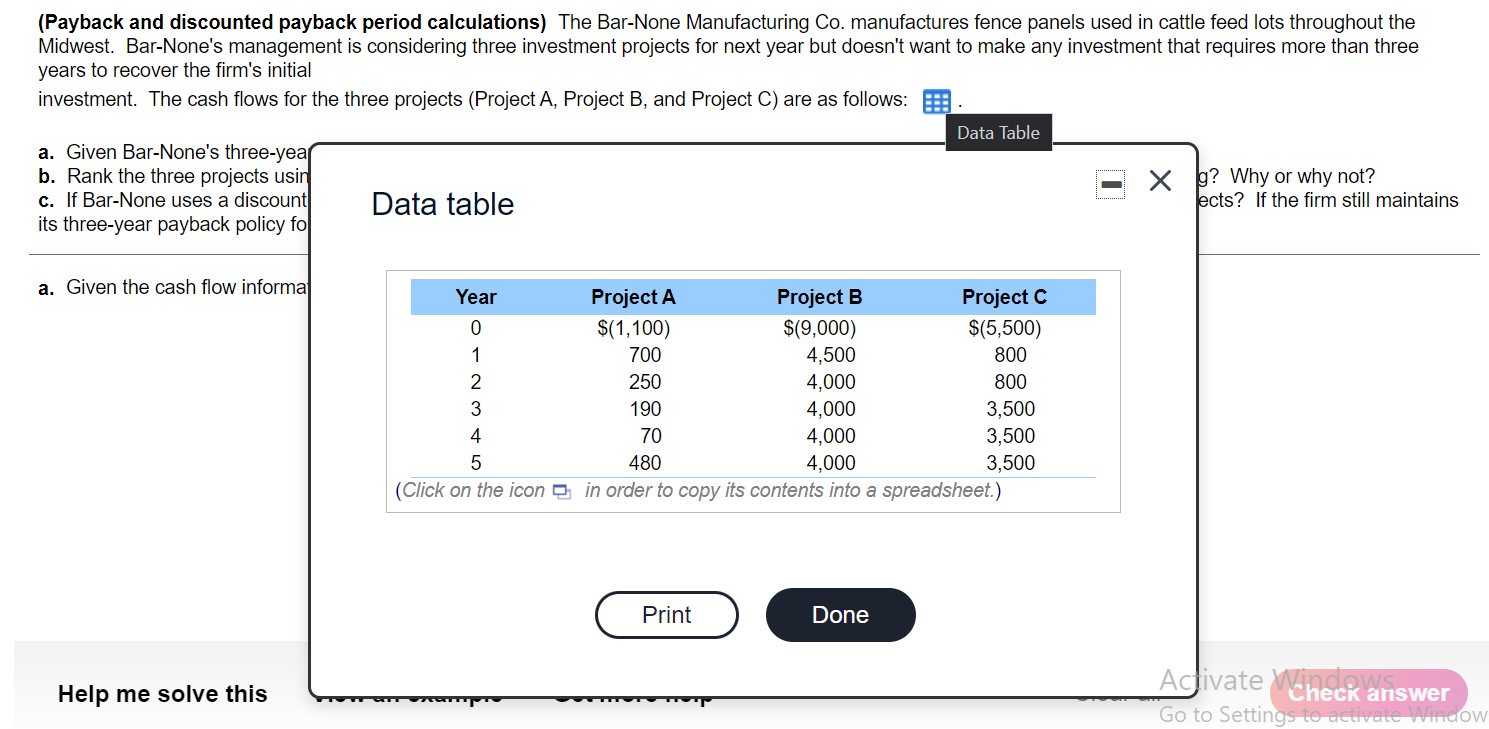

Question 13, P11-22 (si... = Homework: Ho... HW Score: 94.44%, 170 of 180 points X Points: 0 of 10 Save Part 1 of 14 (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 9.6 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? a. Given the cash flow information in the table, the payback period of Project A is years. (Round to two decimal places.) (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: Data Table a. Given Bar-None's three-year b. Rank the three projects usin x g? Why or why not? c. If Bar-None uses a discount Data table ects? If the firm still maintains its three-year payback policy fo a. Given the cash flow informa Year Project A Project B Project C 0 $(1,100) $(9,000) $(5,500) 1 700 4,500 800 2 250 4,000 800 3 190 4,000 3,500 4 70 4,000 3,500 5 480 4,000 3,500 (Click on the icon in order to copy its contents into a spreadsheet.) a WN Print Done Help me solve this mm Activate Windows Check answer Go to Settings to activate Window mMT