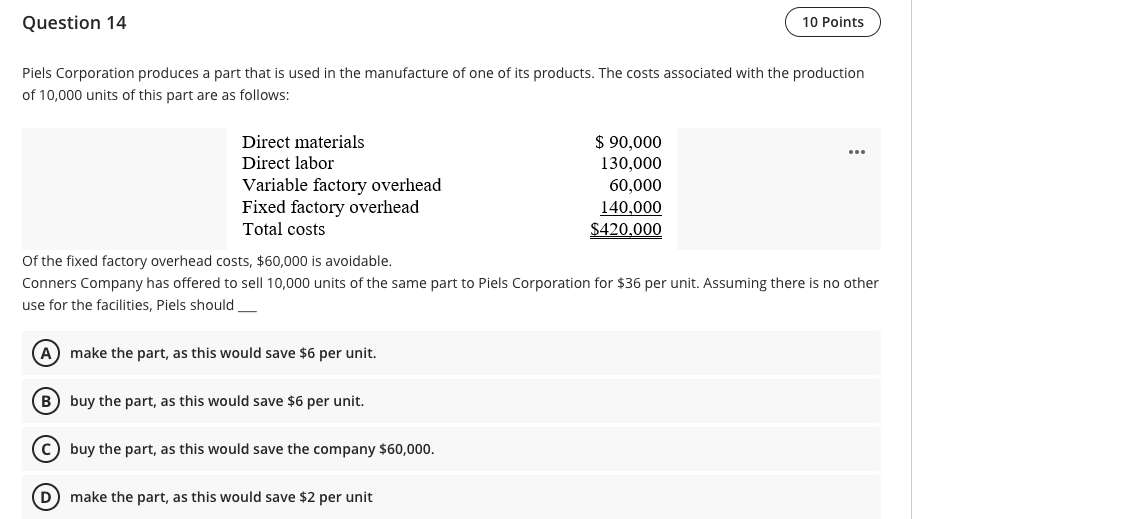

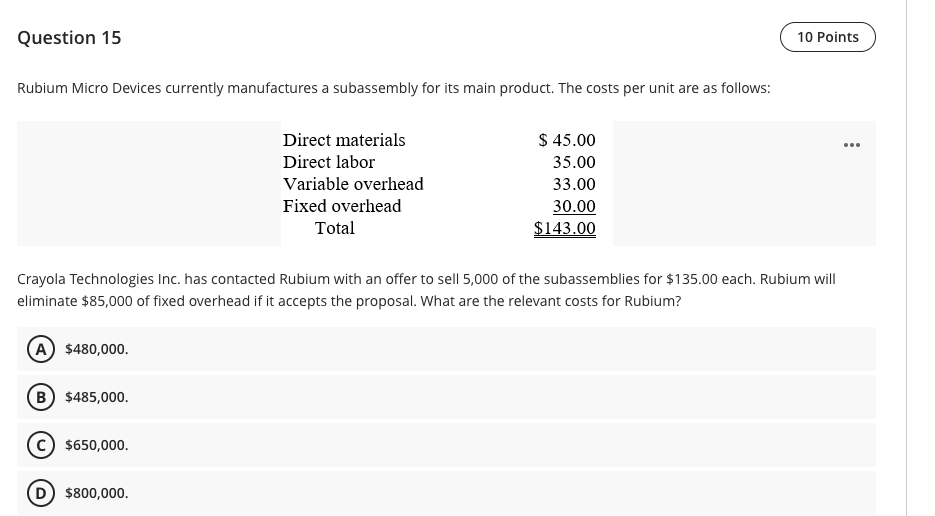

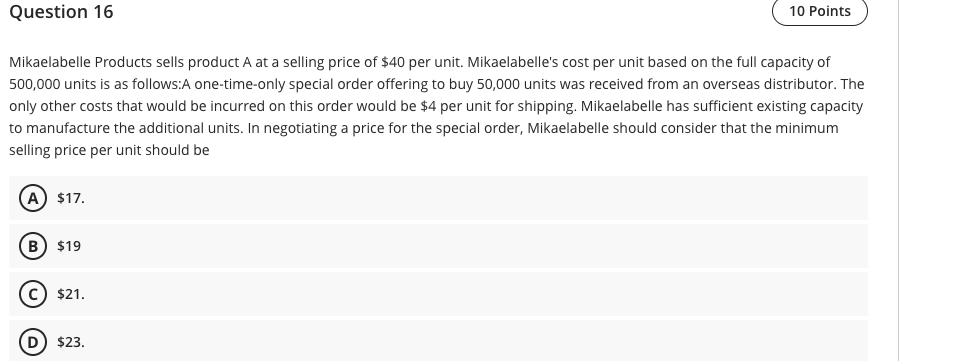

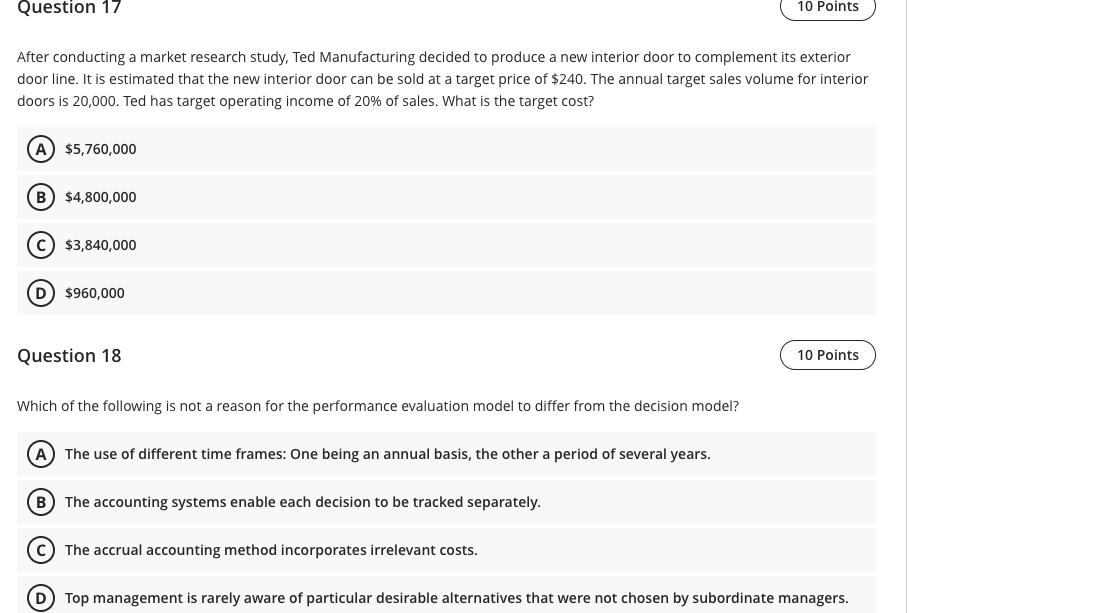

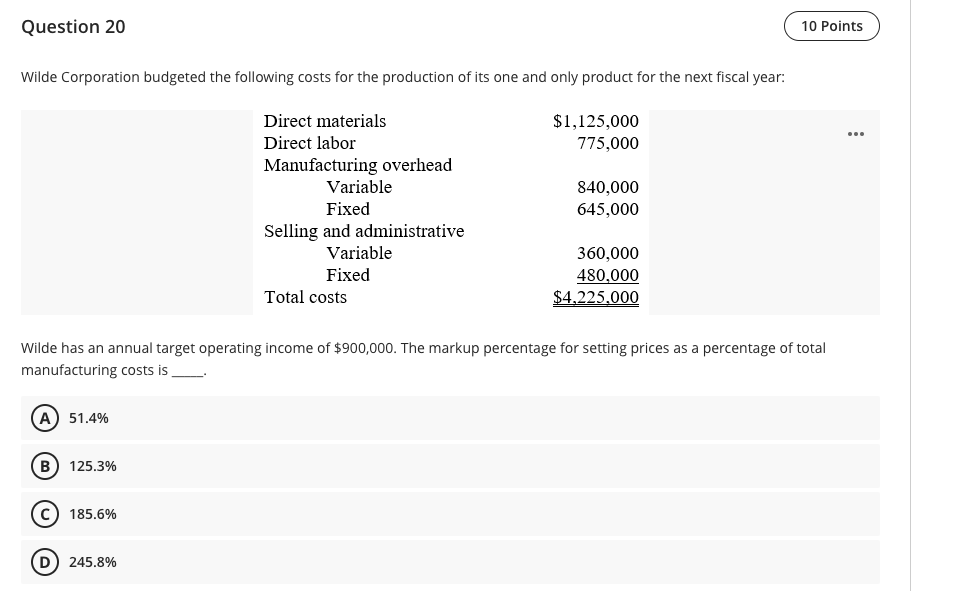

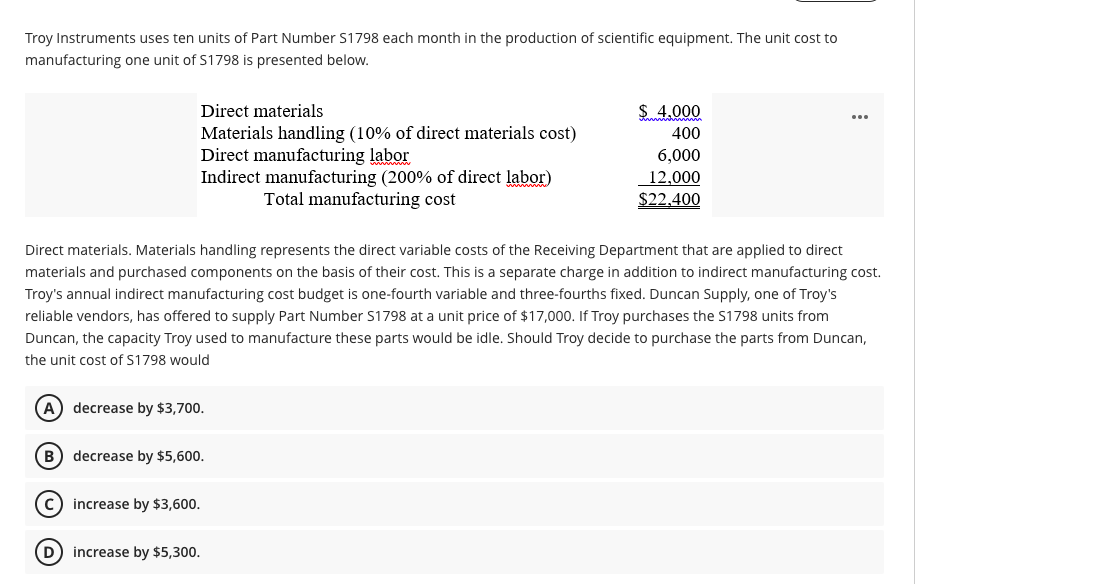

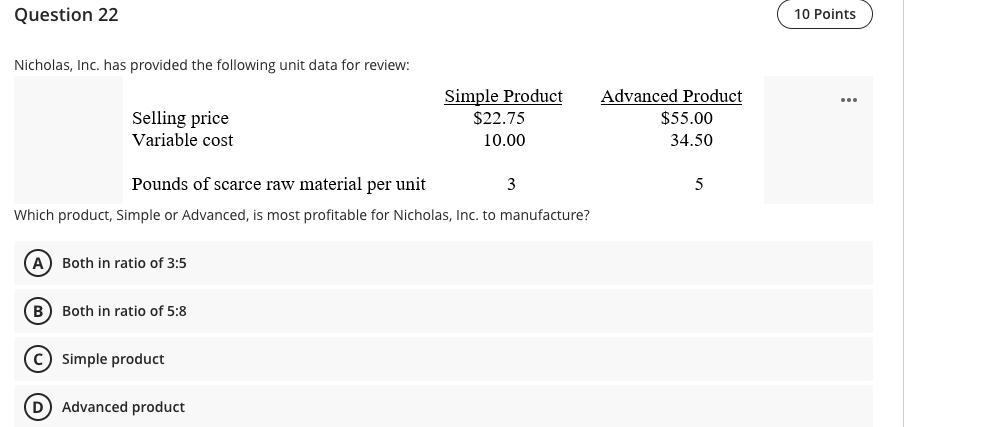

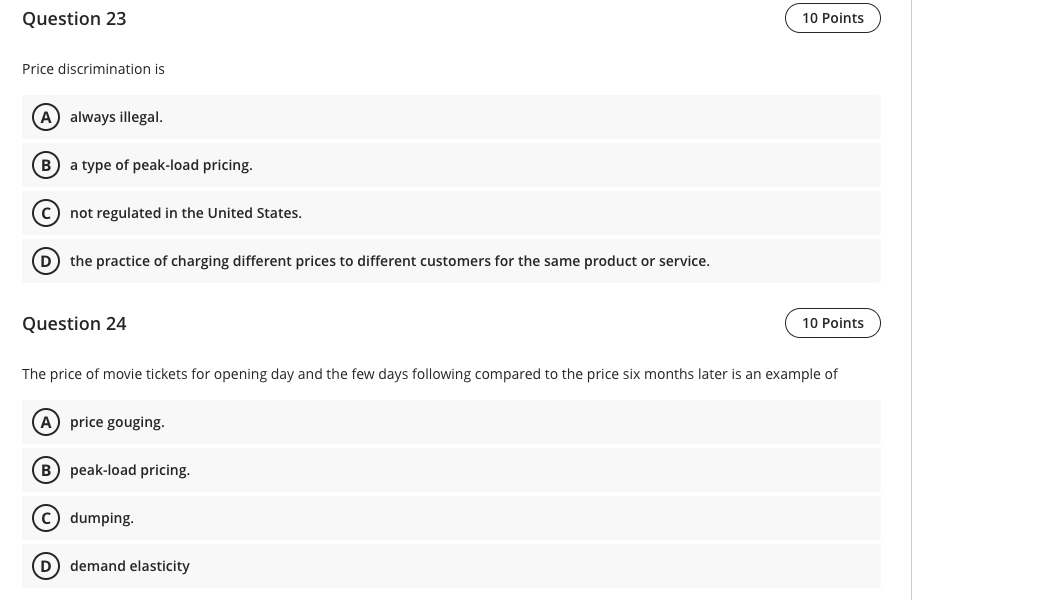

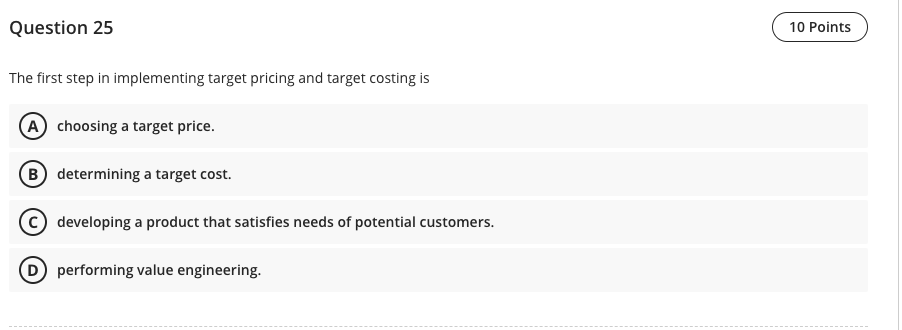

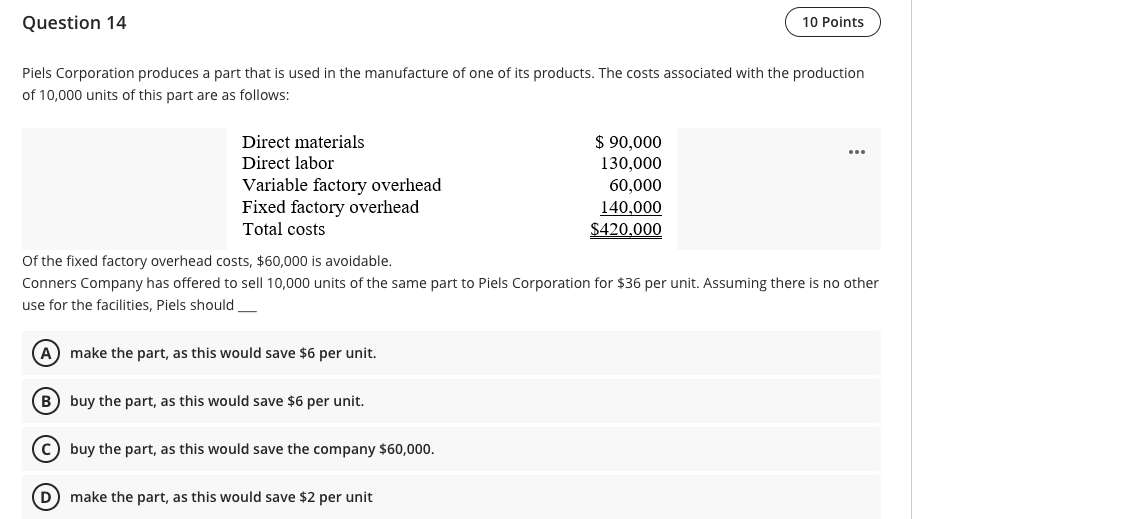

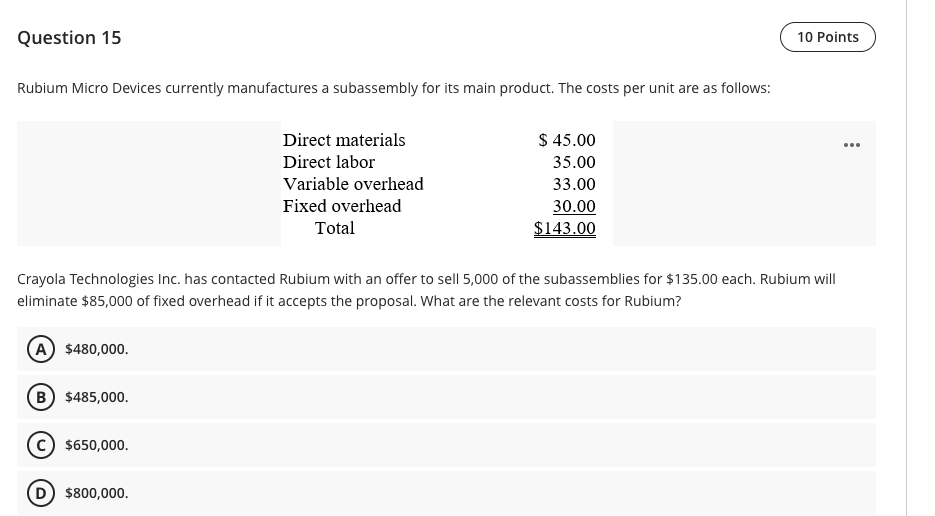

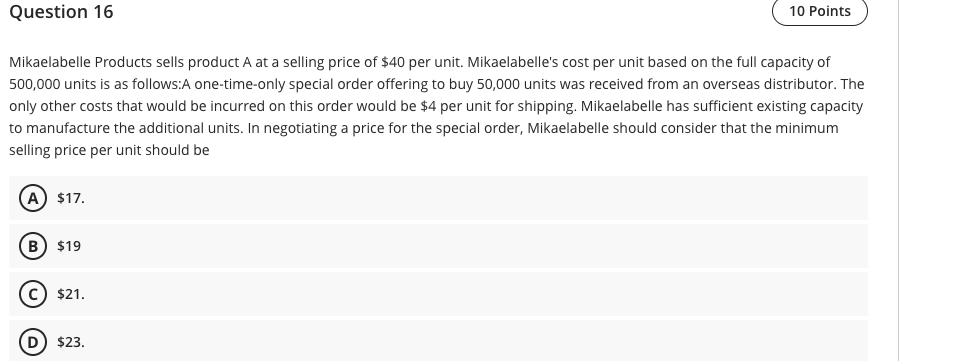

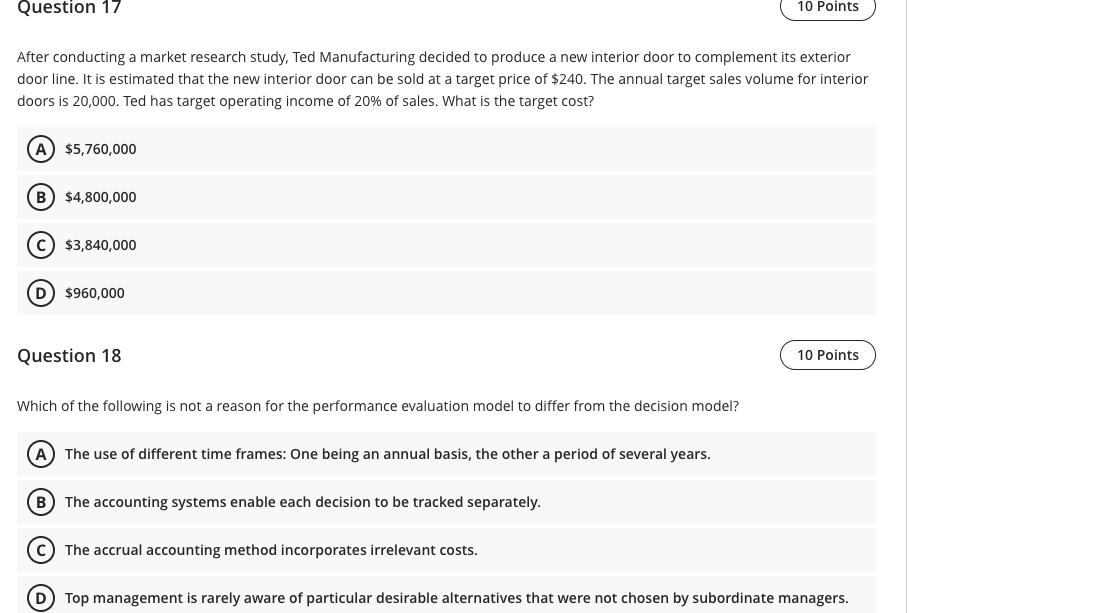

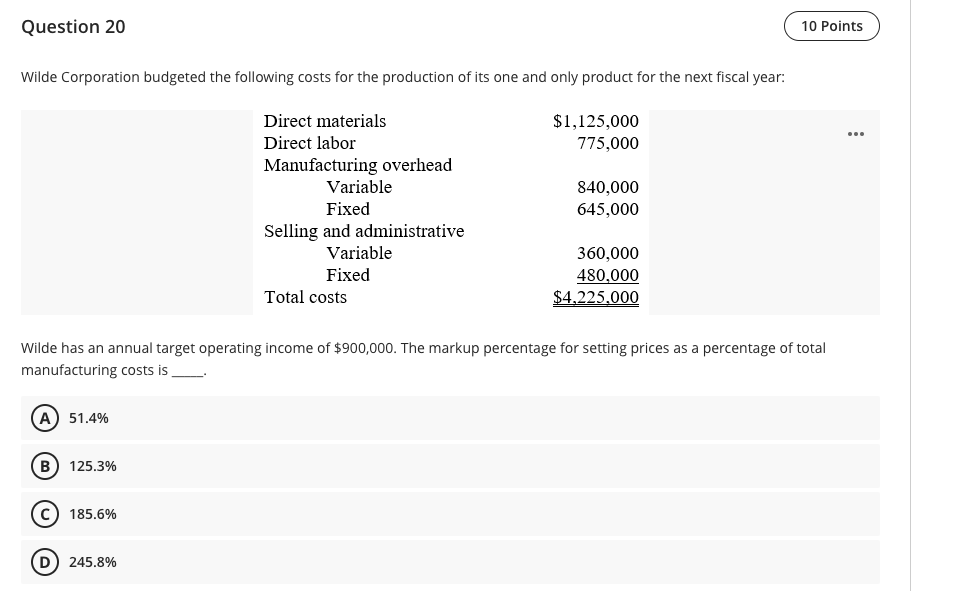

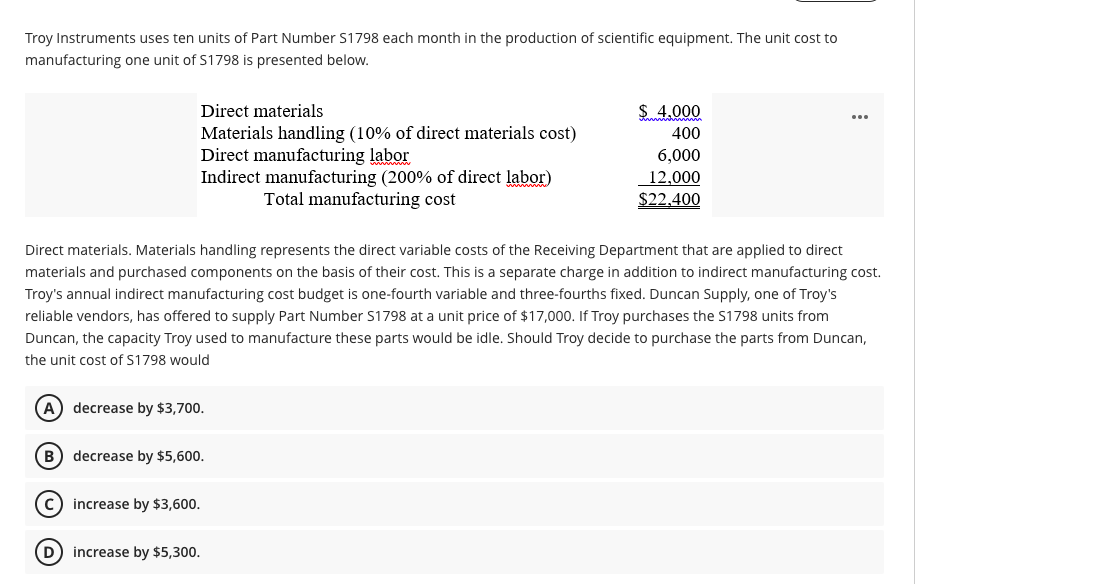

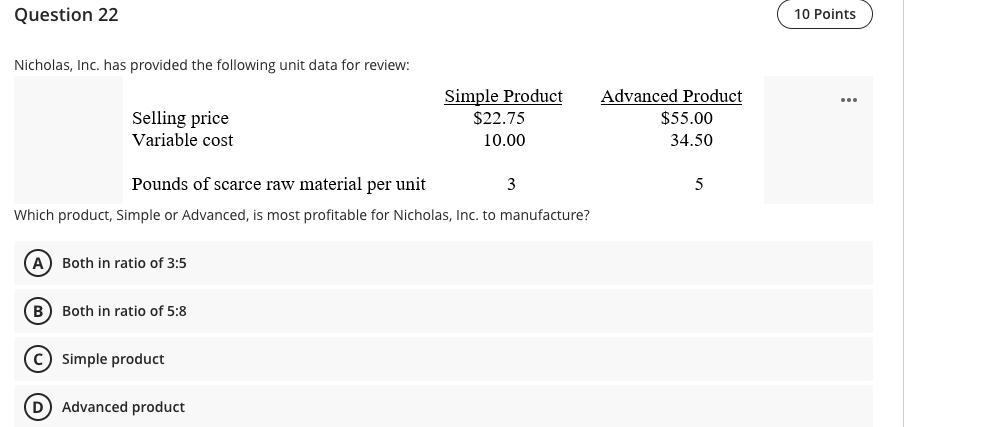

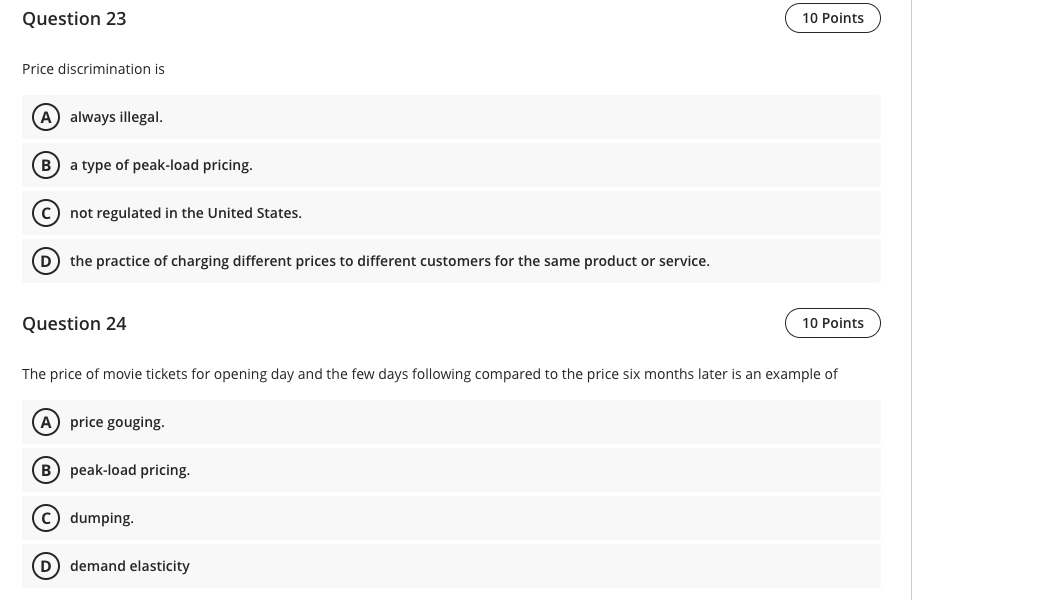

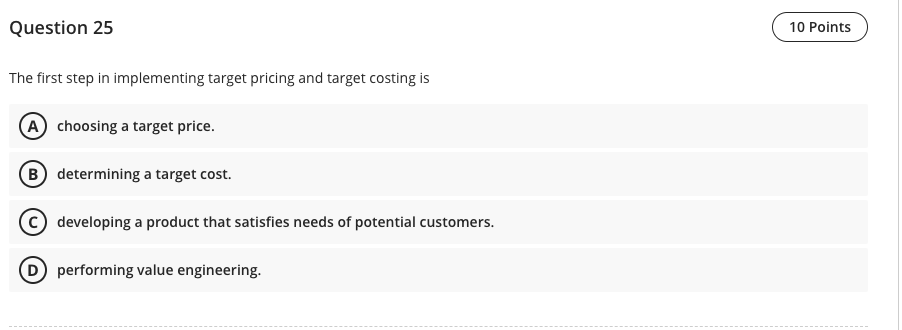

Question 14 10 Points Piels Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total costs $ 90,000 130,000 60,000 140,000 $420,000 Of the fixed factory overhead costs, $60,000 is avoidable. Conners Company has offered to sell 10,000 units of the same part to Piels Corporation for $36 per unit. Assuming there is no other use for the facilities, Piels should A make the part, as this would save $6 per unit. B buy the part, as this would save $6 per unit. C buy the part, as this would save the company $60,000. D make the part, as this would save $2 per unit Question 15 10 Points Rubium Micro Devices currently manufactures a subassembly for its main product. The costs per unit are as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $ 45.00 35.00 33.00 30.00 $143.00 Crayola Technologies Inc. has contacted Rubium with an offer to sell 5,000 of the subassemblies for $135.00 each. Rubium will eliminate $85,000 of fixed overhead if it accepts the proposal. What are the relevant costs for Rubium? A $480,000 B $485,000. $650,000. (D) $800,000. Question 16 10 Points Mikaelabelle Products sells product A at a selling price of $40 per unit. Mikaelabelle's cost per unit based on the full capacity of 500,000 units is as follows:A one-time-only special order offering to buy 50,000 units was received from an overseas distributor. The only other costs that would be incurred on this order would be $4 per unit for shipping. Mikaelabelle has sufficient existing capacity to manufacture the additional units. In negotiating a price for the special order, Mikaelabelle should consider that the minimum selling price per unit should be $17. B $19 $21. 0 0 $23. Question 17 10 Points After conducting a market research study, Ted Manufacturing decided to produce a new interior door to complement its exterior door line. It is estimated that the new interior door can be sold at a target price of $240. The annual target sales volume for interior doors is 20,000. Ted has target operating income of 20% of sales. What is the target cost? A $5,760,000 B $4,800,000 C) $3,840,000 D) $960,000 Question 18 10 Points Which of the following is not a reason for the performance evaluation model to differ from the decision model? A The use of different time frames: One being an annual basis, the other a period of several years. B) The accounting systems enable each decision to be tracked separately. O @ C) The accrual accounting method incorporates irrelevant costs. Top management is rarely aware of particular desirable alternatives that were not chosen by subordinate managers. Question 19 10 Points Crimpson Company has invested $2,000,000 in a plant to make commercial juicer machines. The target operating income desired from the plant is $299,000 annually. The company plans annual sales of 7,000 juicer machines at a selling price of $400 each. What is the markup percentage as a percentage of cost for Crimpson Company? A 22.0% B 18.0% 12.0% D) 11.0% Question 20 10 Points Wilde Corporation budgeted the following costs for the production of its one and only product for the next fiscal year: $1,125,000 775,000 Direct materials Direct labor Manufacturing overhead Variable Fixed Selling and administrative Variable Fixed Total costs 840,000 645,000 360,000 480,000 $4,225,000 Wilde has an annual target operating income of $900,000. The markup percentage for setting prices as a percentage of total manufacturing costs is A) 51.4% B 125.3% C 185.6% D) 245.8% Troy Instruments uses ten units of Part Number S1798 each month in the production of scientific equipment. The unit cost to manufacturing one unit of S1798 is presented below. Direct materials Materials handling (10% of direct materials cost) Direct manufacturing labor Indirect manufacturing (200% of direct labor) Total manufacturing cost $4.000 400 6,000 12,000 $22,400 Direct materials. Materials handling represents the direct variable costs of the Receiving Department that are applied to direct materials and purchased components on the basis of their cost. This is a separate charge in addition to indirect manufacturing cost. Troy's annual indirect manufacturing cost budget is one-fourth variable and three-fourths fixed. Duncan Supply, one of Troy's reliable vendors, has offered to supply Part Number S1798 at a unit price of $17,000. If Troy purchases the S1798 units from Duncan, the capacity Troy used to manufacture these parts would be idle. Should Troy decide to purchase the parts from Duncan, the unit cost of $1798 would A decrease by $3,700. B decrease by $5,600. C increase by $3,600. D increase by $5,300. Question 22 10 Points Nicholas, Inc. has provided the following unit data for review: Selling price Variable cost Simple Product $22.75 10.00 Advanced Product $55.00 34.50 u Pounds of scarce raw material per unit 3 Which product, Simple or Advanced, is most profitable for Nicholas, Inc. to manufacture? A Both in ratio of 3:5 B Both in ratio of 5:8 @ @ @ C Simple product D) Advanced product Question 23 10 Points Price discrimination is A always illegal. B) a type of peak-load pricing. C not regulated in the United States. D the practice of charging different prices to different customers for the same product or service. Question 24 10 Points The price of movie tickets for opening day and the few days following compared to the price six months later is an example of A price gouging. B peak-load pricing. C dumping. D demand elasticity Question 25 10 Points The first step in implementing target pricing and target costing is A choosing a target price. B determining a target cost. developing a product that satisfies needs of potential customers. D performing value engineering