Answered step by step

Verified Expert Solution

Question

1 Approved Answer

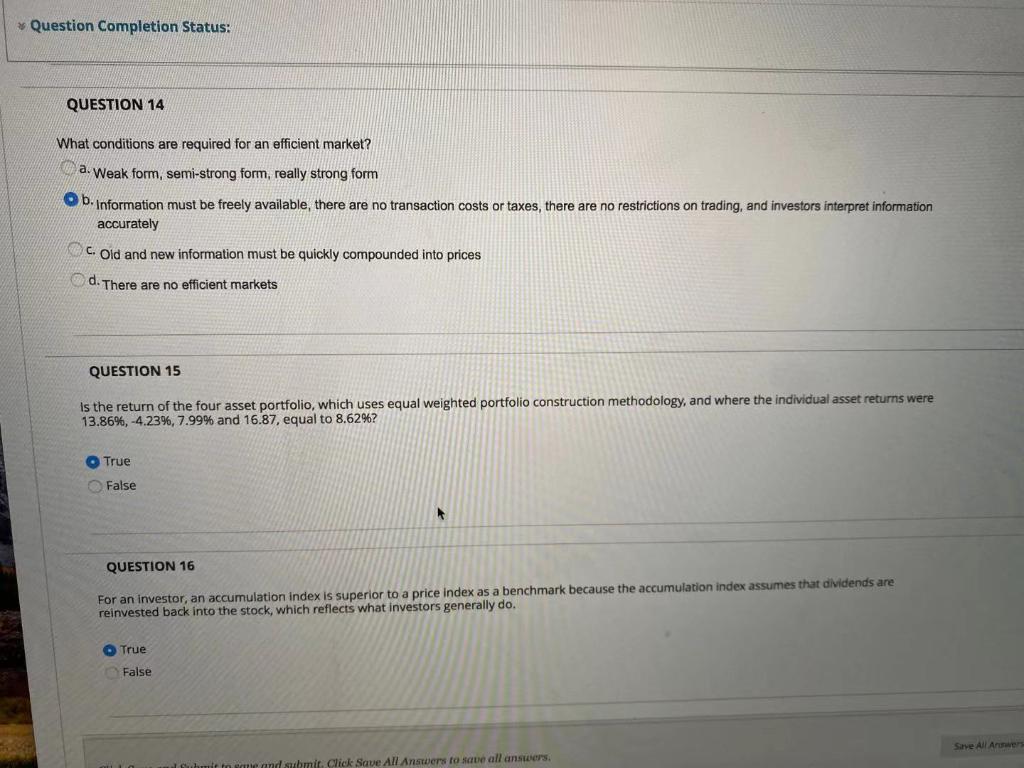

question 14 15 16 * Question Completion Status: QUESTION 14 What conditions are required for an efficient market? a. Weak form, semi-strong form, really strong

question 14 15 16

* Question Completion Status: QUESTION 14 What conditions are required for an efficient market? a. Weak form, semi-strong form, really strong form b. Information must be freely available, there are no transaction costs or taxes, there are no restrictions on trading, and investors interpret information accurately C. Old and new information must be quickly compounded into prices d. There are no efficient markets QUESTION 15 is the return of the four asset portfolio, which uses equal weighted portfolio construction methodology, and where the individual asset returns were 13.86%, -4.23%, 7.99% and 16.87, equal to 8.62967 True False QUESTION 16 For an investor, an accumulation index is superior to a price index as a benchmark because the accumulation index assumes that dividends are reinvested back into the stock, which reflects what investors generally do. True False Save All Are Submit to me and submit. Click Save All Answers to save all answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started