Answered step by step

Verified Expert Solution

Question

1 Approved Answer

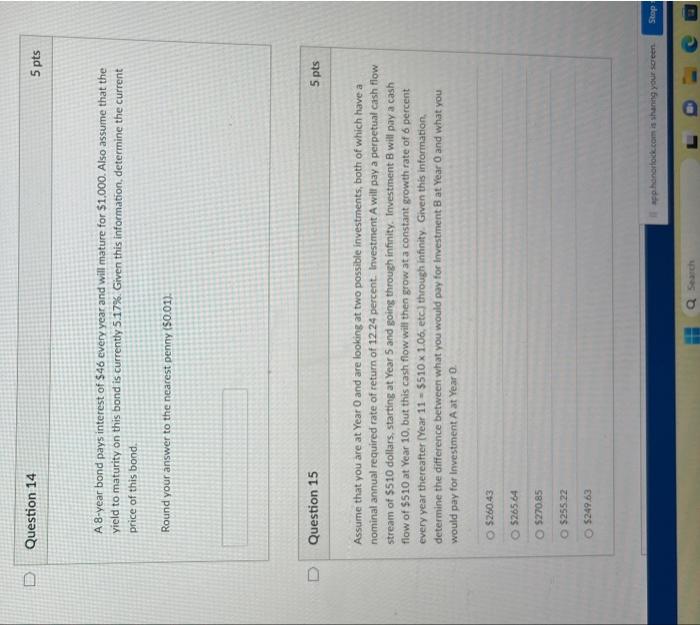

Question 14 A 8-year bond pays interest of $46 every year and will mature for $1,000. Also assume that the yield to maturity on this

Question 14 A 8-year bond pays interest of $46 every year and will mature for $1,000. Also assume that the yield to maturity on this bond is currently 5.17%. Given this information, determine the current price of this bond. Round your answer to the nearest penny ($0.01). Question 15 O $260.43 Assume that you are at Year 0 and are looking at two possible investments, both of which have a nominal annual required rate of return of 12.24 percent. Investment A will pay a perpetual cash flow stream of $510 dollars, starting at Year 5 and going through infinity. Investment B will pay a cash flow of $510 at Year 10, but this cash flow will then grow at a constant growth rate of 6 percent every year thereafter (Year 11 = $510 x 1.06, etc.) through infinity. Given this information, determine the difference between what you would pay for Investment B at Year 0 and what you would pay for Investment A at Year 0. O $265.64 O $270.85 O $255.22 5 pts O $249.63 Q Search 5 pts Il app.honorlock.com is sharing your screen. Stop S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started