Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 14 A Ltd acquired 70% of the share capital of B Ltd on 30 September 2012. There was a balance of $190,000 on B

question 14

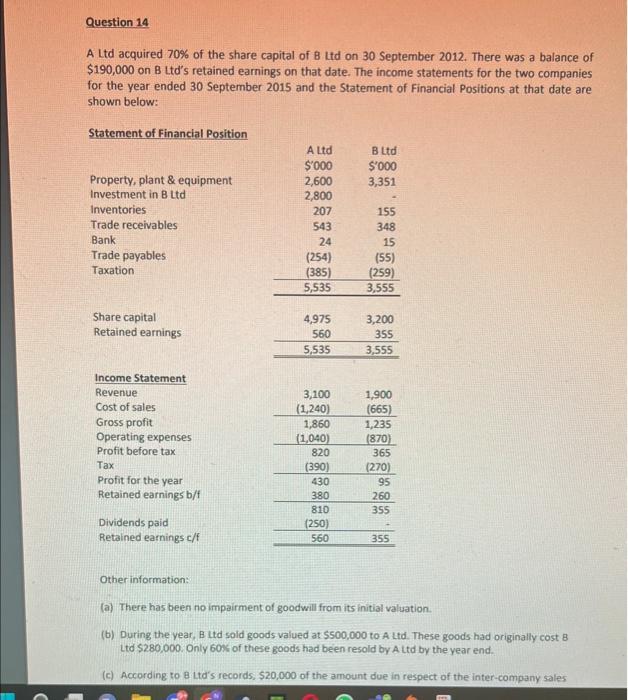

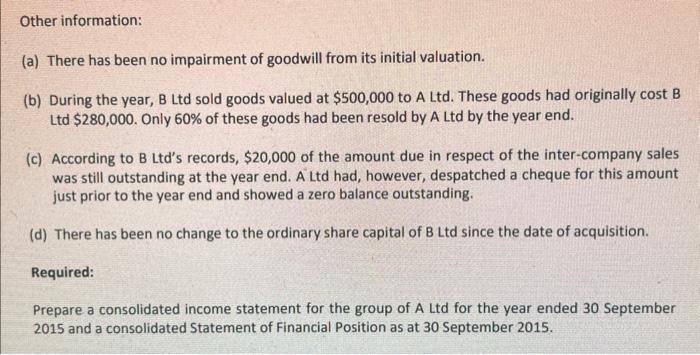

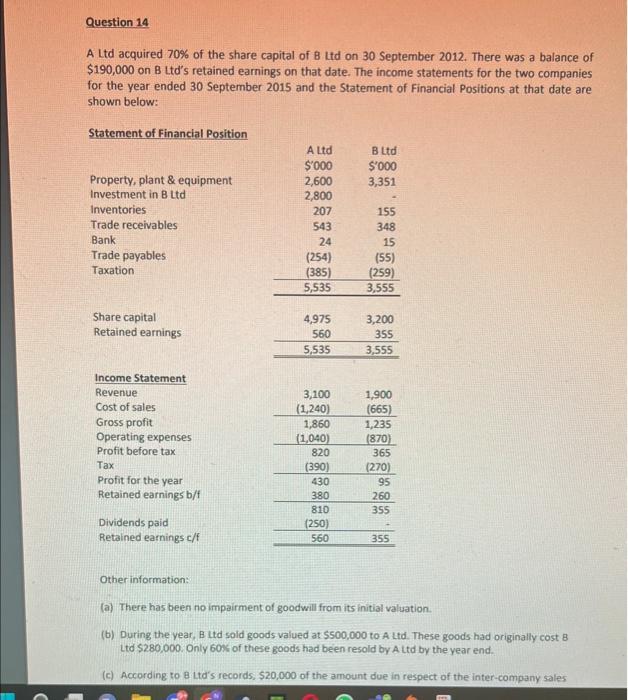

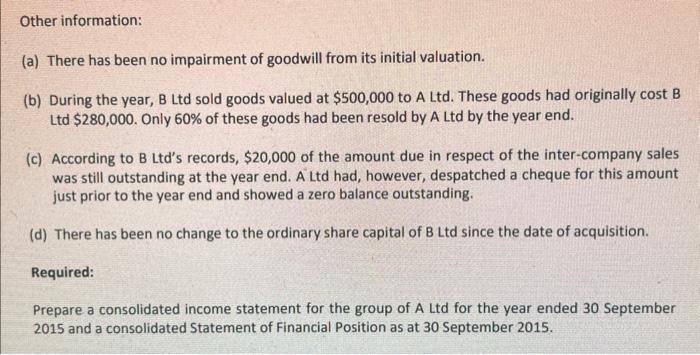

A Ltd acquired 70% of the share capital of B Ltd on 30 September 2012. There was a balance of $190,000 on B Ltd's retained earnings on that date. The income statements for the two companies for the year ended 30 September 2015 and the Statement of Financial Positions at that date are shown below: Other information: (a) There has been no impairment of goodwill from its initial valuation. (b) During the year, B Ltd sold goods valued at 5500,000 to A Ltd. These goods had originally cost B Ltd $280,000. Only 60 of these goods had been resold by A Ltd by the year end. (c) According to 8 Ltd's records, $20,000 of the amount due in respect of the inter-company sales Other information: (a) There has been no impairment of goodwill from its initial valuation. (b) During the year, B Ltd sold goods valued at $500,000 to A Ltd. These goods had originally cost B Ltd $280,000. Only 60% of these goods had been resold by A Ltd by the year end. (c) According to B Ltd's records, $20,000 of the amount due in respect of the inter-company sales was still outstanding at the year end. A Ltd had, however, despatched a cheque for this amount just prior to the year end and showed a zero balance outstanding. (d) There has been no change to the ordinary share capital of B Ltd since the date of acquisition. Required: Prepare a consolidated income statement for the group of A Ltd for the year ended 30 September 2015 and a consolidated Statement of Financial Position as at 30 September 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started