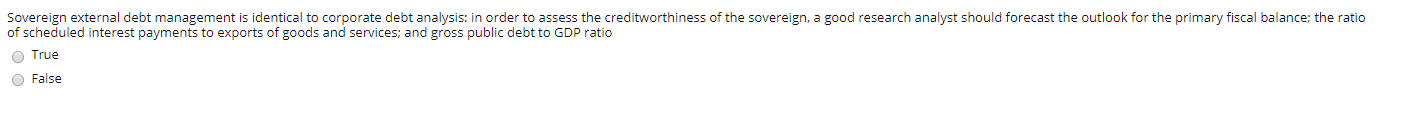

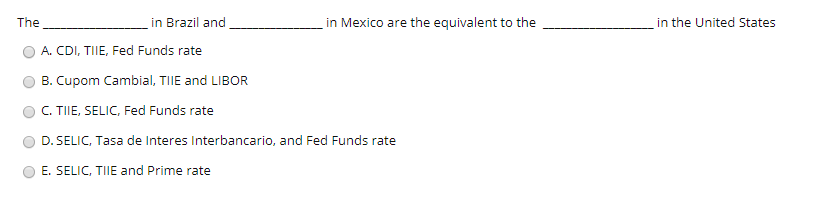

QUESTION 14 Carlos is an equity trader working for WZ Investimentos in Brazil. He is bullish about the upside potential for Intermedica, a leading health care provider (GNDI3). If Carlos wants to profit from the upside on the price of GNDI3 while limiting his downside risk, which plain vanilla option strategy would be the MOST SUITABLE for him? Today, GNDI3 was trading at R$55.42 A. Buy a calendar spread with options having the same strike price with different expiration dates B. Buy a bull spread by buying a call option with a strike price at R$65 on GNDI3 and sell a call option on GNDI3 with a strike at R$75 C. Be long a butterfly spread built with three different pus on GND13 with different strike prices D. Be short a strangle based on GND13 options E. Buy a bull spread by buying a call option with a strike price at R$65 on GND13 and write a call option on GNDI3 with strike at R$45 QUESTION 1 Sovereign external debt management is identical to corporate debt analysis: in order to assess the creditworthiness of the sovereign, a good research analyst should forecast the outlook for the primary fiscal balance; the ratio of scheduled interest payments to exports of goods and services; and gross public debt to GDP ratio O True False in Mexico are the equivalent to the __ in the United States The in Brazil and A. CDI, TIIE, Fed Funds rate B. Cupom Cambial, TIIE and LIBOR OC. TIE, SELIC, Fed Funds rate OD. SELIC, Tasa de Interes Interbancario, and Fed Funds rate E. SELIC, THIE and Prime rate QUESTION 14 Carlos is an equity trader working for WZ Investimentos in Brazil. He is bullish about the upside potential for Intermedica, a leading health care provider (GNDI3). If Carlos wants to profit from the upside on the price of GNDI3 while limiting his downside risk, which plain vanilla option strategy would be the MOST SUITABLE for him? Today, GNDI3 was trading at R$55.42 A. Buy a calendar spread with options having the same strike price with different expiration dates B. Buy a bull spread by buying a call option with a strike price at R$65 on GNDI3 and sell a call option on GNDI3 with a strike at R$75 C. Be long a butterfly spread built with three different pus on GND13 with different strike prices D. Be short a strangle based on GND13 options E. Buy a bull spread by buying a call option with a strike price at R$65 on GND13 and write a call option on GNDI3 with strike at R$45 QUESTION 1 Sovereign external debt management is identical to corporate debt analysis: in order to assess the creditworthiness of the sovereign, a good research analyst should forecast the outlook for the primary fiscal balance; the ratio of scheduled interest payments to exports of goods and services; and gross public debt to GDP ratio O True False in Mexico are the equivalent to the __ in the United States The in Brazil and A. CDI, TIIE, Fed Funds rate B. Cupom Cambial, TIIE and LIBOR OC. TIE, SELIC, Fed Funds rate OD. SELIC, Tasa de Interes Interbancario, and Fed Funds rate E. SELIC, THIE and Prime rate