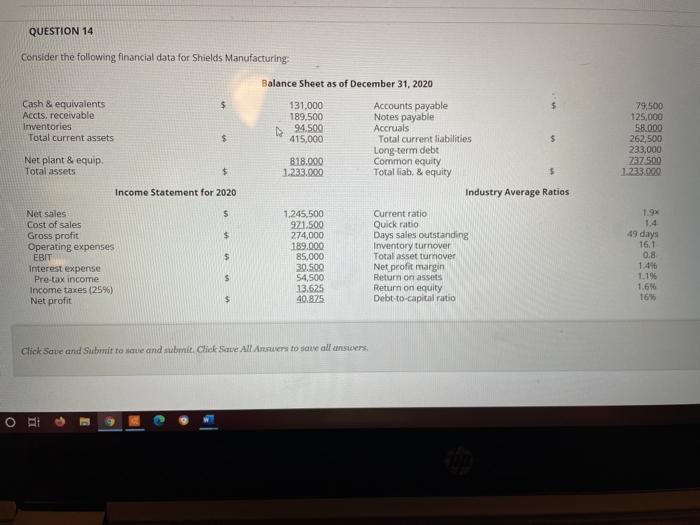

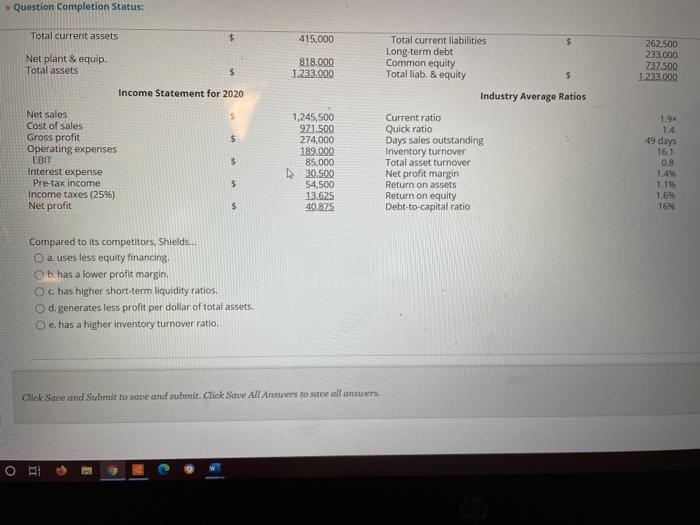

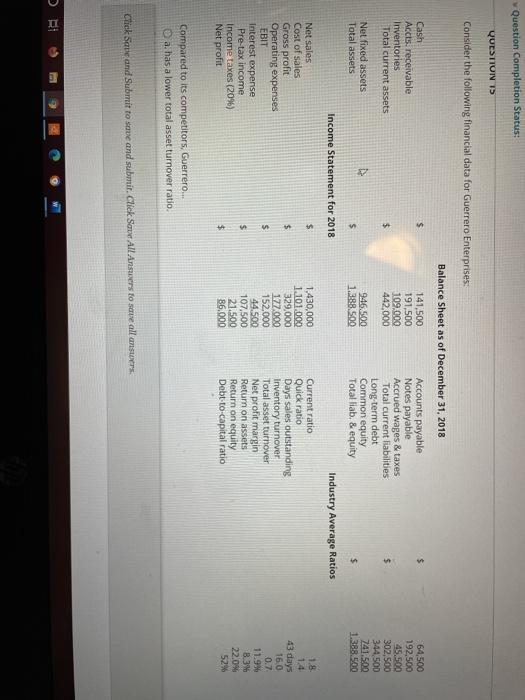

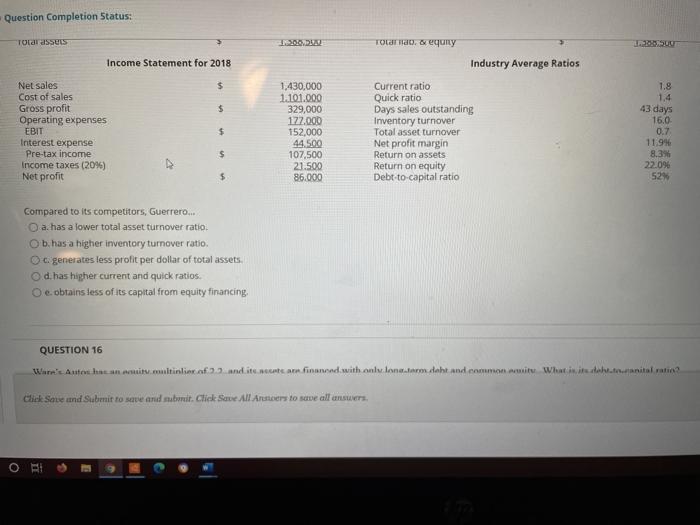

QUESTION 14 Consider the following financial data for Shields Manufacturing $ Cash & equivalents Accts, receivable Inventories Total current assets $ Balance Sheet as of December 31, 2020 131,000 Accounts payable 189,500 Notes payable 94.500 Accruals 415,000 Total current liabilities Long-term debt 818.000 Common equity 1.233.000 Total liab. & equity Industry Average Ratios 79,500 125.000 58.000 262,500 233,000 737.500 1.233.000 Net plant & equip Total assets $ Income Statement for 2020 5 1.9 1.4 $ 49 days Net sales Cost of sales Gross profit Operating expenses EBIT Interest expense Pre-tax income Income taxes (25%) Net profit $ 1.245,500 971.500 274,000 189.000 85,000 30.500 54,500 13.625 40.875 Current ratio Quick ratio Days sales outstanding Inventory turnover Total asset turnover Net profit margin Return on assets Return on equity Debt-to-capital ratio 16.1 08 1.476 1.196 1.6 16 $ $ Click Save and Submit toate and submit Click Save All Armers to save all answers, O i Question Completion Status: Total current assets $ 415,000 Net plant & equip. Total assets 818.000 1.233.000 $ Total current liabilities Long-term debt Common equity Total liab. & equity Industry Average Ratios 262,500 233,000 737.500 1.233.000 Income Statement for 2020 1.94 1.4 $ 49 days Net sales Cost of sales Gross profit Operating expenses EBIT Interest expense Pre-tax income Income taxes (25%) Net profit $ 1,245,500 971.500 274,000 189.000 85.000 30.500 54,500 13.625 40.875 Current ratio Quick ratio Days sales outstanding Inventory turnover Total asset turnover Net profit margin Return on assets Return on equity Debt-to-capital ratio 16.1 0,8 1.4% 1.6% 1696 Compared to its competitors, Shields... a. uses less equity financing b.has a lower profit margin. Ochas higher short-term liquidity ratios. O d. generates less profit per dollar of total assets. e has a higher inventory turnover ratio. Chick Save and Submit to save and submit. Click Save All Ansters to see all ans. O EL Question Completion Status: QUESTION TO Consider the following financial data for Guerrero Enterprises Balance Sheet as of December 31, 2018 $ Cash Accts receivable Inventories Total current assets 141,500 191,500 109.000 442,000 $ 64,500 192,500 45.500 302,500 344,500 741,500 1.388.500 Net fixed assets Total assets 946.500 1.388.500 $ Income Statement for 2018 Accounts payable Notes payable Accrued wages & taxes Total current liabilities Long-term debt Common equity Total liab. & equity Industry Average Ratios Current ratio Quick ratio Days sales outstanding Inventory turnover Total asset turnover Net profit margin Return on assets Return on equity Debt-to-capital ratio $ $ Net sales Cost of sales Gross profit Operating expenses EBIT Interest expense Pre-tax income Income taxes (2096) Net profit $ 1.430,000 1.101.000 329,000 177.000 152.000 44.500 107,500 21.500 86.000 1.8 1.4 43 days 160 0.7 11.9% B.3% 22.04 52% $ $ Compared to its competitors, Guerrero... a. has a lower total asset turnover ratio. Click Save and Submit to save and submit. Click Save All Answers to see all ansters. II Question Completion Status: Total assets 102 TOLTH. exequny Income Statement for 2018 Industry Average Ratios $ $ Net sales Cost of sales Gross profit Operating expenses EBIT Interest expense Pre-tax income Income taxes (20%) Net profit $ 1.430,000 1.101.000 329,000 177.000 152,000 44.500 107,500 21.500 86.000 Current ratio Quick ratio Days sales outstanding Inventory turnover Total asset turnover Net profit margin Return on assets Return on equity Debt-to-capital ratio 1.8 1.4 43 days 16.0 0.7 1194 8.3% 22.096 52% $ $ Compared to its competitors, Guerrero... a. has a lower total asset turnover ratio. Ob has a higher inventory turnover ratio. c. generates less profit per dollar of total assets. d. has higher current and quick ratios O e obtains less of its capital from equity financing, QUESTION 16 War's Autohaan.contine of and it was a finanand, with only lontano dalt and common wit Whitmanital ratio chick Save and Submit to save and subwrit. Click Save All Ansciers to serve all answers, O