Answered step by step

Verified Expert Solution

Question

1 Approved Answer

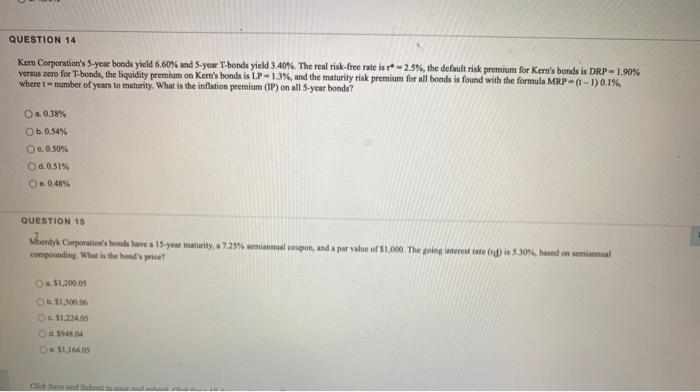

QUESTION 14 Kem Corporation's 5-year bonds yield 6.60% and 5-year T-bonds yield 3.40%. The real risk-free rate is r-2.5%, the default risk premium for

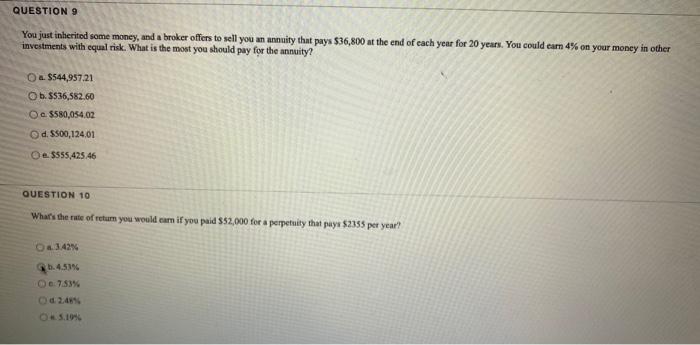

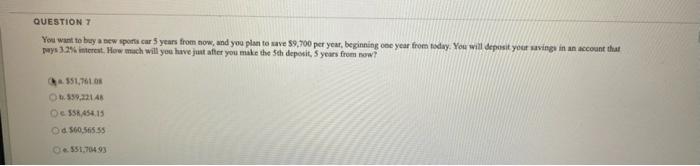

QUESTION 14 Kem Corporation's 5-year bonds yield 6.60% and 5-year T-bonds yield 3.40%. The real risk-free rate is r-2.5%, the default risk premium for Kern's bonds is DRP-1.90% versus zero for T-bonds, the liquidity premium on Kern's bonds is LP 1.3%, and the maturity risk premium for all bonds is found with the formula MRP-(t-1) 0.1%, where t number of years to maturity. What is the inflation premium (IP) on all 5-year bonds? O a 0.38% Ob.0.54% 0.0.0.50% O d. 0.51% (= 0,48 % QUESTION 15 Moerdyk Corporation's boods have a 15-year maturity, a 7.25% semianmaal coupon, and a par value of $1,000. The going interest rate (rd) is 5.30%, based on semiannual compounding. What is the bond's price? &$1,200.05 Ob$1,500.06 Oc$1,224.05 Od $948.04 = $1,164,05 Click Save and Submit QUESTION 9 You just inherited some money, and a broker offers to sell you an annuity that pays $36,800 at the end of each year for 20 years. You could earn 4% on your money in other investments with equal risk. What is the most you should pay for the annuity? Oa. $544,957.21 Ob. $536,582.60 O $580,054.02 d. $500,124.01 Oe. $555,425.46 QUESTION 10 What's the rate of return you would earn if you paid $52,000 for a perpetuity that pays $2355 per year? O.3.42% b.4.53% e-7.53 % (5.19 % QUESTION 7 You want to buy a new sports car 5 years from now, and you plan to save $9,700 per year, beginning one year from today. You will deposit your savings in an account that pays 3.2% interest. How much will you have just after you make the 5th deposit, 5 years from now? 351,761.08 539,221 48 O $58,454.15 Od $60,565.55 551,704.93 QUESTION 14 Kem Corporation's 5-year bonds yield 6.60% and 5-year T-bonds yield 3.40%. The real risk-free rate is r-2.5%, the default risk premium for Kern's bonds is DRP-1.90% versus zero for T-bonds, the liquidity premium on Kern's bonds is LP 1.3%, and the maturity risk premium for all bonds is found with the formula MRP-(t-1) 0.1%, where t number of years to maturity. What is the inflation premium (IP) on all 5-year bonds? O a 0.38% Ob.0.54% 0.0.0.50% O d. 0.51% (= 0,48 % QUESTION 15 Moerdyk Corporation's boods have a 15-year maturity, a 7.25% semianmaal coupon, and a par value of $1,000. The going interest rate (rd) is 5.30%, based on semiannual compounding. What is the bond's price? &$1,200.05 Ob$1,500.06 Oc$1,224.05 Od $948.04 = $1,164,05 Click Save and Submit QUESTION 9 You just inherited some money, and a broker offers to sell you an annuity that pays $36,800 at the end of each year for 20 years. You could earn 4% on your money in other investments with equal risk. What is the most you should pay for the annuity? Oa. $544,957.21 Ob. $536,582.60 O $580,054.02 d. $500,124.01 Oe. $555,425.46 QUESTION 10 What's the rate of return you would earn if you paid $52,000 for a perpetuity that pays $2355 per year? O.3.42% b.4.53% e-7.53 % (5.19 % QUESTION 7 You want to buy a new sports car 5 years from now, and you plan to save $9,700 per year, beginning one year from today. You will deposit your savings in an account that pays 3.2% interest. How much will you have just after you make the 5th deposit, 5 years from now? 351,761.08 539,221 48 O $58,454.15 Od $60,565.55 551,704.93

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

14 Option C is the correct answer 050 15 Par Value or Maturity Value 1000 Annual coupon rate 725 Sem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started