Answered step by step

Verified Expert Solution

Question

1 Approved Answer

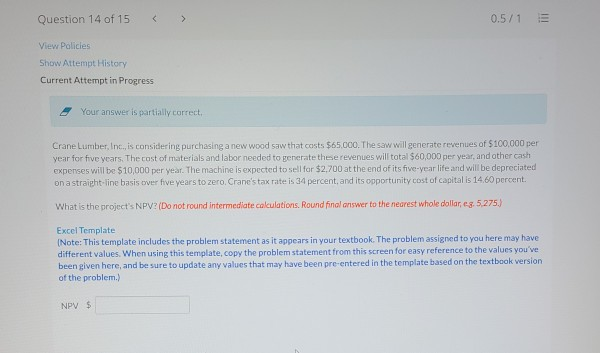

Question 14 of 15 0.5/1 iii View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct, Crane Lumber, Inc., is considering

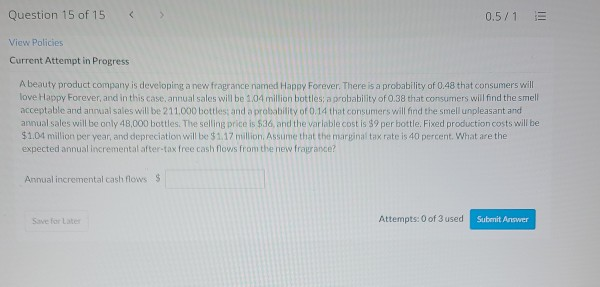

Question 14 of 15 0.5/1 iii View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct, Crane Lumber, Inc., is considering purchasing a new wood saw that costs $65.000. The saw will generate revenues of $100.000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $2,700 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero, Crane's tax rate is 34 percent, and its opportunity cost of capitalis 14,60 percent. What is the project's NPV? (Do not round intermediate calculations. Round final answer to the nearest whole dollar, eg. 5.275. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) NPV $ Question 15 of 15 0.5/1 III View Policies Current Attempt in Progress A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.48 that consumers will love Happy Forever, and in this case, annual sales will be 104 million bottles, a probability of 0.38 that consumers will find the smell acceptable and annual sales will be 211.000 bottles and a probability of 0.14 that consumers will find the smell unpleasant and annual sales will be only 48,000 bottles. The selling price is $36, and the variable cost is $9 per bottle. Fixed production costs will be $1.04 million per year, and depreciation will be $1.17 million. Assume that the marginal tax rate is 40 percent. What are the expected annual incremental after-tax free cash flows from the new fraurance? Annual incremental cash flows $ Save for Late Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started